Regulatory shortcomings regarding trading frequency

Vietnam’s Ministry of Finance is seeking feedback on a draft law to amend and supplement the Securities Law. The draft adds conditions for professional securities investors and introduces requirements for organizations issuing public bonds.

According to the draft, individuals seeking to become professional securities investors must now meet additional criteria: a minimum of two years of securities investment experience, a minimum trading frequency of 10 trades per quarter in the last four quarters, and an annual income of at least VND 1 billion in the last two years.

For institutional investors, companies with a chartered capital of over VND 100 billion must have operated for a minimum of two years. Professional securities investors participating in the purchase, trading, and transfer of private enterprise bonds must be organizations.

Analysts and investors argue that the private enterprise bond market is not intended for the general public. Thus, it is appropriate to set conditions for investors to meet certain standards. However, the proposed trading frequency criterion to determine professionalism is seen as inadequate.

The amended Securities Law draft adds a condition for professional investors, including a minimum trading frequency of 10 times per quarter (in the last four quarters).

In an interview with Tien Phong , Mr. Vu Duy Khanh, Director of Analysis at Smart Invest Securities Joint Stock Company (AAS), stated that trading frequency is challenging to quantify and qualify. High trading volume does not necessarily indicate a better understanding of risk.

“The best approach is to require investors to purchase through funds, shifting the burden of assessment and liquidity pressure to the funds. If these bonds are allowed to trade in the secondary market, consider permitting leverage for such products, with brokerage firms assuming the assessment role,” suggested Mr. Khanh.

The AAS expert also recommended enhancing credit rating and bond classification to assign groups and interest rates accordingly.

The draft amended Securities Law also mandates that organizations issuing public bonds must provide collateral or bank guarantees when applying for issuance permission, except for secondary debt instruments from credit institutions that meet the conditions to be counted as Tier 2 capital.

According to Mr. Khanh, this solution can be implemented in the short term to standardize the market, followed by gradual relaxation. “The bond market needs transparency, and expanding its scale can wait. In addition to issuance conditions, listing requirements should be clear, and bond trading should be similar to stock trading, with the possibility of losses, avoiding the current confusion. Repo bonds (issuing new debt to repay old debt) should not be traded as if they are purchases,” Mr. Khanh cautioned.

Regarding the proposed trading frequency criterion for professional investors, Mr. Nguyen The Minh, Director of Research and Analysis for Retail Clients at Yuanta Securities Joint Stock Company, remarked that it could create barriers for investors looking to enter the bond market. Consequently, capital raising for enterprises becomes more challenging, given the low liquidity in this market following the collapses in 2022.

How do other countries regulate this?

Markets in the region do not consider trading frequency as a standard for professional investors. According to Mr. Minh, the criteria used by other countries focus on three main factors: experience in the securities market, net asset value (NAV), and annual income or financial assets.

In Singapore, individuals classified as professional investors must have a net asset value exceeding SGD 2 million (VND 38 billion), an annual income of at least SGD 300,000 (over VND 5.7 billion), or financial assets surpassing SGD 1 million (approximately VND 1.9 billion). Institutional investors meet the requirement if they have a net asset value of over SGD 10 million (equivalent to VND 19 billion) or are licensed financial institutions.

In Malaysia, professional investor criteria for individuals include a total personal asset value of over MYR 3 million (approximately VND 17.4 billion) or an annual income of no less than MYR 300,000 (VND 1.7 billion). Institutional investors comprise banks, investment funds, and insurance companies with managed assets exceeding MYR 10 million (over VND 58.1 billion).

Thailand’s Securities and Exchange Commission (SEC) defines professional investors in two main categories: organizations (banks, insurance companies, pension funds, or other financial institutions) and high-income investors.

Specifically, individuals with a net asset value of at least THB 30 million (VND 22.2 billion) or an annual income of at least THB 3 million (VND 2.2 billion) qualify. Another criterion is based on a minimum investment of THB 8 million (VND 5.9 billion) or THB 15 million (VND 11.1 billion) in securities and derivatives.

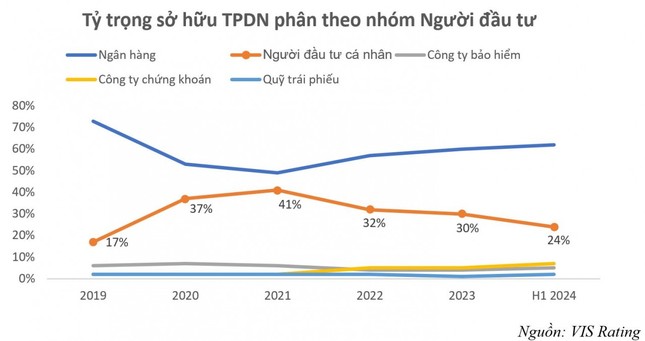

Individual investors hold the second-largest proportion of corporate bonds in the market

Individual investors hold the second-largest proportion of corporate bonds in the market, accounting for 24%, second only to banks. However, corporate bonds are complex financial instruments with specific terms and conditions, requiring specialized knowledge, and are not suitable for small-scale individual investors.

Mr. Tran Le Minh, General Director of Vietnam Credit Rating Joint Stock Company (VIS Rating), noted that the current definitions of professional investors are based solely on asset and trading criteria, without considering experience and knowledge. Many holders of corporate bonds are not professional investors but individual small-scale investors.

According to Mr. Minh, the total value of bonds circulating in the market reached a new peak in 2022. The value of newly issued bonds exceeded that of 2021. Therefore, it is crucial to establish an appropriate legal framework to promote a swift recovery without compromising stability for the sake of growth.

Enterprise Private Bonds: A Playing Field for Professionals Only, Inadvisable for Retail Investors

The proposed amendments to the current Securities Law aim to foster a stable development phase, paving the way for a more transparent market recovery and preventing past risks from reoccurring. This is according to experts in the field, who emphasize the importance of creating a robust foundation for the market’s rebound.