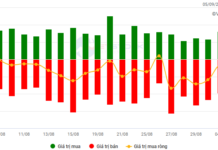

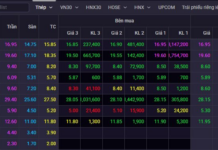

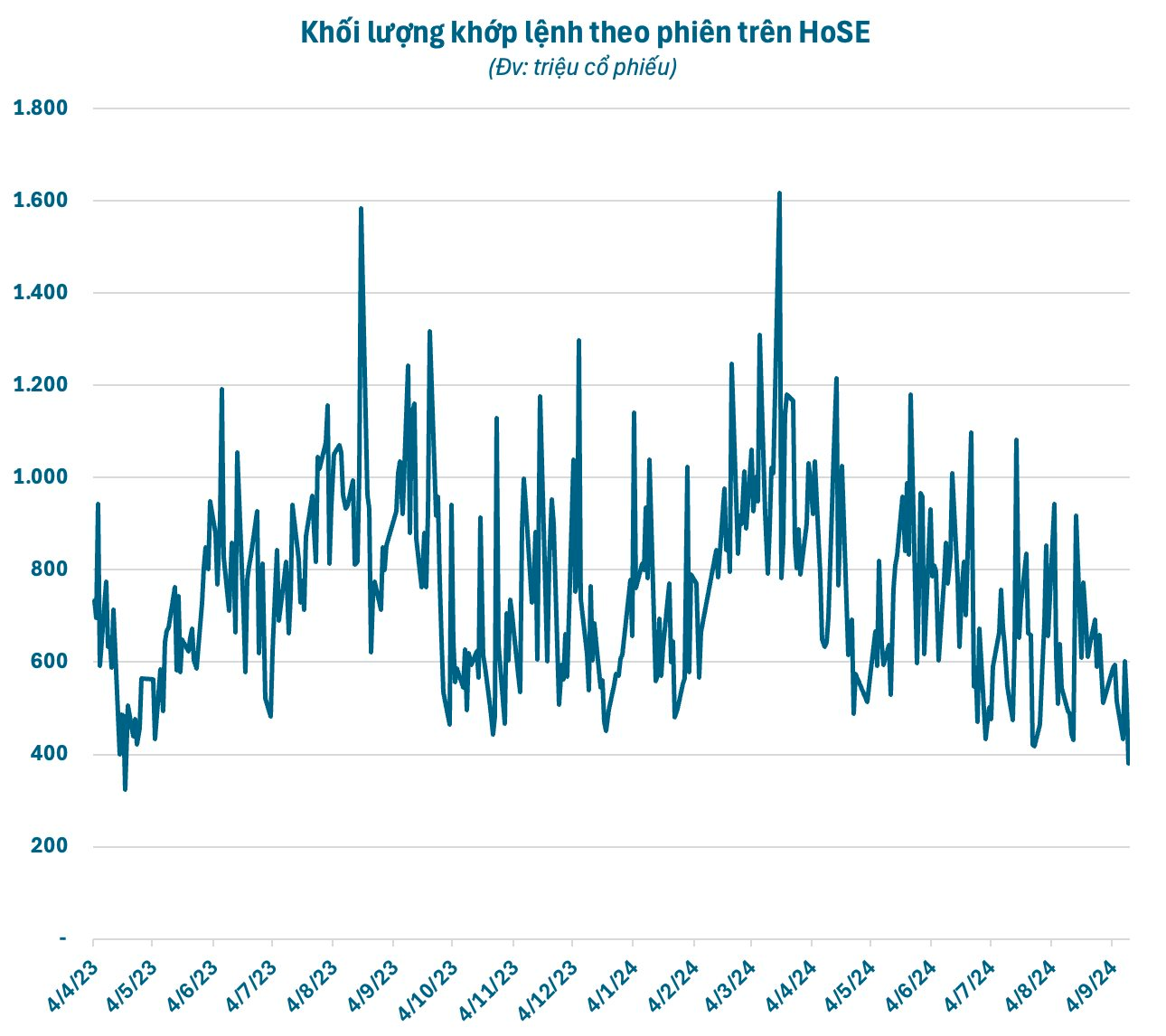

Vietnam’s stock market experienced a dull trading session on September 12, 2024, with the matching volume on HoSE reaching just over 380 million units, the lowest in 17 months since mid-April 2023. The matching value barely reached VND 9,300 billion, a decrease of nearly 18% compared to the previous session and the lowest since late October last year.

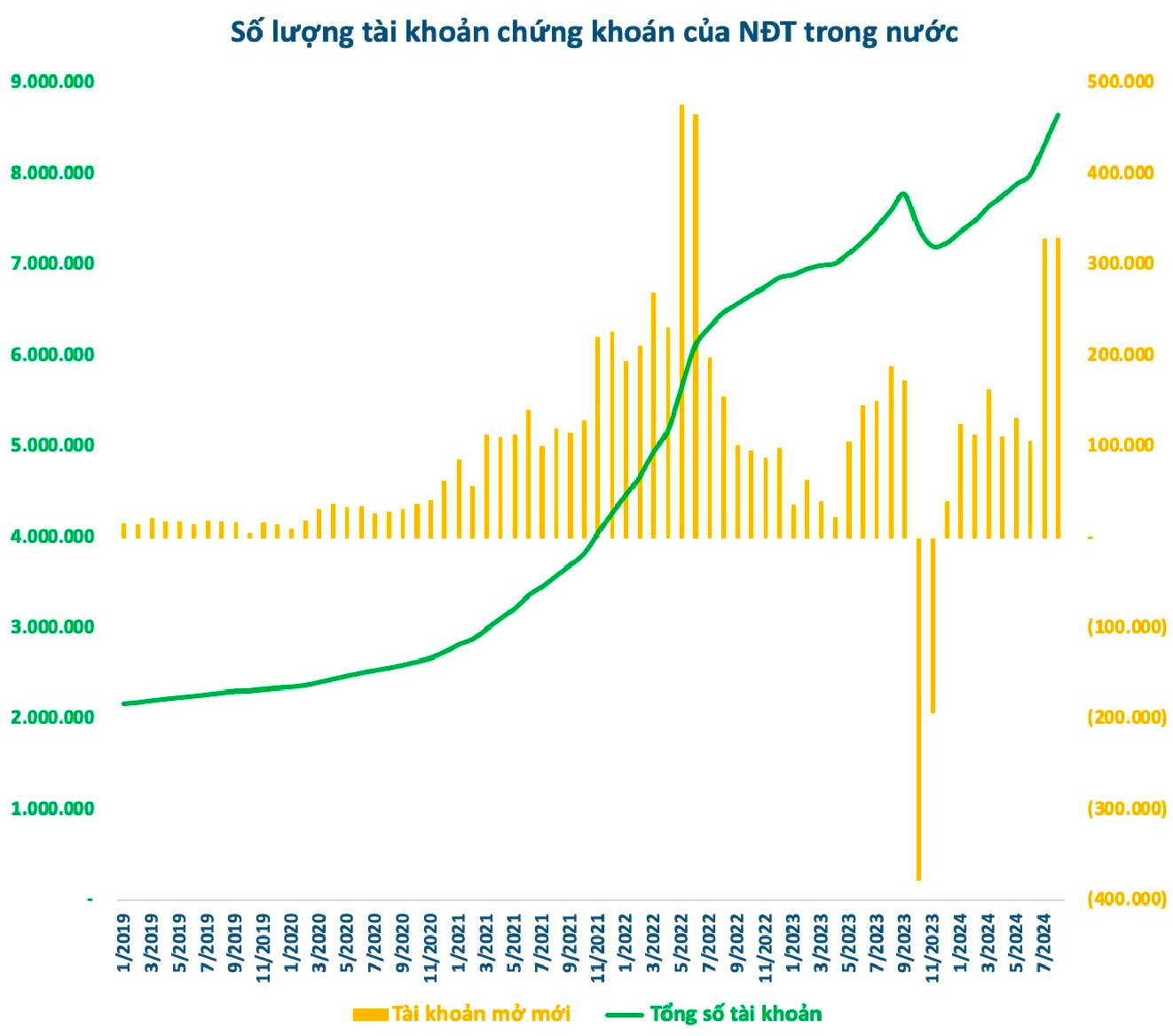

Notably, liquidity dried up despite a significant increase in new account openings recently. According to data from the Vietnam Securities Depository (VSD), the number of domestic investor accounts increased by more than 330,000 in August 2024, slightly higher than the previous month and the highest in over two years since the period of May-June 2022.

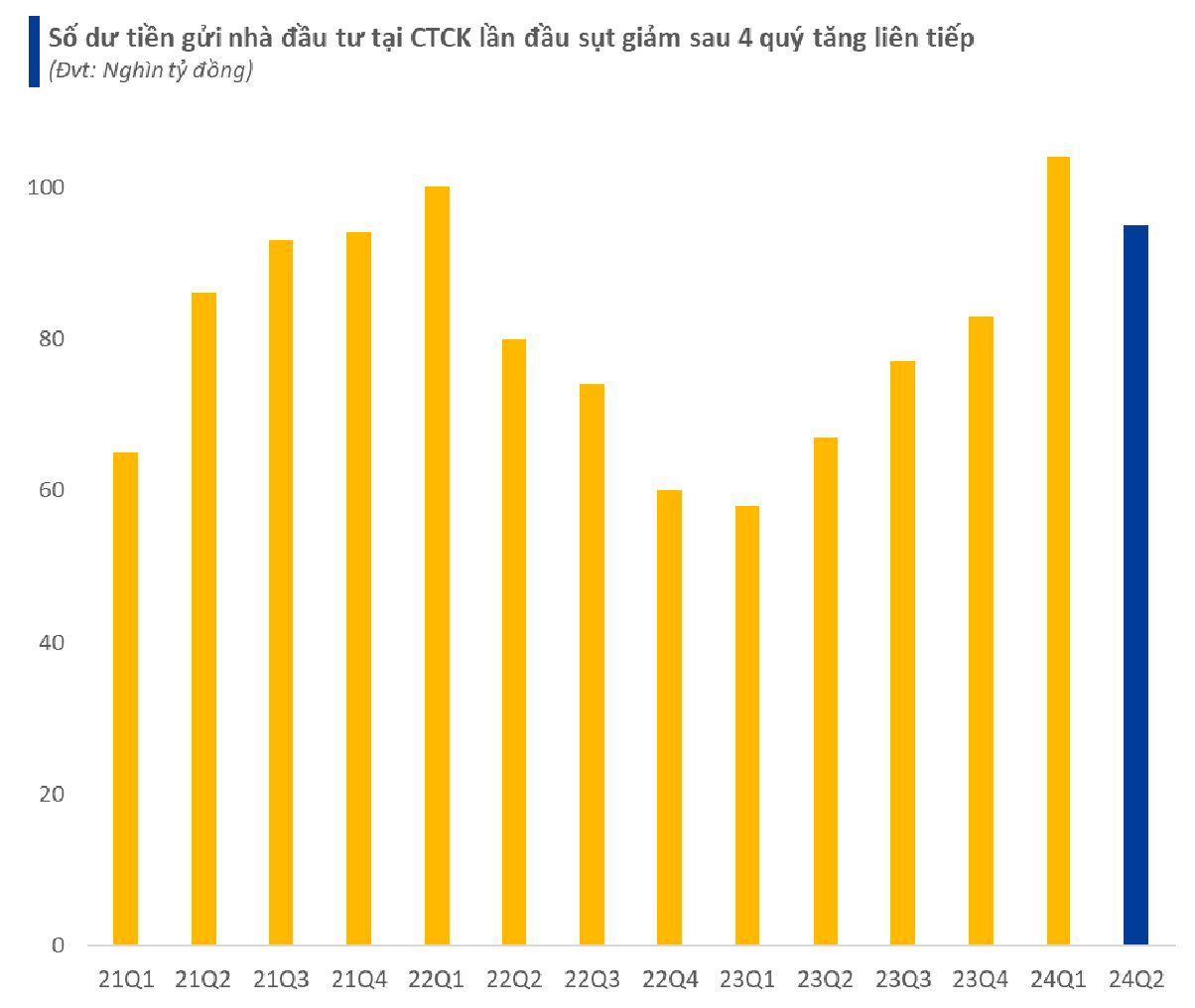

The subdued trading doesn’t necessarily indicate investors’ disinterest in stocks, but rather a lack of attractive investment opportunities. In reality, the amount of money held by investors at securities companies at the end of the second quarter of 2024 was lower than the previous record three months earlier, but it was still significantly higher than the average of the past two years.

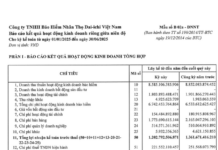

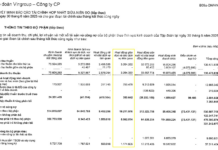

According to estimates, the balance of customer deposits at securities companies at the end of Q2 2024 was approximately VND 95 trillion, a decrease of VND 9 trillion compared to the record high at the end of Q1. However, this still represents the second-highest amount of idle money in the past nine quarters.

Investors’ cautious sentiment is partly due to concerns about unpredictable global developments. Next week, the US Federal Reserve (Fed) will hold an important meeting, and international observers predict a likely interest rate cut. However, the extent of the reduction remains unknown and could significantly impact global and Vietnamese stock market sentiment.

Essentially, the Fed’s interest rate cut is only a matter of time. However, the focus of the global financial market is shifting from rate cut expectations to recession fears, which prevailed a few months ago. Ongoing geopolitical tensions in various regions worldwide further contribute to investors’ cautious attitude.

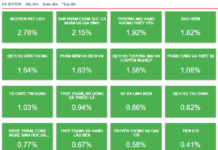

According to SGI Capital, recent positive domestic macroeconomic news no longer positively influences capital flows in the market. Additionally, the real estate market has unexpectedly become a hot topic, attracting investors’ attention. This could lead to a diversion of investment funds from stocks to this sector.

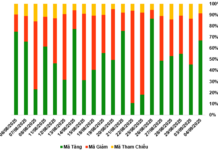

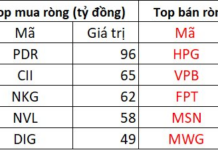

The market’s repeated failures to surpass the 1,300-point mark have also impacted investor sentiment. While foreign investors have slowed down their selling pace, they still maintain a net selling position whenever the VN-Index approaches this resistance level. Meanwhile, domestic capital remains unchanged and is further pressured by recent substantial issuances of securities, real estate stocks, and corporate bonds.

The pressure of bond maturities at the end of the year remains a burden on the cash flow of many large enterprises, including listed companies. SGI Capital believes that liquidity and cash flow are unlikely to improve in the coming months as risks may increase, especially due to significant fluctuations in the global market.

“In investing, it is crucial to seek and choose opportunities with low risk and high returns. The current environment presents significant risks and potential for significant fluctuations, while clear opportunities are relatively scarce,” SGI Capital emphasized.

Similarly, experts from Dragon Capital noted a shift in investor sentiment towards a more cautious approach, with a preference for large-cap stocks and a focus on sustainability. A balanced investment strategy that avoids overvalued assets will help mitigate risks from international markets and seize domestic growth opportunities.

According to Dragon Capital, the stock market’s performance will depend on domestic growth drivers, especially supportive policies from the government, to compensate for the slowing growth of major economies. Additionally, the expected implementation of the non-prefunding circular by the end of the year may attract more capital inflows into the market.