|

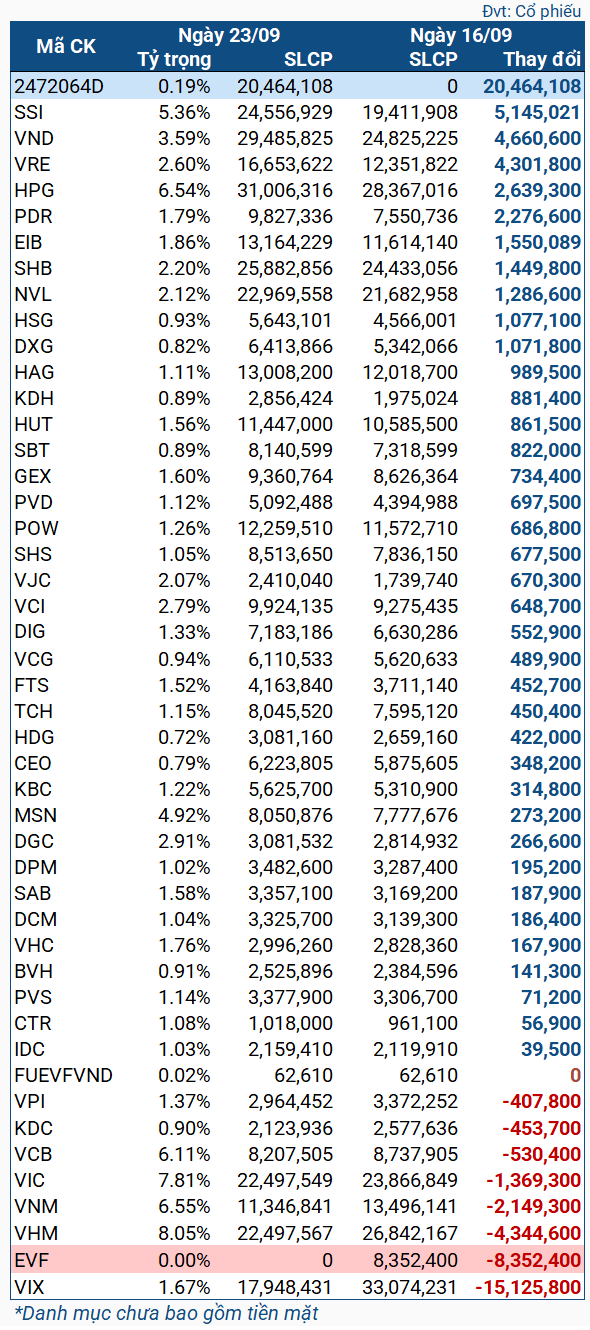

Stock Changes in VNM ETF from 9/16-9/23

|

During this period, VIX saw the largest sell-off with over 15.1 million shares sold. EVF was removed from the portfolio, with nearly 8.4 million shares sold. This was followed by VHM with over 4.3 million shares sold. VNM and VIC also experienced significant selling pressure, with more than 2.1 million and nearly 1.4 million shares sold, respectively.

On the buying side, the Fund purchased shares in the remaining stocks. The strongest buying activity was seen in SSI, VND, and VRE, with purchases of over 5.1 million, nearly 4.7 million, and over 4.3 million shares, respectively. Additionally, two stocks, HPG and PDR, saw purchases of more than 2 million shares each, while five stocks, EIB, SHB, NVL, HSG, and DXG, had buying activity of over 1 million shares each.

In the case of SSI, the increase in share price is likely due to the company’s dividend and bonus share issuance, with a total ratio of 30% (100 old shares receive 30 new shares). The Fund also acquired nearly 20.5 million warrants to purchase SSI shares, which were offered to existing shareholders at a ratio of 100:10 (1 old share receives 1 warrant, and 10 warrants can purchase 1 new share).

The stocks that were bought and sold by VNM ETF during this period correspond to the results of the review of the third quarter of 2024 by MarketVector Indexes, which was announced in the early morning of September 14 and took effect on September 20. Accordingly, the MarketVector Vietnam Local Index – the reference index for the VNM ETF – removed EVF after just one quarter of being added. VHM and VIX were also predicted to be the two stocks with the largest sell-off, while VRE, HPG, and VND were notable on the buying side.

As of September 23, the total assets of VNM ETF exceeded 496 million USD, a decrease from the 484 million USD recorded on September 16. With the sale of many large-cap stocks, the Fund’s cash holdings (VND) surged to nearly 37.7 million USD (equivalent to more than 927 billion VND), accounting for 7.59% of total assets.

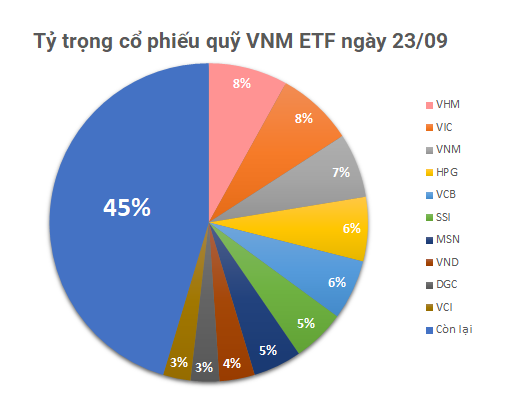

In terms of stock allocation, the top holdings as of this date were VHM (8.05%), VIC (7.81%), VNM (6.55%), HPG (6.54%), and VCB (6.11%).