|

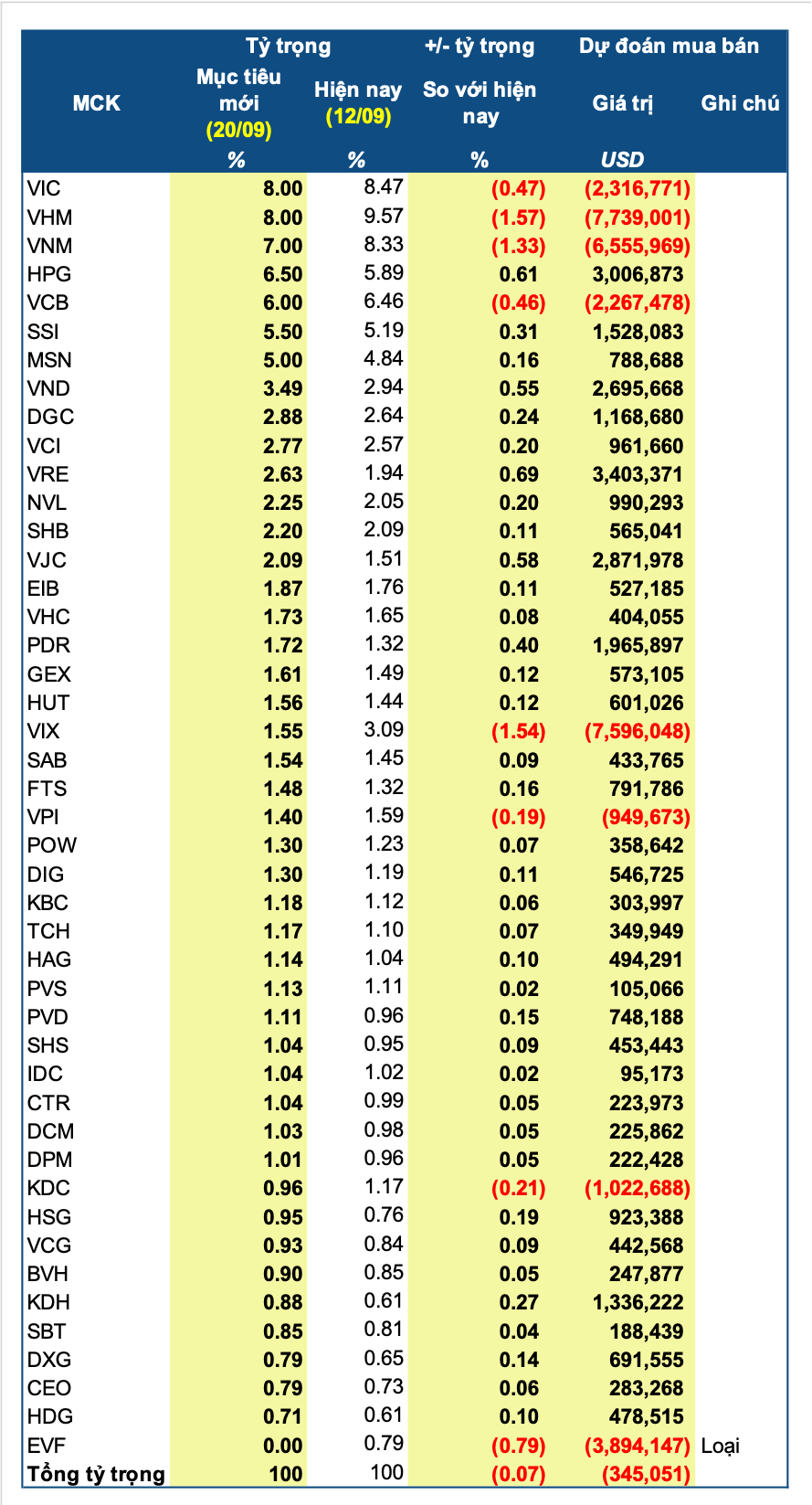

VNM ETF’s Stock Weighting Forecast Changes After Q3 2024 Review

|

In the latest review, VHM is predicted to see the largest sell-off in value, with over 7.7 million USD, equivalent to selling nearly 4.4 million shares at the current stock price (43,000 VND/share as of September 13th). Ranking second is VIX, expected to sell nearly 7.6 million USD, or about 16.4 million shares at the current price (11,300 VND/share).

The index will also remove EVF from its portfolio, with a sell-off value of approximately 3.9 million USD. Notably, EVF was only added to the index during the Q2 2024 review, only to be removed in the following quarter.

On the other hand, VRE and HPG are anticipated to be the biggest buys in terms of value, at 3.4 million USD and over 3 million USD, respectively. Additionally, VJC and VND are also expected to be purchased for around 2.7 – 2.9 million USD.

Following the Q3 2024 review, the number of stocks in VNM ETF’s portfolio stands at 45, along with one fund certificate, a decrease of one stock from Q2. All are Vietnamese stocks. The largest weightings are VHM and VIC (both at 8%). Following closely are VNM (7%), HPG (6.5%), and VCB (6%).

The changes in the constituent stocks of the MarketVector Vietnam Local Index will take effect after the market closes on Friday (September 20th) and will be officially traded from Monday (September 23rd).

The Haunting of Real Estate Stocks: Unraveling the Continuous Mishaps

In recent times, DIG shareholders and investors have been through a rollercoaster. From the tragic passing of the company’s chairman to the ongoing inspections and the subsequent stock volatility, it’s been a challenging period. As the company navigates these trials, one can’t help but wonder what the future holds for this business and those invested in it.