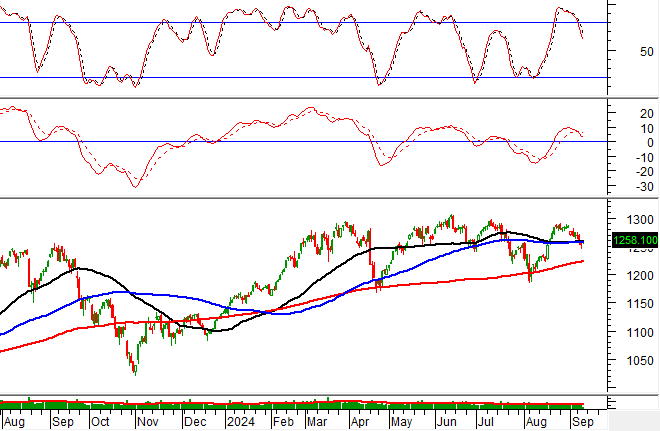

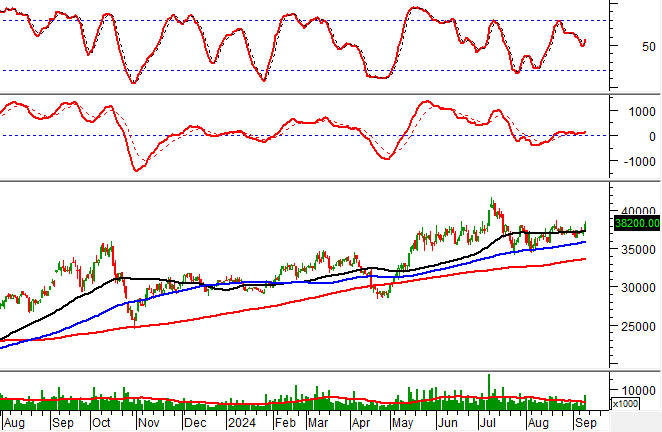

Technical Signals for the VN-Index

In the trading session on the morning of September 12, 2024, the VN-Index gained points and a Doji candlestick pattern emerged, while trading volume slightly declined. This indicates that investors’ sentiments are somewhat uncertain.

At present, the VN-Index is retesting the group of 50-day and 100-day SMA lines. The Stochastic Oscillator indicator continues to head downwards after giving a sell signal in the overbought zone. If this factor improves, the optimistic outlook may return in the upcoming sessions.

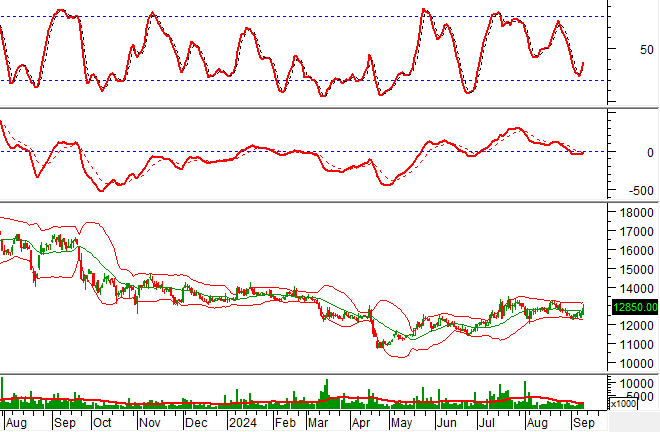

Technical Signals for the HNX-Index

On September 12, 2024, the HNX-Index rose alongside a slight decrease in trading volume during the morning session, reflecting investors’ doubts.

Additionally, the ADX indicator is moving within the grey zone (20 < adx < 25). This suggests that the market trend is relatively weak, and the index's movement may be range-bound in the near term.

DCM – Ca Mau Petroleum Fertilizer Joint Stock Company

During the morning session of September 12, 2024, DCM’s share price increased, forming a Rising Window candlestick pattern. The trading volume also surpassed the 20-session average, indicating improving investor sentiment.

Furthermore, the stock price has crossed above the 50-day SMA line, and the Stochastic Oscillator indicator has provided a buy signal, suggesting that medium-term optimism is emerging.

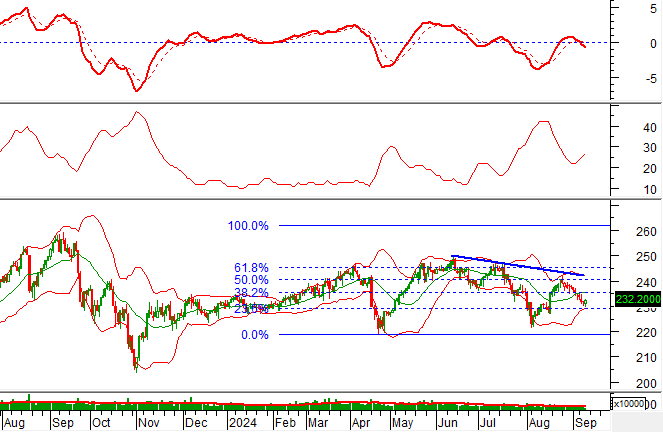

SBT – Thanh Thanh Cong – Bien Hoa Joint Stock Company

On the morning of September 12, 2024, SBT’s share price rose, and the trading volume exceeded the 20-session average, reflecting investors’ optimism.

Additionally, the stock price is retesting the Middle line of the Bollinger Bands. The MACD indicator is narrowing the gap with the Signal line after previously giving a sell signal. If a buy signal reappears in the upcoming sessions, the short-term upward prospect will likely return.

Technical Analysis Team, Vietstock Consulting Department

The Most ‘Expensive’ Stock on the Stock Exchange Takes a Negative Turn

Today’s trading session (September 9) was relatively dull, with the value of stocks traded on the HoSE through matching orders hovering around VND 10 trillion, hitting a three-week low. Large-cap stocks were painted in red, and the market lacked driving force. The negative trend also continued for VNZ, the most expensive stock on the exchange, as shares of VNG Corporation continued to be heavily sold off.