The VN-Index closed the past week at 1,272.04 points, a rise of 20.33 points or +1.62% from the previous week, with improved liquidity.

The average trading value of the three exchanges last week reached VND 18,021 billion. Order-matched transactions averaged VND 15,010 billion, up 25.5% from the nine-month low set the week before. Compared to the five-week average, week 38’s average liquidity was slightly lower (-0.1%).

Buying force was more active than the previous week, while selling force was less dominant.

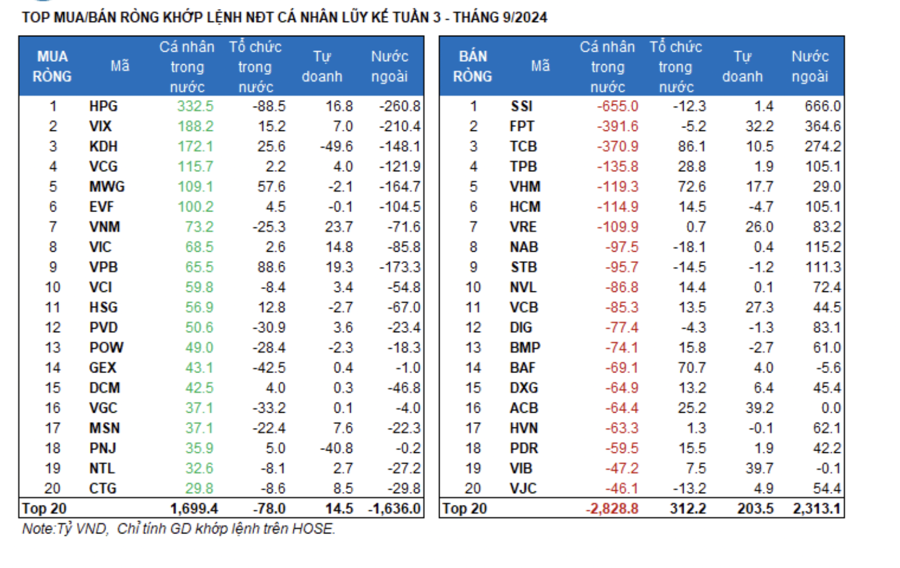

Foreign investors bought a net amount of VND 1,222.6 billion, with a net purchase of VND 1,141 billion in order-matched transactions.

The main net purchase by foreigners was in the Financial Services and Banking groups. The top net purchases by foreigners included: SSI, FPT, TCB, NAB, STB, HCM, TPB, VRE, DIG, and NVL.

On the selling side, foreigners net sold Basic Resources. The top net sales by foreigners included: HPG, VIX, VPB, MWG, KDH, EVF, VIC, VNM, and HSG.

Individual investors bought a net amount of VND 1,319.96 billion, of which they sold a net amount of VND 1,513.5 billion.

In order-matched transactions, they net bought 9/18 industries, mainly Basic Resources. The top net purchases by individual investors included: HPG, VIX, KDH, VCG, MWG, EVF, VNM, VIC, VPB, and VCI.

On the net selling side: they net sold 9/18 industries, mainly Banking and Financial Services. The top net sales included: SSI, FPT, TCB, TPB, VHM, HCM, NAB, STB, and NVL.

Proprietary trading sold a net amount of VND 399 billion, with a net purchase of VND 219.8 billion in order-matched transactions.

In order-matched transactions, proprietary trading net bought 10/18 industries. The top net purchases included VIB, ACB, FPT, GAS, HDB, GMD, VCB, VRE, VNM, and VPB.

The top net sales were in the Personal & Household Goods group. The top net sold stocks included MBB, KDH, PNJ, DGC, FUEVFVND, CTR, FRT, VTP, TLG, and IJC.

Domestic institutional investors sold a net amount of VND 2,143.6 billion, with a net purchase of VND 152.7 billion in order-matched transactions.

In order-matched transactions, domestic institutions net sold 10/18 industries, with the largest value in Basic Resources. The top net sales included HPG, NLG, GEX, REE, VGC, PVD, GMD, PC1, POW, and BID.

The largest net purchase was in the Banking group. The top net purchases included VPB, TCB, VHM, BAF, MWG, DGC, MBB, EIB, TPB, and KDH.

Looking at the weekly framework, the money flow allocation increased in Banking, Securities, Oil & Gas, and Construction Materials, while it decreased in Real Estate, Steel, Food, Chemicals, Retail, Information Technology, and Agriculture & Seafood. The sector price indices also increased last week.

In the weekly framework, money flow returned to large-cap stocks in the VN30 group, while it decreased in mid-cap stocks in the VNMID group and small-cap stocks in the VNSML group.

Last week, the money flow allocation in the large-cap VN30 group reached 54.4%, the highest weekly level recorded since the beginning of 2022. In contrast, the money flow allocation in the mid-cap VNMID and small-cap VNSML groups decreased to 35% and 8%, respectively, from 39.7% and 9% in the previous week.

In terms of money flow size, the average trading value increased in all three groups, with the strongest increase in VN30 (+VND 1,770 billion). This was followed by VNMID (+VND 730 billion) and VNSML (+VND 181 billion).

Regarding price movements, the large-cap VN30 group increased the most (+2.45%), followed by VNMID (+1.57%) and VNSML (+1.02%).