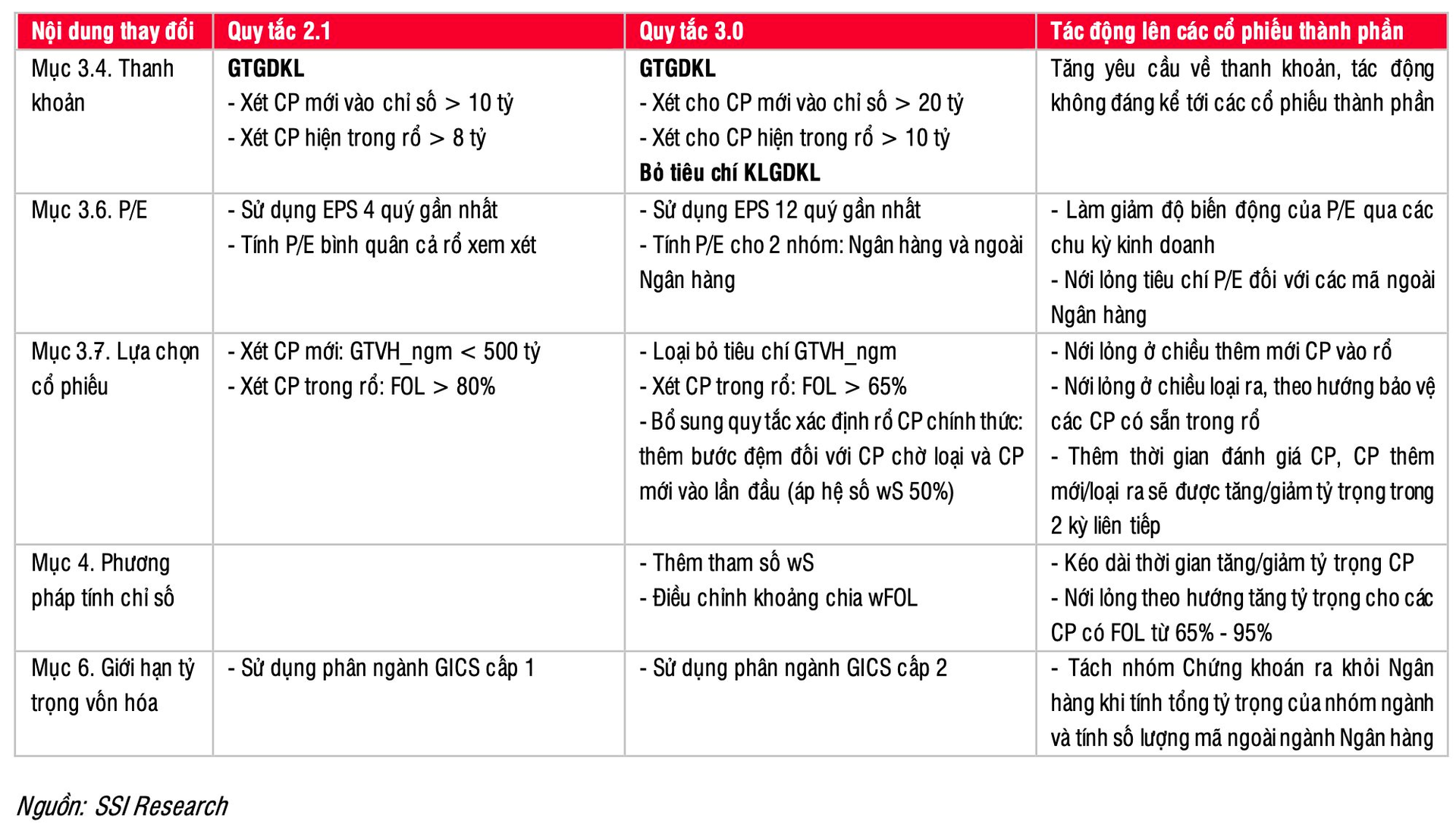

The Ho Chi Minh City Stock Exchange (HoSE) has released the VNDiamond Index Rules version 3.0, replacing version 2.1, effective from the October 2024 review period. ETFs will implement portfolio restructuring for the 4th quarter of 2024 according to the following schedule, with the portfolio restructuring completion date falling on November 1st.

According to SSI Research, the new index rules tighten the conditions for stock liquidity while loosening the conditions for FOL to ensure a sufficient number of stocks meet the index criteria. Additionally, the new rules adjust the P/E filter, add rules for determining the official stock basket, and introduce the wS parameter to limit volatility in the index.

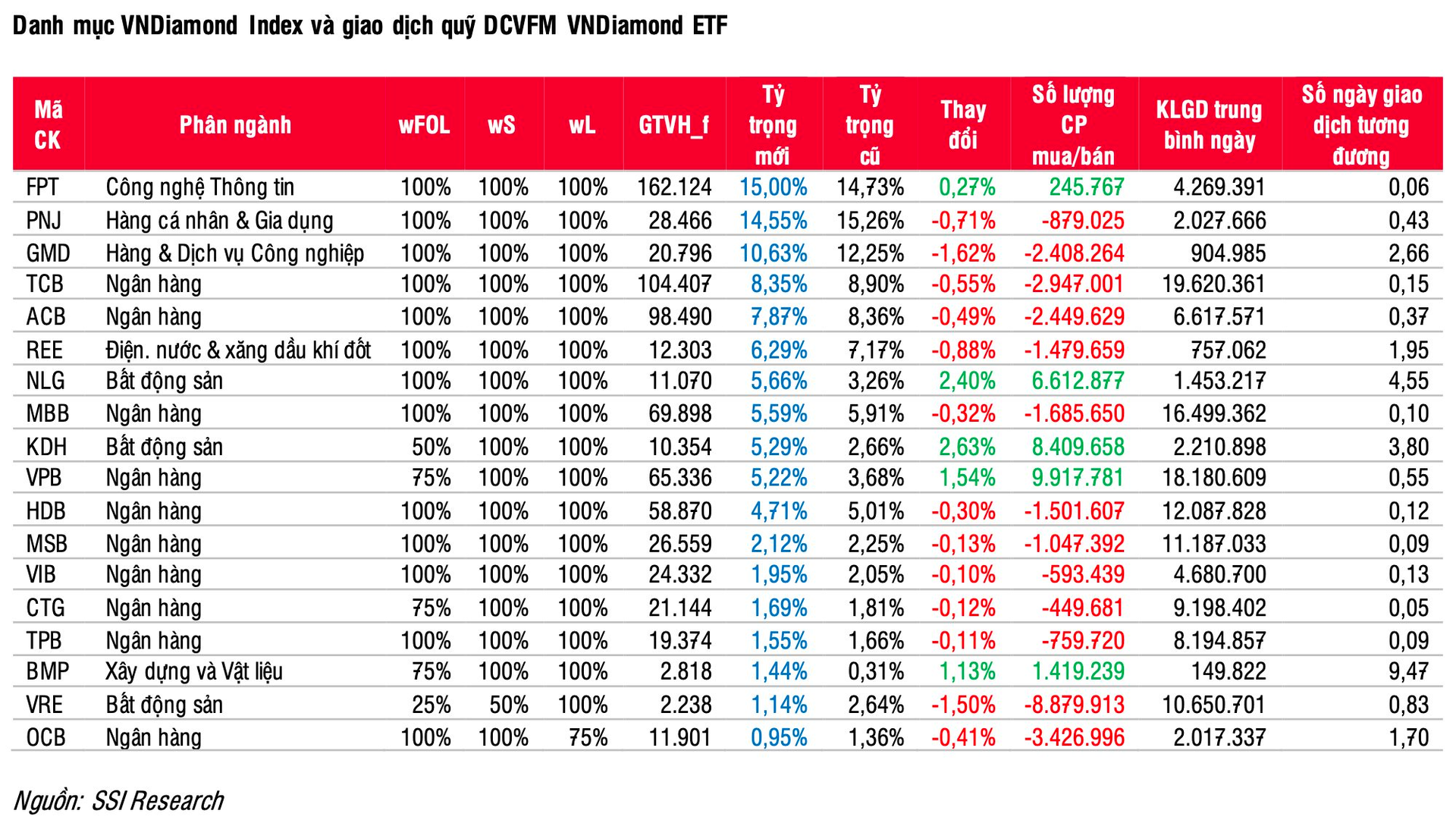

Based on provisional data as of September 5th, SSI Research forecasts no changes in the VNDiamond Index constituents for this period, with 18 stocks comprising 10 banking stocks and 8 non-banking stocks. However, the analysis team highlights some notable points:

VRE’s FOL has dropped below 65%, disqualifying it from remaining in the index. Per the new rules, VRE is placed in the “To be Deleted” group and assigned a wS factor of 50%, equivalent to a 50% reduction in stock weight. In the next period, if VRE fails to improve its FOL above 65%, it may be completely removed from the index.

Meanwhile, MWG has met the P/E criterion under the new index rules (<2 times the average PE of the non-banking stock group), but its FOL has not yet reached the required threshold of 95%, so it will not be added to the index in this period. In the next period, MWG may be included in the index if VRE is officially removed.

According to SSI Research, stocks like NLG, KDH, VPB, and BMP may see increased weights due to adjustments in the wFOL factor scale. Conversely, the remaining stocks will experience reduced weights to balance the portfolio.

Among the ETFs in the market, five ETFs currently use the VNDiamond Index as a reference: DCVFM VNDiamond, MAFM VNDiamond, BVF VNDiamond, KIM Growth Diamond, and ABF VNDiamond. As of September 5, 2024, these ETFs collectively held approximately VND 12,000 billion in net assets, with the DCVFM VNDiamond ETF alone accounting for VND 12,000 billion.

“Novagroup Finalizes Sale of Over 3 Million Shares; Major Shareholder Group Linked to Mr. Bui Thanh Nhon Now Holds Less Than 39% Stake in Novaland”

Since the beginning of the year, NovaGroup has sold over 36 million Novaland shares, including shares liquidated by the securities company.