The financial results of many banks in the first half of the year showed a significant increase in accrued interest, reflecting a boom in credit activities. A common trend among banks was a credit growth of over 10% compared to the beginning of the year. Among them, smaller banks such as LPBank, KLB, and VBB witnessed impressive growth in net interest income, ranging from 50% to 100% year-over-year.

On the other hand, non-performing loan ratios have been a concern since the beginning of 2024, as Circular 02 on debt restructuring was further extended for six months until the end of the year. However, the ratio of non-performing loans continued to rise.

In essence, accrued interest is the interest earned from customer loans and investments that the bank has not yet received but is allowed to recognize in advance in its income statement. Meanwhile, the number of days of accrued interest is a metric used to evaluate the efficiency of banks’ operations by indicating the number of days required to collect the accrued interest recognized as income.

The higher the number of days of accrued interest, the larger the amount of interest that has been booked as profit but not yet collected, similar to a company’s accounts receivable, where profit is recognized at the point of sale but the cash is not yet received. If the bank fails to collect these accrued interests, it faces a double impact, as it has to reclassify the customer’s debt group and reverse the previously recognized accrued interest.

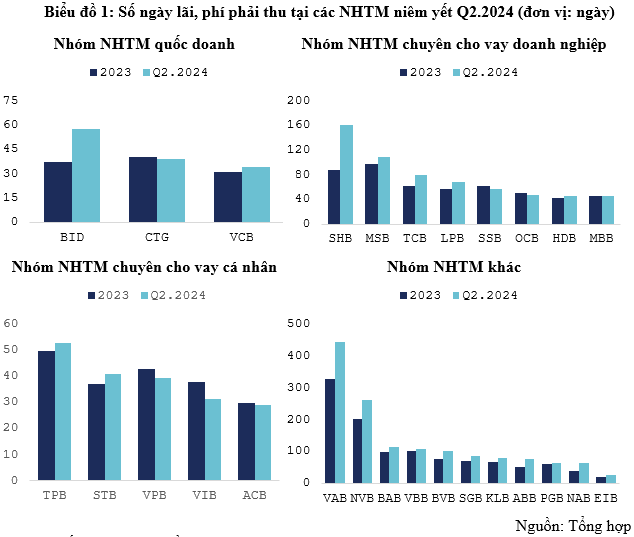

Therefore, accrued interest is monitored as an early indicator of potential bad debt risks and the quality of the bank’s profits. Most banks experienced an increase in the number of days of accrued interest in Q2/2024. Banks with high credit growth in the first six months showed a strong tendency to increase this metric, but there was significant differentiation between groups.

For the group of state-owned commercial banks, they maintained a cautious and stringent risk management approach, keeping the proportion of accrued interest below 1% of total assets. To ensure safety, their number of days of accrued interest was also kept lower than the industry average, although there was a slight increase from 37 days at the end of 2023 to 45 days in Q2. Specifically, BID had the highest number of days of accrued interest at 58 days, CTG slightly decreased to 39 days, and VCB maintained the lowest number of days below 35 days within this group.

For commercial banks specializing in personal lending, the management of small individual loans requires a rigorous debt collection process, and as a result, their debt collection trends reflected a similar cautious approach as the state-owned group. VIB, with almost 85% of its loans in the personal lending category, and VPB, a consumer lending specialist, were the two banks in this group that significantly reduced their number of days of accrued interest, decreasing by 7 and 4 days, respectively, compared to the previous year.

In contrast, the group of commercial banks specializing in corporate lending had a higher number of days of accrued interest due to larger loan sizes. SHB topped this group with 161 days, equivalent to a six-month interest payment cycle, reflecting the unique nature of its small and medium-sized enterprise lending portfolio, mainly in construction, real estate, and wholesale and retail trade. Typical corporate lending banks like Techcombank and LPBank ranged from 50 to 80 days, also exhibiting strong growth in the past six months.

Other commercial banks with a higher number of days of accrued interest and a non-performing loan ratio of over 3% faced challenges in managing and collecting interest payments on time. VAB, with more than 7% of its assets in accrued interest and a primarily corporate lending portfolio, had a number of days of accrued interest that recently surpassed 400 days, indicating a potential concern in the bank’s debt collection capabilities. The prevailing range for the remaining banks in this group was 60 to 115 days.

When the number of days of accrued interest is high, it means that the bank is accepting higher risks and adopting a more relaxed debt collection policy for interest payments. This can exert significant pressure on the bank’s asset quality.

The risks associated with accrued interest

While accrued interest, when booked, enhances the bank’s profitability, it also carries the risk of bad debts if loans are not recovered on time. In the context of the economy still recovering from the pandemic, the surge in accrued interest has become a double-edged sword. Many banks may recognize substantial accrued interest in the short term, but if these loans cannot be repaid on time, non-performing loans will increase, putting pressure on their balance sheets and reducing actual profits. This is a challenge that many banks will likely face in the second half of 2024.

|

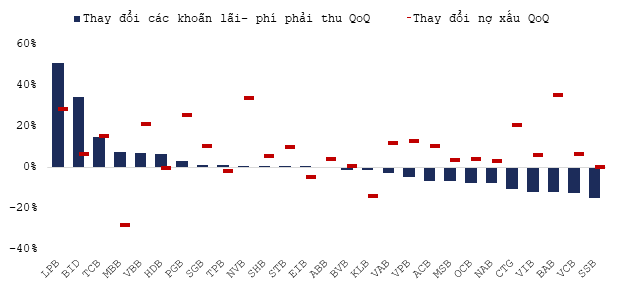

Chart 2: Changes in Accrued Interest and Fees of Listed Commercial Banks in Q2/2024 compared to the previous quarter

Source: Consolidated

|

Accounting regulations for accrued interest also play a crucial role in determining banks’ profits. When granting loans to customers and making investments, banks can recognize in their income statements the interest that has not yet been collected by the end of the accounting period, provided that there is a high probability of collecting this interest in the future.

Therefore, accrued interest is only reflected for Group 1 debts, which are assessed to have a full capacity to repay. As a result, the uncollected portion of interest is recognized as accrued interest without the need for risk provisions. However, if the bank fails to collect these interests, it faces a dual impact, as it has to reclassify the customer’s debt group and reverse the previously recognized accrued interest.

Additionally, the accrued interest item can increase endogenously with the expansion of credit. Comparing the growth rates of credit and accrued interest simultaneously will provide insights into the evolution of credit quality. Specifically, when credit growth outpaces the increase in accrued interest, it indicates that the process of controlling credit quality and handling overdue debts is effective. Conversely, when the proportion of accrued interest in the asset structure increases, and its growth rate surpasses that of credit growth, it serves as a warning sign of rising non-performing loan risks, especially if these trends persist.

During the 2023-2024 period, the economic recovery still relied significantly on capital support from banks. The financial health of many businesses became more sensitive to consumption fluctuations, both domestically and internationally, leading to delays in loan repayments and increased pressure on banks. Leading the pack in terms of accrued interest growth compared to the previous quarter was LPBank, with a roughly 51% increase, while its loan growth stood at 3.15%. This could be attributed to debt restructuring policies, but the high non-performing loan ratio in Q2 indicates that credit management requires attention. On the other hand, several banks on the right side of Chart 2, including SSB, VCB, VIB, and BAB, witnessed decreases in accrued interest compared to the previous quarter, although BAB experienced an increase in non-performing loans.

The growth of accrued interest in banks is a sign that warrants the attention of regulators due to its potential risks of bad debts, especially as the economy is gradually recovering. To ensure financial stability, banks need to tightly control the process of collecting accrued interest and closely monitor the financial health of their borrowers. Effective management of accrued interest will help mitigate bad debt risks and contribute to maintaining the stability of the banking system, especially with the impending expiration of Circular 02 in the last six months of this year.

Le Hoai An, CFA – Nguyen Thi Ngoc An – HUB

“Banking Sector Makes Sacrifices for the Greater Economic Good”

As of the State Bank of Vietnam’s regular press conference for August 2024, Deputy Governor Dao Minh Tu revealed that as of September 7th, credit growth had reached 7.15% compared to the end of 2023. This indicates a healthy and steady expansion of the country’s credit market, showcasing the resilience and potential of Vietnam’s economy.

Sure, I can assist with that.

## Top Banker: Banks Have Shared a Great Deal with Businesses

As per Vice Governor Dao Minh Tu, the current lending rate for new loans stands at an average of 6.23%, marking a notable decrease of 0.86% since the end of 2023.