The Vital Role of Increasing Charter Capital

According to Decree 141, by December 31, 2010, commercial banks were required to have a chartered capital of VND 3,000 billion, with an extension granted until December 31, 2011. Thus, 2011 also marked a race among banks to increase their capital to meet the VND 3,000 billion requirement, including SGB, KLB, VBB, NCB, OCB, and NAB.

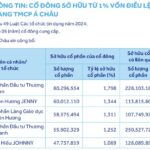

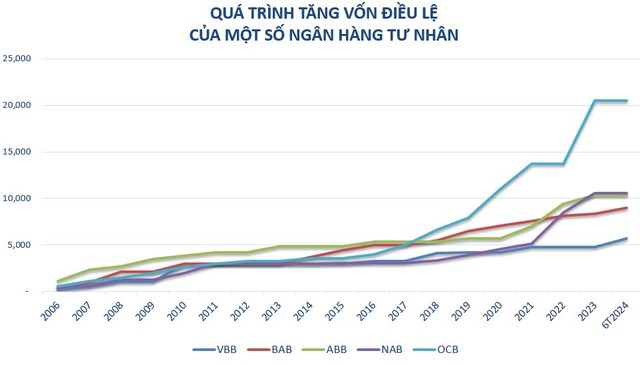

Data from the State Bank of Vietnam (SBV) shows that ten years ago, in 2014, state-owned commercial banks accounted for 30% of the total charter capital in the system, while private banks held 44%. However, by the end of June 2024, the charter capital of these two groups stood at 21% and 55%, respectively, indicating the remarkable growth of private banks in the capital race. Specifically, the charter capital of state-owned commercial banks reached VND 228,229 billion by December 31, 2024, an increase of VND 94,023 billion, equivalent to a 41% growth compared to the end of 2014. In contrast, the charter capital of private banks reached VND 587,850 billion, a substantial increase of VND 587,850 billion, equivalent to a 67% growth rate.

Private commercial banks had a unique opportunity to break away in terms of charter capital, especially during the 2017-2018 period, as banks rushed to list on the stock exchange, opening up possibilities for capital increases and attracting potential strategic investors while also taking advantage of opportunities to raise capital domestically and internationally.

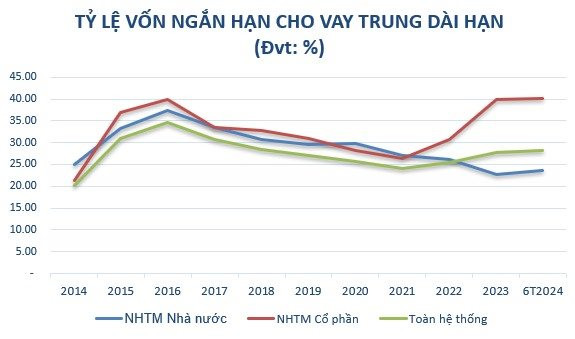

Apart from complying with regulatory requirements, increasing charter capital is crucial for banks to expand their medium and long-term capital sources and diversify their business operations as the ratio of short-term capital used for medium and long-term loans is gradually tightened following the roadmap outlined in SBV’s Circular No. 08/2020/TT-NHNN dated August 14, 2020, amending and supplementing Circular No. 22/2019/TT-NHNN on the limits and ratios to ensure safe operations of banks and foreign bank branches.

Source: SBV Consolidated Data

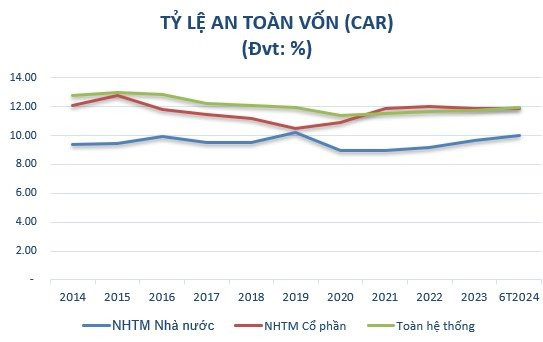

Additionally, increasing capital aims to ensure the Capital Adequacy Ratio (CAR) as stipulated by the competent authorities, striving to meet international standards and achieve continuous annual profit growth. Capital increase is also in line with the Project on Restructuring the System of Credit Institutions associated with Handling Bad Debts in the 2021-2025 period under Decision No. 689/QD-TTg dated June 8, 2022, issued by the Prime Minister. One of the critical objectives is to achieve a CAR of at least 10-11% for commercial banks by 2023 and at least 11-12% by 2025.

After ten years of high charter capital growth, the CAR of private banks is significantly higher than that of state-owned banks. Specifically, in 2014, the minimum capital adequacy ratio of state-owned commercial banks was 9.4%, while that of private banks was 12.07%. By June 2024, the capital adequacy ratio of joint-stock commercial banks (11.86%) was also higher than that of state-owned banks (9.99%), in accordance with Circular 41/2016/TT-NHNN.

(*) Since 2020, the CAR has been calculated based on banks applying Circular 41/2016/TT-NHNN. Source: SBV Consolidated Data

Thus, it can be seen that increasing charter capital plays a crucial role in ensuring the stability and sustainable development of banks. It not only helps banks meet legal requirements and regulatory mandates but also expands their business operations, enhances their financial capacity, and strengthens their competitiveness in the market.

Currently, banks are proactively seeking suitable solutions, especially small and medium-sized banks, including flexible capital increase methods, improving operational efficiency, and complying with new legal regulations to maintain sustainable development in the current market context.

Increasing Charter Capital through Dividend Payout is Becoming a Trend

There are several forms of capital increase that banks can employ, such as issuing new shares, convertible bonds, and collaborating with strategic investors. However, the choice depends on the financial situation, strategic orientation, shareholders’ wishes, and the economic conditions at a given time.

In the context of the current stock market, which is not very vibrant, issuing new shares faces challenges in attracting shareholders to purchase them. Moreover, banks must also consider the impact of new share issuance on the current ownership ratio of shareholders and comply with regulatory requirements.

Therefore, issuing shares to pay dividends – a method of increasing capital without external mobilization – is gradually becoming a trend among banks, especially after the COVID-19 pandemic. Banks can use accumulated dividends to issue shares to existing shareholders. This approach is reasonable when banks want to maintain the unity of shareholders and are not keen on sharing ownership with new investors.

During the post-COVID-19 recovery phase (2021-2022), the SBV encouraged banks not to pay cash dividends to conserve resources for lowering lending interest rates. As a result, most banks had to switch to paying dividends in shares. In 2023, along with the ratio of share dividends, banks also paid a certain ratio of cash dividends. This shift was not only due to the SBV’s relaxation of the cash dividend policy but also aimed to satisfy a portion of shareholders who were no longer interested in receiving share dividends, given the less favorable stock market performance.

In the group of state-owned joint-stock commercial banks, since the end of 2023, the SBV has allowed this group to increase its charter capital to ensure the capital adequacy ratio and consolidate lending capacity. Vietcombank issued an additional 2.17 billion shares to existing shareholders to pay dividends at a ratio of 38.79%. After completion, the bank’s charter capital will increase from VND 55,891 billion to over VND 77,571 billion. VietinBank was also approved to use the remaining profit in 2022, approximately VND 11,648 billion, to pay dividends in shares, raising its charter capital from VND 53,700 billion to over VND 65,300 billion.

Similarly, Agribank received approval from the 15th National Assembly to supplement its charter capital in the 2021-2030 period, with a maximum of VND 17,100 billion. If this supplement is realized, Agribank’s charter capital will increase to over VND 51,500 billion.

Private banks have also been continuously approved by the SBV for charter capital increases and have completed the necessary license amendment procedures since the beginning of 2024.

At the end of July 2024, the SBV approved OCB to increase its charter capital by issuing shares to pay dividends to existing shareholders at a rate of 20%, with a maximum of VND 4,109 billion. After the successful issuance, the bank’s charter capital will increase from VND 20,548 billion to VND 24,658 billion.

Previously, NAB was also approved to increase its charter capital from VND 10,580 billion to VND 13,725 billion by paying dividends in shares at a rate of 25% and issuing 50 million ESOP shares at a price of VND 10,000 per share.

Meanwhile, Vietbank plans to use nearly VND 1,445 billion to pay dividends in shares and retain VND 148 billion. Specifically, Vietbank continues to implement the plan to increase capital by offering shares to existing shareholders (approved by the SBV in July 2023) with a total additional amount of VND 1,003 billion, raising its charter capital from VND 4,777 billion to VND 5,780 billion. To date, the bank has completed the offering of over 100.3 million shares and is in the process of requesting the SBV’s approval for license amendment, expected to be completed in Q3/2024.

Vietbank also plans to issue nearly 144.5 million shares to pay dividends to existing shareholders, equivalent to a ratio of 25%, expected to be implemented in Q3 and Q4/2024. The total par value of the issuance is nearly VND 1,445 billion. If the license amendment procedure for charter capital and the issuance of shares for dividend payment are successfully completed, Vietbank’s charter capital will increase to nearly VND 7,225 billion.

In recent years, small and medium-sized banks have been proactive in continuously increasing their charter capital. Despite joining the capital race later, banks like OCB (5.8 times), NamABank (3.5 times), ABBank, BacABank, and Vietbank have doubled their charter capital over the past ten years.

Although Vietbank (VBB) was established later than other banks in the system (2006), after eight capital increases through various forms, its charter capital has increased from VND 200 billion to VND 5,712 billion (as of June 30, 2024). Thanks to strategic shareholders, talented human resources, and a well-defined business orientation, the bank’s performance has improved with each capital increase. Consequently, Vietbank has enhanced its ability to attract more strategic shareholders in the future, and its potential for charter capital growth remains high.

Along with the annual business growth plan, increasing charter capital is necessary to enhance the bank’s financial capacity, including expanding its scale, improving competitiveness, and meeting the plan to expand its transaction network. It also enables continued investment in technology systems to modernize the bank, support the development of new products, and enhance customer service experiences.

Notably, in the current phase, charter capital is also considered a “buffer” reserve, providing resources for banks to cope with challenges in an unstable economic environment and facilitating credit activities to support the economy as per the government’s orientation.

It is worth noting that the new Law on Credit Institutions, which took effect on July 1, 2024, will significantly impact banks’ charter capital increases. The new law sets out requirements and regulations on minimum capital, risk management, and credit institutions, presenting both opportunities and challenges. Banks must comply with these regulations to ensure their operations conform to the law while also improving management quality and enhancing financial capacity.