The VN-Index ended the trading session on September 12, 2024, with a gain of 0.25%, closing at 1,256.35.

The total trading value on the three exchanges reached VND 11,949.2 billion, a 15.6% decrease compared to the previous session. Of this, the matched order trading value was VND 10,270.3 billion, down 17.1% from the previous session, 25.8% lower than the 5-session average, and 34.1% lower than the 20-session average.

Across sectors, liquidity declined broadly, notably in Real Estate, Securities, Steel, and Retail. In contrast, the Banking, Chemicals, and Information Technology sectors witnessed both price and liquidity increases compared to the previous day’s trading.

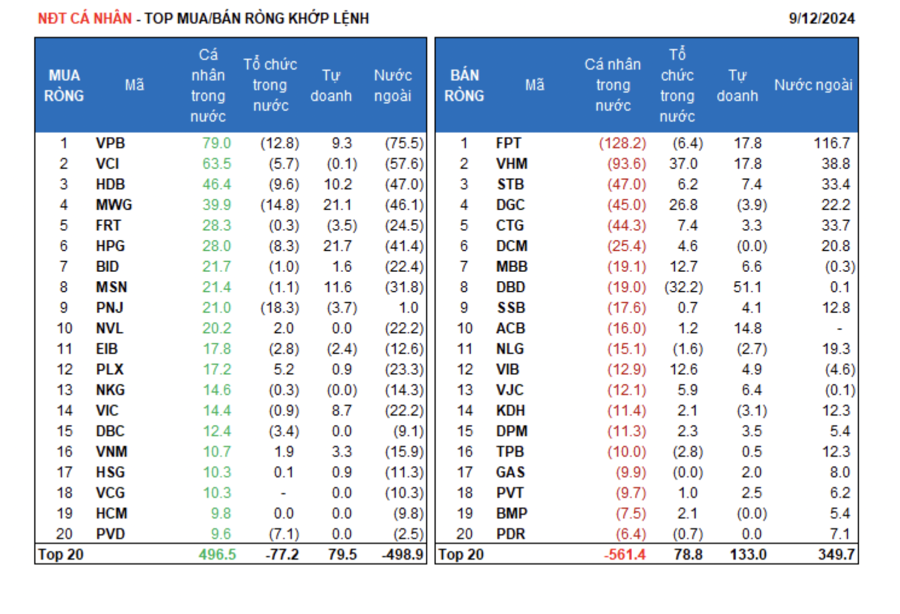

Foreign investors sold a net of VND 223.6 billion, and their net selling value in matched orders was VND 171.3 billion.

The main sectors that foreign investors net bought on the matched order were Information Technology and Chemicals. The top stocks that foreign investors net bought were FPT, VHM, CTG, STB, DGC, DCM, NLG, SSB, TPB, and KDH.

On the selling side, foreign investors net sold Financial Services stocks. The top stocks that foreign investors net sold were VPB, VCI, HDB, MWG, HPG, FRT, PLX, BID, and NVL.

Individual investors net bought VND 117.6 billion, while their net selling value in matched orders was VND 22.8 billion.

In terms of matched orders, they net bought 9 out of 18 sectors, mainly in the Financial Services sector. The top stocks that individual investors net bought were VPB, VCI, HDB, MWG, FRT, HPG, BID, MSN, PNJ, and NVL.

On the selling side, they net sold 9 out of 18 sectors, mainly in the Information Technology and Real Estate sectors. The top stocks that they net sold were FPT, VHM, STB, DGC, CTG, DCM, DBD, SSB, and ACB.

Proprietary trading bought a net of VND 305.9 billion, and their net buying value in matched orders was VND 252.4 billion.

In terms of matched orders, proprietary trading net bought 15 out of 18 sectors. The sectors with the strongest net buying were Banking and Healthcare. The top stocks that proprietary trading net bought today were DBD, HPG, MWG, FPT, VHM, ACB, TCB, MSN, HDB, and VPB. On the selling side, the main sector was Financial Services. The top stocks that they net sold were E1VFVN30, DGC, PNJ, FRT, CTR, KDH, FUEVFVND, NLG, EIB, and GMD.

Domestic institutional investors net sold VND 236.2 billion, and their net selling value in matched orders was VND 58.3 billion.

In terms of matched orders, domestic institutions net sold 14 out of 18 sectors, with the highest value in the Healthcare sector. The top stocks that domestic institutions net sold were DBD, TCB, PNJ, MWG, VPB, HDB, PC1, HPG, PVD, and FPT. The sector with the highest net buying value was Real Estate. The top stocks that they net bought were VHM, DGC, MBB, VIB, CTG, STB, VJC, PLX, VCB, and TCD.

Today’s matched orders reached VND 1,678.9 billion, a decrease of 5.8% compared to the previous session, contributing 14.1% of the total trading value.

Notable transactions today included over 21.7 million EIB shares, equivalent to VND 391.6 billion, traded between individual investors. Additionally, there was a transaction of more than 2.6 million MBB shares (worth VND 67.6 billion) between foreign institutions.

The money flow allocation ratio increased in Banking, Chemicals, Agricultural & Seafood, Software, and Building Materials & Interiors sectors, while it decreased in Real Estate, Securities, Construction, Steel, Retail, and Electrical Equipment sectors.

In terms of matched orders, the money flow allocation ratio increased in the large-cap VN30 and small-cap VNSML groups, while it decreased in the mid-cap VNMID group.