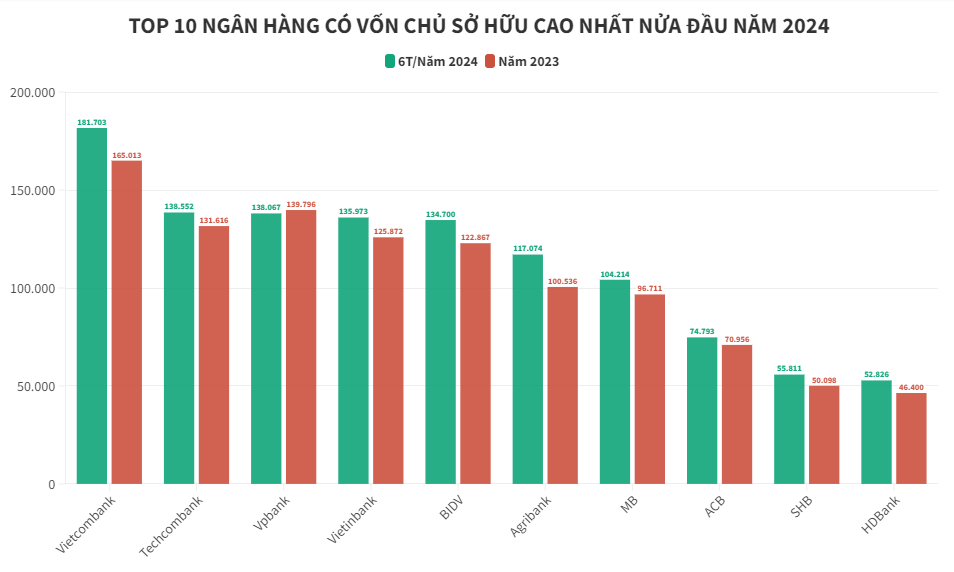

According to the latest data from the Banking Association, based on the financial reports of 30 banks for Q2 2024, the total charter capital of these banks reached VND 1.5 quadrillion, an 8% increase compared to the same period last year.

Techcombank followed in second place, with charter capital reaching VND 138,522 billion, a 5% increase compared to the beginning of the year.

VPBank ranked third on the list, with charter capital of VND 138,067 billion, a slight 1% decrease compared to the end of the previous year.

VietinBank and BIDV secured the fourth and fifth positions, respectively, with charter capital of VND 135,973 billion and VND 134,700 billion, reflecting increases of 8% and 10% from the end of 2023.

Agribank, with charter capital of VND 117,074 billion, a substantial 16% increase compared to the end of the previous year, secured the sixth position. Agribank received an additional capital injection of VND 10,347 billion in the first half of 2024.

The Top 10 also included banks like MB, ACB, SHB, and HDBank, with MB being one of the seven banks to surpass the VND 100,000 billion charter capital milestone.

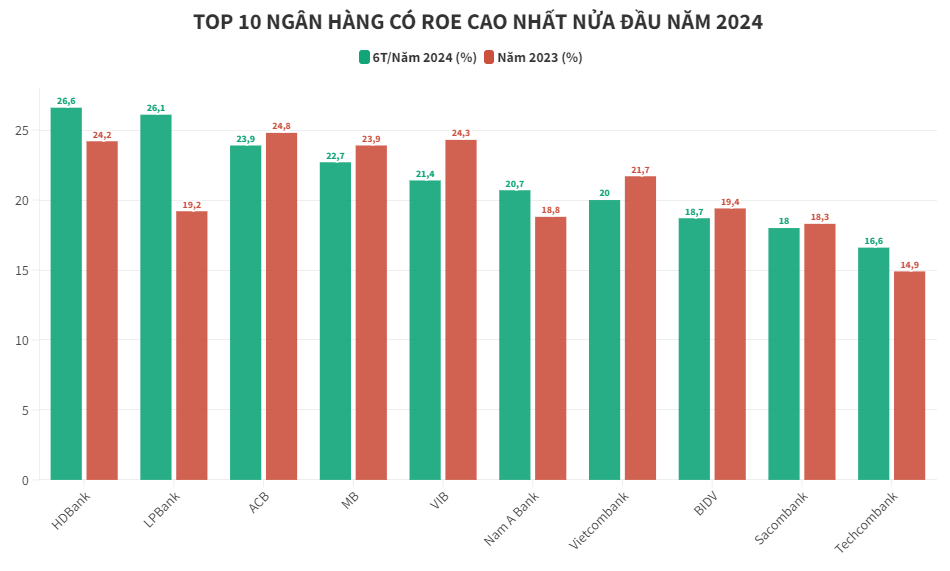

According to statistics from WiChart, the four-quarter trailing return on equity (ROE) of 27 listed banks as of Q2 2024 showed a recovery, reaching 17.1%, an increase of 0.4 percentage points compared to Q1 2024. However, compared to the end of 2023, the ROE of these banks still decreased by 0.1 percentage points.

HDBank maintaining its top position with an ROE of 26.6%, an increase of 2.4 percentage points compared to the beginning of the year. LPBank surpassed VIB, ACB, and MB to rank second with an ROE of 26.1%, a significant improvement of 6.9 percentage points – the highest increase in the banking industry. ACB dropped to third place, with an ROE of 23.9%, a 1 percentage point decrease compared to the previous year’s figure. MB ranked fourth with an ROE of 22.7%, a slight decrease of 1.2 percentage points. VIB’s ROE fell to 21.4%, placing them in fifth position, a decrease of 2.9 percentage points compared to the beginning of the year. Nam A Bank improved its ranking, surpassing Vietcombank, as its ROE increased by 1.9 percentage points to 20.7% in Q2 2024. The remaining positions in the Top 10 were held by Vietcombank, BIDV, Sacombank, and Techcombank. Notably, OCB, VIB, and Vietcombank experienced the sharpest declines in ROE in the first half of the year, at 5.1, 2.9, and 1.72 percentage points, respectively.

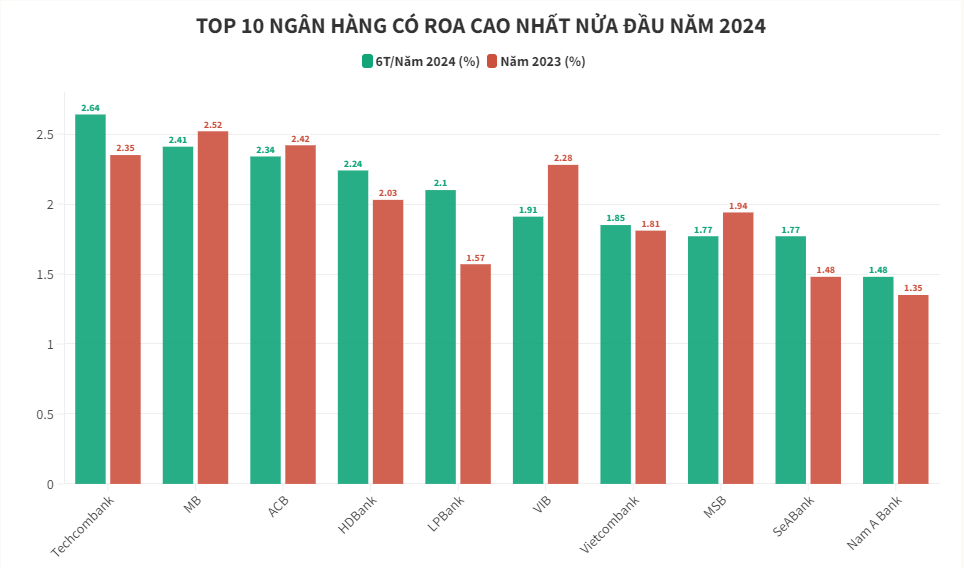

Regarding the return on assets (ROA), the profitability indicator of listed banks showed a recovery compared to the end of 2023. The banking industry’s ROA (comprising 27 banks) increased by 0.04 percentage points to 1.52% in Q2 2024.