Mr. Le Duc Khanh, Director of Investment Analysis at VPS Securities, at the Midday Match Livestream on September 18th

|

The Fed is likely to kick off its rate-cutting campaign with a cautious approach.

Tonight, Vietnam time, the US Federal Reserve (Fed) will hold a meeting and is highly expected to cut interest rates, but the extent of the cut has sparked differing views.

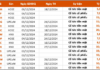

Based on the Dot Plot chart, statements from Fed Chairman Jerome Powell in the recent period, along with the current US job market, inflation rate, and unemployment situation, it is highly likely that the Fed will cut interest rates at the meeting on September 18-19.

According to Mr. Khanh, by observing the Fed’s monetary policy through multiple chairpersons, their approach has consistently been cautious, avoiding statements or actions that could lead to significant shocks in the financial market.

Mr. Khanh stated that the probability of a 50-basis-point cut is higher, at around 60%. However, the Fed may opt for a milder reduction of 25 basis points, leaving room for two more rate cuts in November and December, with 25 points each or a 50-point cut in one of the months.

Mr. Khanh emphasized that a gradual shift in policy direction, starting with a small step and then increasing in magnitude, would be more appropriate.

VN-Index is poised to advance towards the 1,290-point region in September.

Regarding the performance of the Vietnamese stock market in recent days, Mr. Khanh shared that he was surprised by the strong recovery in the index, and while liquidity has not yet exploded, it is approaching the average of the last 7 sessions.

In Mr. Khanh’s opinion, the market has touched the mid-term adjustment bottom, the deepest bottom of 2024, and there are still high hopes to reach the old peak of 1,290 points in September. It is entirely reasonable to reinvest, even with 30-40% equity ratio.

The market may recover quickly, but it will then need to accumulate and adjust at the resistance zone of 1,280-1,290 points several times before officially breaking through. Therefore, investors should not rush their expectations, but the overall trend until the end of 2024 is still expected to be upward.

For professional investors who can closely monitor the market, investing with a large ratio is feasible. In contrast, non-professional investors who are uncertain about market opportunities should opt for a moderate equity ratio.