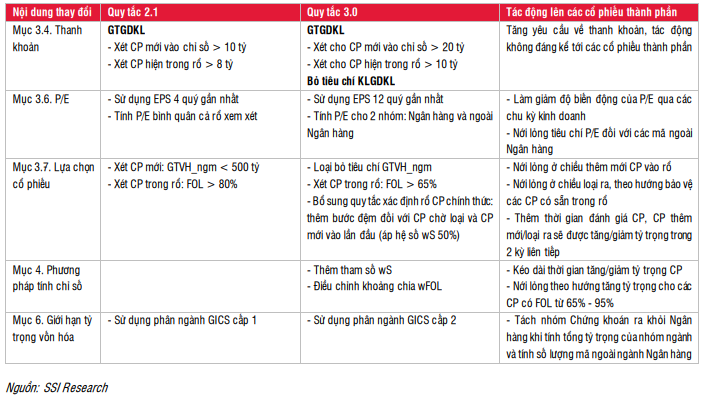

There have been some notable changes in the calculation of the VNDiamond Index.

Recently, HOSE announced version 3.0 of the VNDiamond Index Rules, replacing version 2.1, effective from the October 2024 review period.

The first notable change in the new version is the tightening of liquidity criteria. The minimum matched trading value (GTGDKL) for new stocks in the index has increased from 10 billion to 20 billion VND. In addition, the new rules also relax the conditions for foreign ownership ratio (FOL). Stocks in the basket now only need to maintain an FOL above 65%, instead of the previous 80%.

Another important change is the calculation of the P/E ratio. Instead of using the EPS of the last four quarters, the new rules apply the EPS of the last 12 quarters and calculate it separately for two groups: Banks and Non-banks.

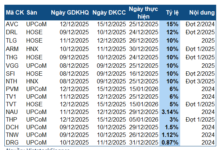

These changes also impact the October 2024 review period.

Who’s in and who’s out this review period?

Analysts at SSI Research believe that VRE is at risk of being removed from the index as its FOL has fallen below 65%. However, under the new rules, VRE will be placed in the “pending removal” group and only reduced by 50% in weight this period. If FOL does not improve in the next period, VRE may be completely removed from the index.

“Since VRE is still retained in the index this period, the number of non-banking stocks remains at 8, so there is no need to select additional stocks for replacement,” the analysts said.

Meanwhile, MWG has met the new P/E criteria but has not yet reached the 95% FOL threshold, so it has not been added to the index. According to SSI Research, in the next period, MWG can be added to the index if VRE is officially removed.

For other stocks, NLG, KDH, VPB, and BMP are expected to increase their weights due to adjustments in the wFOL scaling ladder.

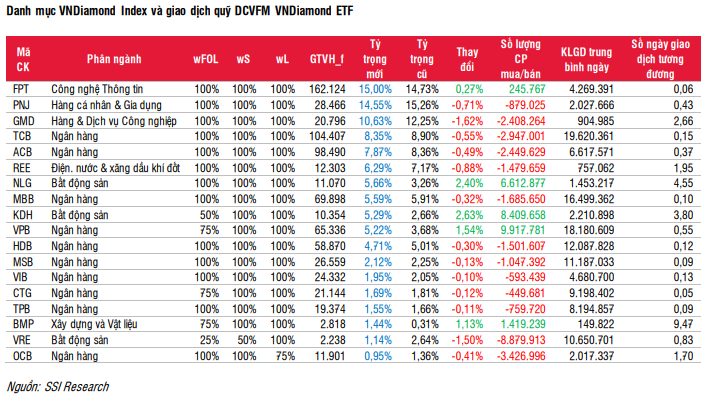

The VNDiamond Index basket is expected to remain at 18 stocks, including 10 banking stocks and 8 non-banking stocks.

What’s the trading strategy?

Among the ETFs in the market, there are currently 5 ETFs that use the VNDiamond Index as a reference, including DCVFMVN Diamond, MAFM VNDiamond, BVFVN Diamond, KIM Growth Diamond, and ABF VNDiamond, with a total net asset value of approximately 12,600 billion VND as of September 5, 2024. The DCVFMVN Diamond fund alone has a total asset value of approximately 12,100 billion VND.

With the above forecasts, SSI Research predicts that the real estate group will be bought strongly, including 8.4 million KDH shares and 6.6 million NLG shares. Meanwhile, other codes are sold off, including 8.9 million VRE shares, 3.4 million OCB shares, 2.9 million TCB shares, and 2.4 million GMD shares.