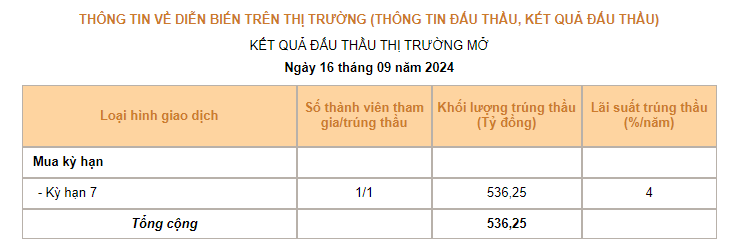

On the trading session of September 16, 2024, the State Bank of Vietnam (SBV) lowered the auction interest rate for collateralized bills (OMO) from 4.25%/year to 4%/year.

The OMO bid amount in the September 16 session reached more than VND 536 billion, slightly higher than in the previous week’s session.

Source: SBV

|

This is the second time the SBV has cut the OMO rate in just over a month. Previously, on August 5, 2024, the SBV lowered this interest rate from 4.5%/year to 4.25%/year.

Earlier this year, the SBV twice adjusted the OMO rate in mid-April and May 2024, from 4%/year to 4.25%/year and then to 4.5%/year.

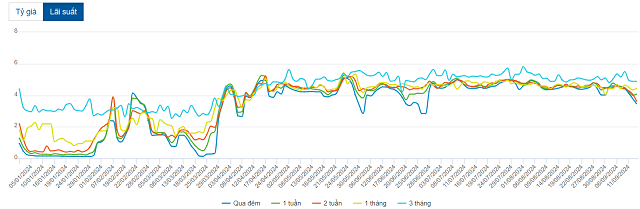

In the interbank market, at the end of the session on September 13, the average overnight interest rate was 3.47%/year, the 1-month term was 4.44%/year, and the 3-month term was 4.48%/year…

|

Interbank interest rates since the beginning of the year

Source: VietstockFinance

|

Lowering the OMO rate does not necessarily mean lowering the lending rate

Mr. Nguyen Quang Huy – CEO of Finance and Banking, Nguyen Trai University stated that the SBV’s reduction in the OMO rate could help commercial banks access short-term capital at a lower cost. However, this does not mean that commercial banks will easily reduce lending rates.

First, the relationship between the OMO rate and the ability to lower lending rates. The OMO rate only directly affects the borrowing of commercial banks from the SBV through open market operations (short-term maturity of 7-14 days). This provides commercial banks with short-term liquidity and somewhat reduces capital costs. However, lending rates depend on many other factors, not just short-term capital costs from OMO but also including capital mobilization costs from deposits, credit risks, and the goal of maintaining the net interest margin (NIM).

Second is the pressure from capital mobilization costs. Recently, many commercial banks have had to increase deposit interest rates to attract deposits from individual and corporate customers. This is because market liquidity is not as abundant as expected, especially after the pandemic, and the economy is still recovering slowly. In addition, credit demand remains high in some fields, such as real estate, consumer goods, and production, increasing the pressure on capital mobilization by banks.

When deposit interest rates increase, the capital costs of commercial banks also increase, making it more difficult to reduce lending rates. NIM (the difference between lending rates and deposit interest rates) is an important indicator of bank profitability, so a significant reduction in lending rates will affect their profitability.

Third is the impact on NIM and bank profits. NIM is an indicator that banks care about because it reflects the profitability of credit activities. If the capital mobilization interest rate increases and the lending rate does not increase accordingly, NIM will narrow, directly affecting the profits of banks.

With the SBV lowering the OMO rate, banks can have more short-term liquidity at a lower cost, but to sustainably reduce lending rates, they need to reduce overall capital costs, including mobilization costs from deposits.

In the context of many banks competing to attract deposits, maintaining NIM stability is a priority. Therefore, banks will consider carefully before deciding to reduce lending rates, especially for long-term loans or in high-risk fields.

Fourth is the requirement of the SBV and the pressure of implementation. Although the SBV requires commercial banks to reduce lending rates to support businesses and the economy, the implementation capacity will not be the same among banks. Banks with abundant liquidity or strong capital structure can reduce interest rates faster than small banks with low NIM ratios and high dependence on market capital mobilization.

The difference in the capital structure between banks will also affect their ability to adjust lending rates. Banks with a large amount of non-term deposits (high CASA) can easily reduce interest rates compared to banks with a large proportion of long-term deposits with high mobilization interest rates.

Finally is the overall impact of the policy. Large enterprises with good negotiation capacity and easy access to banks will benefit when some banks can reduce lending rates. However, the impact may not be the same across industries, as banks will prioritize sectors with lower risks.

On the other hand, small and medium-sized enterprises (SMEs) may face more difficulties in benefiting from this policy because banks often set higher interest rates for loans with high credit risks. Although the SBV calls for support for SMEs, implementation will be challenging when banks’ capital costs have not really decreased.

The monetary easing policy can promote economic growth but also potentially leads to inflation, especially if the money flowing into the economy is not used efficiently. If lending rates do not fall sharply, the impact on consumption and prices can be controlled.

Although the SBV is implementing a monetary easing policy by lowering the OMO rate and requiring commercial banks to reduce lending rates, banks will not easily do so due to the pressure to maintain NIM and increase deposit interest rates to attract deposits. The reduction in lending rates will depend on liquidity, capital structure, and the business strategy of each bank. In the short term, this policy can partially support large enterprises, but the impact on small and medium-sized enterprises will be unclear if banks cannot reduce capital mobilization costs.

The Stock Market ‘Anticipates’ Next Week’s Key Event

The market experienced a rather dull trading week, with the last two sessions seeing the lowest liquidity since April 2023. Investor sentiment seems to be heavily impacted by the aftermath of the third storm, which disrupted the business operations of a significant number of enterprises. The market is also awaiting the response of the State Bank of Vietnam following the interest rate cut by the Federal Reserve.