The MVIS Vietnam Local Index, the underlying index of the Vaneck Vectors Vietnam ETF (VNM ETF), has just announced its quarterly portfolio rebalancing for Q3 2024.

In this rebalancing, MVIS Vietnam Local Index removed EVF (EVNFinance) and did not add any new stocks. Additionally, HNG was also removed from the portfolio due to delisting, bringing the total number of stocks down to 44. Notably, EVF was only recently added during the previous rebalancing quarter.

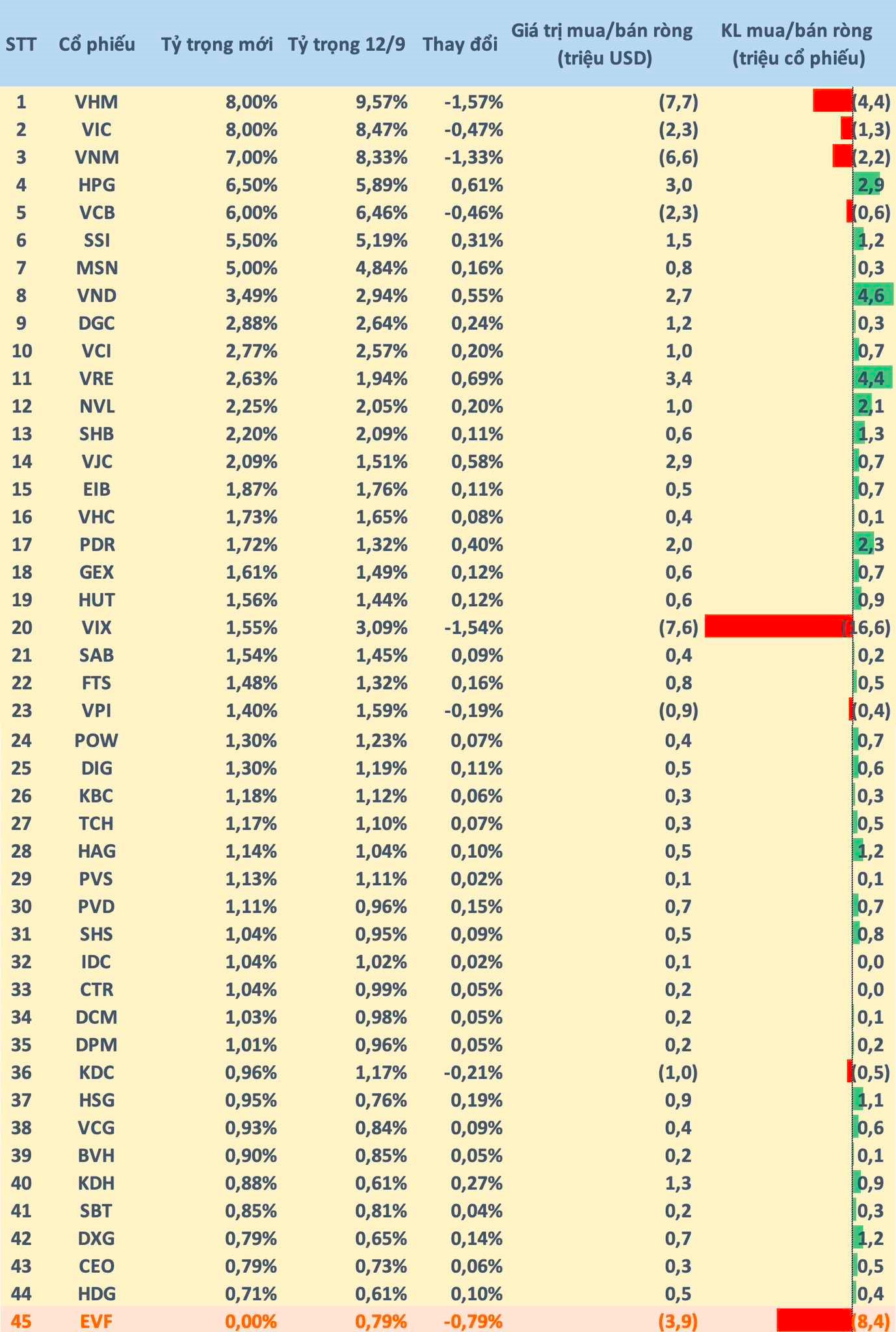

As of September 12, the VNM ETF’s portfolio size reached nearly USD 493 million (~VND 12,000 billion). The fund is estimated to buy more of most of the stocks in its portfolio. Notably, VND (4.6 million shares), VRE (4.4 million shares), and HPG (2.9 million shares) are expected to be among the largest purchases by the VNM ETF.

On the other hand, the fund will significantly reduce its holdings in some stocks after the Q3 rebalancing, although the selling pressure is relatively concentrated on a few stocks. In addition to selling all 8.4 million EVF shares due to its removal, the VNM ETF will also reduce its holdings in VIX (16.6 million shares), VHM (4.4 million shares), VNM (2.2 million shares), and VIC (1.3 million shares).

Estimated details of the VNM ETF’s portfolio for the Q3 2024 rebalancing:

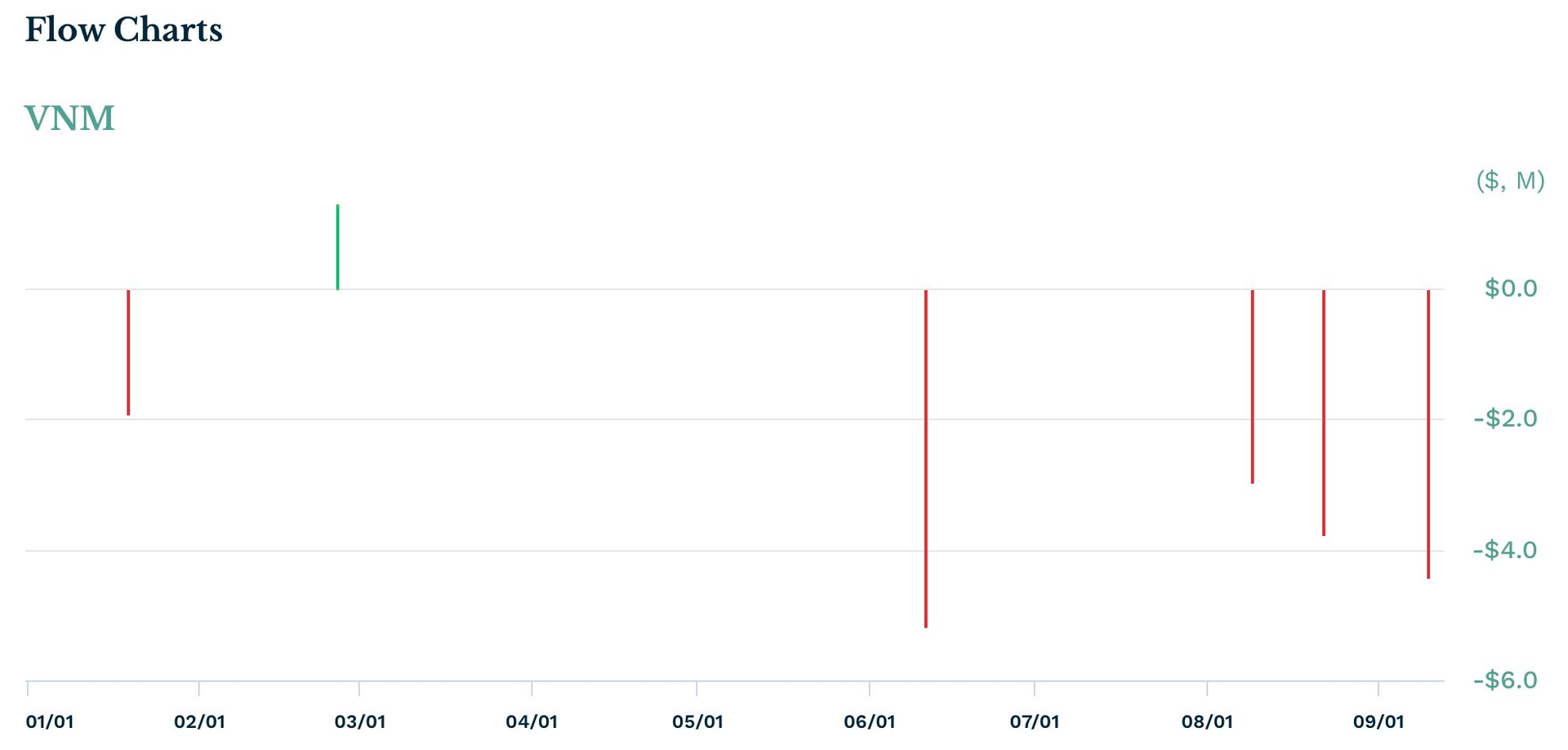

The VNM ETF officially changed its reference index to the MVIS Vietnam Local Index (comprising 100% Vietnamese stocks) from March 17, 2023, after attracting strong inflows in the period from late 2022 to early 2023. Last year, the fund attracted a net inflow of USD 71.3 million (~VND 1,700 billion). Since the beginning of 2024, the VNM ETF has been trading lackluster and experienced outflows of nearly USD 17 million, mainly in the last three months.

In the previous week, the FTSE Vietnam Index, the reference index of the FTSE Vietnam ETF, added FTS, FRT, and KDH while removing no stocks, thus increasing the number of Vietnamese stocks to 31. The foreign fund has a total net asset value of USD 295 million (approximately VND 5,500 billion), focusing mainly on the financial, real estate, consumer, and industrial sectors. The most-held stocks include HPG, VIC, VHM, VCB, MSN, VNM, SSI, DGC, and VRE.

Both the VNM ETF and the FTSE Vietnam ETF will complete their rebalancing next week, and the new portfolios will take effect after the market closes on Friday (September 20) and officially trade on the following Monday (September 23).