Article 67 of the 2024 Social Insurance Law (effective from July 1, 2025) stipulates that pension adjustments are based on the increase in the consumer price index, taking into account the state budget and Social Insurance Fund capabilities.

The law also emphasizes the need to adjust pension increases reasonably for those with low pensions and those who retired before 1995, narrowing the pension gap between retirees from different periods. It further clarifies that the government will determine the timing, subjects, and amount of pension adjustments.

From July 1, 2025, those with low pensions and retirees before 1995 will receive reasonable pension increases.

To implement this regulation, the state will annually transfer funds from the budget to the Social Insurance Fund to ensure sufficient pension and social insurance allowances for those receiving pensions and allowances before January 1, 1995.

According to the Ministry of Labour, Invalids and Social Affairs, the adjustment of pension increases for those with low pensions and pre-1995 retirees is aimed at institutionalizing Resolution No. 28 of the 12th Central Committee on social insurance policy reform. Specifically, it involves synchronously implementing reform contents to expand social insurance coverage, striving for universal social insurance…

To realize Resolution No. 28, the government issued Decree No. 75/2024 on adjusting pensions, social insurance allowances, and monthly allowances.

Accordingly, there is a 15% increase in pensions, social insurance allowances, and monthly allowances for the specified subjects. Additionally, for cases with an enjoyment level lower than 3.5 million VND/month, adjustments continue to be made to reach 3.5 million VND/month.

Ms. Le Thi Thu Lan, a resident of Ho Chi Minh City, retired due to ill health before 1995. In the latest salary increase on July 1, her salary rose from almost 1.9 million VND to 2.5 million VND/month.

Following the salary increase roadmap, from July 1, 2025, Ms. Lan will continue to receive pension adjustments until she reaches the amount of 3.5 million VND/month. Ms. Thu believes that the state’s consecutive pension adjustments for pre-1995 retirees significantly help stabilize the lives of many people like her, who are now elderly and frail.

“Our daily expenses mostly depend on pension money. So, when the pension increases, our living standards improve, and we don’t have to rely as much on our children,” Ms. Lan shared.

Dr. Bui Sy Loi, former Vice Chairman of the National Assembly’s Committee for Social Affairs, assessed that retirees before 1995 have relatively low pensions compared to the general level. Therefore, the state’s continued pension increases for this group demonstrate preferential treatment for those who worked and contributed during that period.

Mr. Loi also stated that salary reform is a multi-year accumulation process, with previous generations accumulating for the present. Increasing the salaries of pre-1995 retirees ensures fairness and provides them with a better life.

Mr. Pham Minh Huan, former Deputy Minister of Labour, Invalids, and Social Affairs, mentioned that during the salary increase process, the state always pays attention to those with low pensions, especially those who retired before 1995. Although there have been several pension adjustments, there is still a gap compared to those who retired after the establishment of the Social Insurance Fund.

“Continuing to adjust pension increases for pre-1995 retirees will fulfill the wishes of long-serving retirees who are now elderly but have low benefits,” Mr. Huan emphasized.

“Inflation’s Steady Climb: CPI Rises 4.04% in the First Eight Months of 2024, With Core Inflation Up 2.71% Year-on-Year.”

Consumer goods and service prices in August exhibited a mixed bag of fluctuations. Compared to July 2024, the prices of staple foods and rental housing witnessed an uptick, while domestic fuel prices declined in tandem with the global trend. Overall, the consumer price index (CPI) for August 2024 remained stable relative to the previous month. August’s CPI reflected a 1.89% increase from December 2023 and a 3.45% year-over-year rise. On average, the first eight months of 2024 saw a 4.04% CPI increase compared to the same period last year, with core inflation climbing by 2.71%.

Retirement Pensions Have Seen a Seven-Fold Increase Over the Last Decade

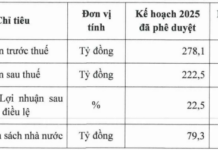

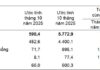

According to the Ministry of Labour, Invalids and Social Affairs, over the past decade (2013-2023), the government has adjusted retirement pensions seven times, with an average increase of over 8.43% each time. This is significantly higher than the consumer price index increase for the same period.

The Art of Tax Deductions: Unraveling the Nuances for Savvy Taxpayers

The Ministry of Finance asserts that the personal income tax exemption amount requires careful consideration and calculation. This amount should be determined by taking into account various factors such as the per capita GDP, minimum regional wages, and average per capita expenditure over a defined period. It is crucial to ensure that this exemption amount is set at a level that is higher than these economic indicators to provide adequate financial relief to taxpayers.