This is the State Treasury’s third foreign currency purchase this year. Previously, on May 22, 2024, the State Treasury also offered to buy foreign currency from commercial banks, purchasing 100 million USD. In the second purchase on September 6, 2024, the State Treasury bought 150 million USD.

Based on the USD buying rate listed at the State Bank of Vietnam on September 12 (23,400 VND/USD), the expected expenditure for this transaction is approximately 2.34 trillion VND.

The State Treasury’s foreign currency purchase occurs amidst a backdrop of declining interbank USD exchange rates, commercial bank-quoted rates, and free-market rates ahead of the Federal Reserve’s monetary policy meeting on September 17-18.

On the morning of September 12, the central exchange rate of the Vietnamese dong to the USD, as announced by the State Bank of Vietnam, was 24,187, a decrease of 25 VND compared to the previous day. Globally, the USD-Index (DXY) stood at 101.75 points, a 0.07% increase from September 11, 2024.

|

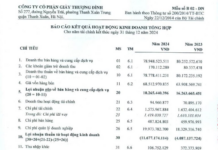

USD-Index Year-to-Date Performance

Source: Investing.com

|

The USD selling rates quoted by commercial banks have also been plummeting. The selling rates fluctuate around 24,355 VND/USD, while the buying rates are at 24,725 VND/USD. Since the beginning of August, the USD rates at these banks have dropped by over 2%.

Vietcombank’s buying and selling rates are now at 24,380 – 24,410 and 24,725 VND/USD, respectively. VietinBank offers rates of 24,420 VND/USD for buying and 24,760 VND/USD for selling. Meanwhile, Agribank has announced rates of 24,400-24,740 VND/USD for buying and selling, respectively.

Reduced Pressure on Exchange Rates

Mr. Pham Nhu Anh, CEO of Military Bank (MB), shared that after the Fed’s move to cut interest rates, the exchange rates have decreased, and market liquidity has improved. Given the current economic situation, the reduction in exchange rates helps alleviate inflationary pressures and provides relief to importers and manufacturers.

The monetary market also benefits from improved liquidity. The State Bank of Vietnam now has more room to maneuver its monetary policy flexibly until the end of the year.

With the reduced pressure on exchange rates, commercial banks can access cheaper capital and experience less liquidity stress, enabling them to offer more competitive loan rates to individuals and businesses.

Professor Nguyen Huu Huan, a senior lecturer at the University of Economics in Ho Chi Minh City, stated that typically, during the third and fourth quarters, foreign currency demand increases due to the need for raw material imports for year-end export orders. However, he expects the exchange rate to remain stable. Foreign currency supply this year has been ample, and the State Bank of Vietnam has been proactively and flexibly managing its policies to prevent exchange rate speculation.

Mr. Suan Teck Kin, Head of Research at UOB Bank, concurred that the reduced exchange rates ease the burden on the State Bank of Vietnam in managing exchange rates. They can maintain interest rates at high levels to address inflation concerns. The Vietnamese dong is predicted to continue appreciating. The VND has started to strengthen again, reaching a higher level of 25,000 VND per USD. The exchange rate is projected to gradually increase to 24,100 VND/USD in the second quarter of 2025.

The Power of Words: Unlocking the Art of Persuasion

“PNJ Unveils its Premier Status in Retail’s Contribution to the National Coffers”

PNJ has solidified its leadership in the retail industry, not only through impressive business figures but also by spearheading the journey towards sustainable development. The company has made a significant impact, contributing 4,500 billion VND to the state budget in the last three years, clearly demonstrating its commitment to the nation’s progress and solidifying its position as a powerhouse in the jewelry industry.

The Ice Cream Conundrum: A Sweet Treat Turned Sour?

In the first half of 2024, OCH – the owner of Trang Tien Ice Cream and Givral Cake – reported a loss of over VND 70 billion, with the parent company losing VND 26.6 billion, bringing the cumulative loss to nearly VND 655 billion.