Taxpayers facing hardships due to natural disasters, fires, accidents, or critical illnesses affecting their ability to pay taxes will be eligible for personal income tax reductions corresponding to the extent of their damages, without exceeding the payable tax amount.

Producers of goods subject to special consumption tax who encounter difficulties due to natural disasters or unexpected accidents will also receive tax reductions. The amount of reduction will be determined based on actual losses but not exceed 30% of the payable tax amount for the year in which the damage occurred.

Input VAT on goods and services used for the production and trading of VAT-liable goods and services is fully deductible, including non-compensated VAT on VAT-liable goods damaged or lost.

Hanoi offers tax exemptions and reductions to those affected by Typhoon Yagi.

For corporate income tax, if a company incurs expenses related to the value of losses due to natural disasters, epidemics, fires, or other force majeure events, and these expenses are not compensated, they can be included as deductible expenses when determining taxable income.

Taxpayers of resource taxes who experience natural disasters, fires, or unexpected accidents resulting in resource losses will be considered for tax exemptions or reductions for the lost resources. If they have already paid the tax, they will be refunded the amount paid or have it deducted from their next resource tax payment.

Taxpayers who suffer damages in cases of force majeure will be exempt from administrative fines for tax management violations. The total amount of fine exemption will not exceed the value of the damaged assets or goods after deducting any insurance or compensation received (if applicable).

Late payment penalties will be waived for taxpayers who experience damages in cases of force majeure.

Taxpayers unable to submit tax declarations on time due to natural disasters will be granted an extension by the direct managing tax authority upon request.

The extension for tax payment will be considered based on the taxpayer’s request in cases of physical damage directly affecting production and business operations due to force majeure. The extension period will not exceed two years from the tax payment deadline.

Home Loan Insurance: Will My Policy Cover Damage Caused by Storm Yagi?

According to legal experts, in the event of storm damage to your property, such as broken windows, burst pipes, or water tank leaks caused by Storm Yagi, your loan insurance policy with the bank may cover the repairs. It is important to review your contract terms to understand your coverage.

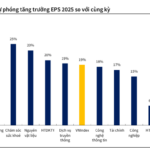

Resolution No. 28/NQ-CP: Consistent Objectives for Promoting Growth while Maintaining Macroeconomic Stability

The government mandates that ministries, agencies, and localities must firmly and consistently prioritize goals to promote growth while maintaining macroeconomic stability, controlling inflation, and ensuring the major balances of the economy.