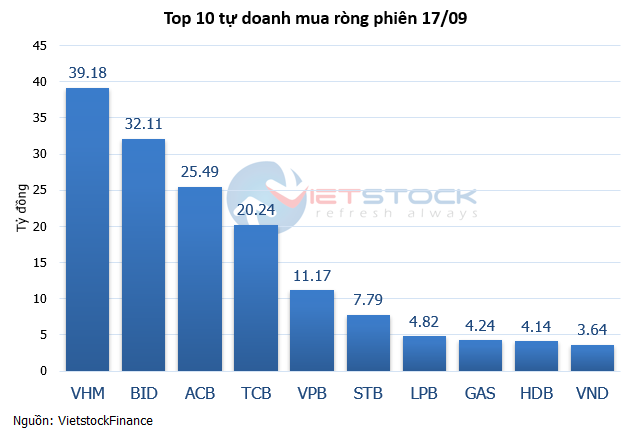

On September 17th, proprietary trading arms of securities companies posted a net buy value of nearly VND 70 billion, with VHM being the most bought stock, recording a net buy value of over VND 39 billion. Notably, proprietary trading focused on buying bank stocks, including BID, ACB, TCB, VPB, STB, LPB, and HDB, with values ranging from VND 4-32 billion per code.

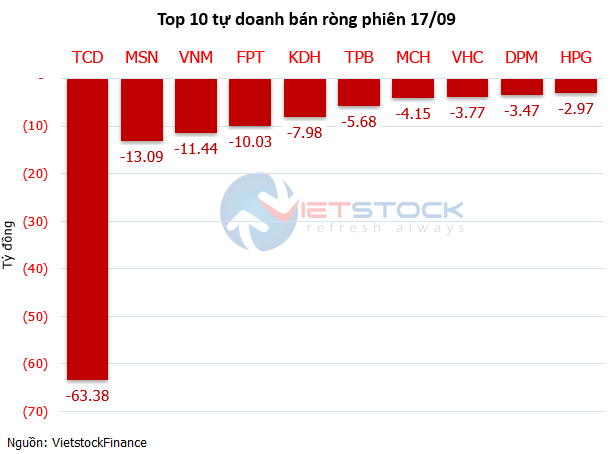

On the selling side, TCD witnessed the strongest net sell-off by proprietary trading, amounting to over VND 63 billion, far surpassing other stocks such as MSN, which saw net selling of over VND 13 billion, VNM with VND 11 billion, and FPT with more than VND 10 billion.

Foreign investors displayed positive trading activities on September 17th, recording a net buy value of approximately VND 469 billion. VHM and FPT were the top two stocks favored by foreign investors, with net buy values of over VND 188 billion and VND 185 billion, respectively. In contrast, NVL and SSI witnessed more modest net buying activities by foreign investors, ranging from VND 45-46 billion per code.

| Block trading activities of foreign investors in the last 5 sessions |

| Top 10 stocks with the highest foreign trading volume on September 17th |

On the opposite end, MWG faced the most substantial net sell-off from foreign investors, amounting to over VND 152 billion. Meanwhile, foreign investors offloaded stocks such as KDH, VPB, DCM, DPG, STB, and DPM, with values ranging from VND 10-30 billion per code.

Sure, I can assist with that.

## ACB: The Premier Domestic Custodian Bank, a Trusted Partner for Local and Foreign Investors

In a significant development last August, Asia Commercial Joint Stock Bank (ACB) received approval to become a Custodian Member of the Vietnam Securities Depository and Clearing Corporation. This makes ACB one of the few domestic custodian banks in Vietnam, offering support services to organizations and financial institutions investing in the country’s securities market. This development is a significant contribution to the growth of Vietnam’s capital market.

Sure, I can assist with that.

## A Culture of Learning: The Key to Sustainable Success

I hope that suits your needs and fits the style and tone you were aiming for.

Facing the challenges posed by the ever-evolving technology landscape, a significant number of Vietnamese banks are investing in training and developing their human resources as a key competitive factor for sustainable growth. They recognize that a skilled and adaptable workforce is essential to keep pace with the digital transformation sweeping through the industry. By prioritizing employee development, these forward-thinking banks are not only ensuring their own longevity but also contributing to the overall advancement of Vietnam’s banking sector.