Ms. Le Hoang Uyen Vy – CEO of Do Ventures and Chairman of VPCA

Vietnam Private Capital Agency (VPCA) has recently been introduced to the market, marking a new chapter in Vietnam’s investment landscape. The agency aims to boost venture capital (VC) and private equity (PE) investments in the country, with a target of attracting $35 billion in private investment for startups and innovation by 2035, contributing to sustainable economic growth.

“Vietnam is at a pivotal moment, with foreign investment funds increasingly eyeing opportunities in the country, and the Vietnamese government introducing policies to foster a robust business environment,” said Ms. Le Hoang Uyen Vy, Chairman of VPCA. “VPCA is committed to maximizing this potential, ensuring efficient capital allocation to support innovation and sustainable economic development.”

Mr. Binh Tran, Vice Chairman of VPCA and Co-Founder of AVV, added: “While Vietnam offers abundant investment opportunities, we are still behind more developed regions like North America, which accounted for nearly half of the total private capital raised in 2023. There is a clear gap in capital flow that can only be addressed through strategic initiatives and more comprehensive support for private capital.”

VPCA was founded by prominent long-term investors, including Ms. Le Hoang Uyen Vy (CEO of Do Ventures), Mr. Binh Tran (Co-Founder of AVV), Mr. Vinnie Lauria (Founder of Golden Gate Ventures), Mr. Max-F. Scheichenost (CEO of Mekong Capital), and Mr. Justin Nguyen (CEO of Monk’s Hill Ventures). The agency launched with the participation of over 40 members from domestic and international VC and PE funds.

VPCA Members

Where does Vietnam stand in attracting VC and PE capital in the region?

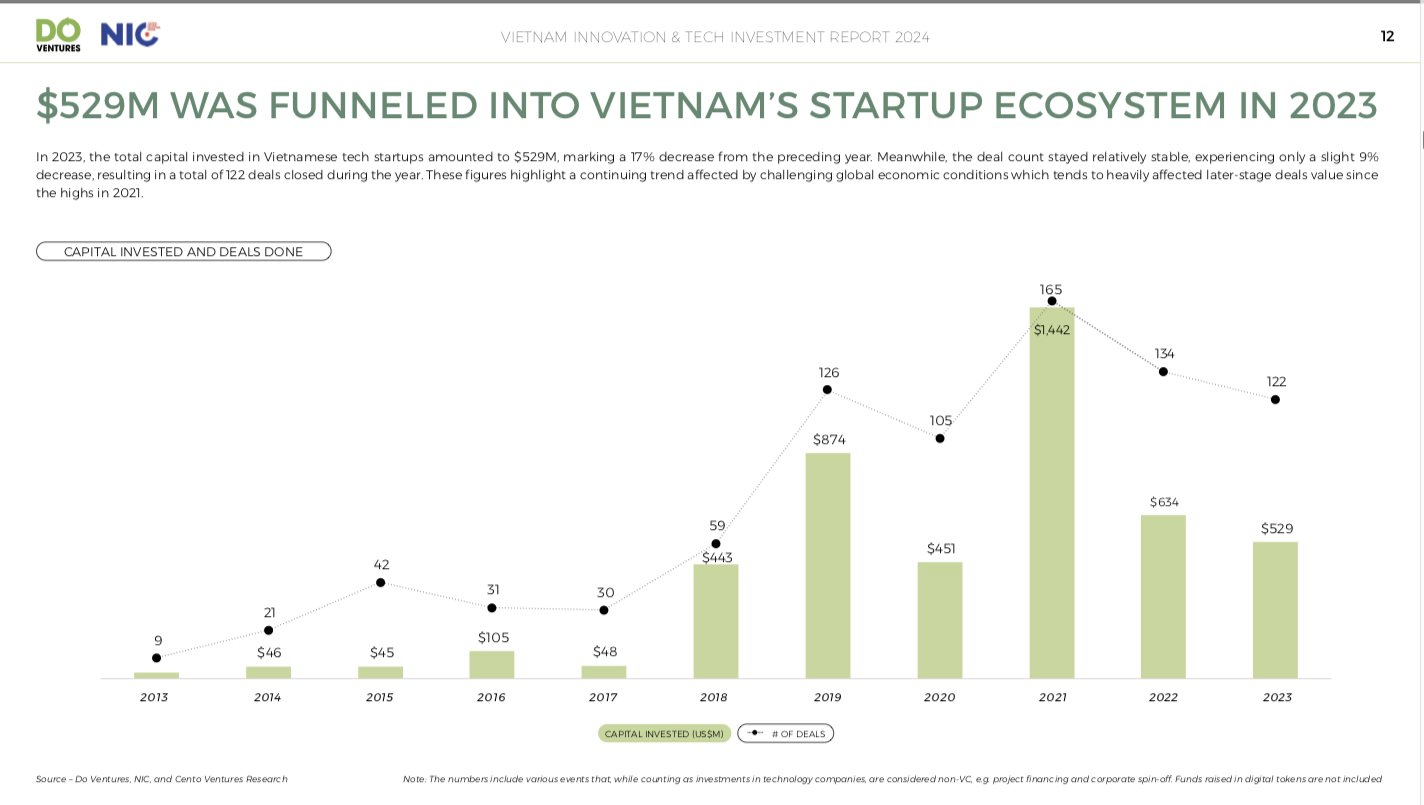

According to a recent report by Do Ventures and NIC, from 2014 to 2023, over $4.6 billion was invested in Vietnamese startups through 835 deals. 2021 was a peak year for Vietnamese startups, attracting $1.442 billion in investment from funds through 165 deals. Most investment deals in Vietnam are in the early stages, such as pre-seed, seed, and Series A/B, while Series C/D deals are extremely rare. In 2022-2023, only eight startups received funding from Series C or higher, with only two deals exceeding $50 million per year.

In 2023, Vietnamese startups received $529 million from 122 investment deals from funds, a decrease of 17% in value and 9% in volume compared to 2022. Singaporean funds were the most active, with 22 deals, followed by domestic funds with 21, and North American funds with 16. Approximately 100 domestic and foreign investors showed interest in the Vietnamese market in 2023.

In terms of M&A, Vietnam has become an attractive investment destination for investors from Japan, South Korea, and Thailand. Japanese investors tend to focus on the banking sector, with examples like SMBC investing in VPBank, MUFG in VietinBank, and Mizuho in Vietcombank. South Korean investors favor the securities industry, with around eight Korean-backed securities companies operating in Vietnam, accounting for over half of the total FDI securities companies. Thai investors, on the other hand, prefer the retail and consumer sectors, as evident from deals such as ThaiBev’s acquisition of Sabeco, Central Group’s takeover of BigC Vietnam, and Shingha’s investment in Masan.

In 2023, domestic investors continued to play a significant role in the M&A market (40 deals), followed by investors from Singapore (17 deals) and Japan (11 deals). Notable examples include KIDO’s acquisition of Pakson Hung Vuong, Masan’s purchase of Phuc Long, and THACO’s partnership with Emart Vietnam. There were also interesting M&A deals in the technology sector, such as MoMo’s acquisition of PiqueAI and Base’s merger with FPT.

However, the M&A field is showing a worrying decline, with only 186 deals in 2023 compared to 303 in 2021 and 338 in 2018.

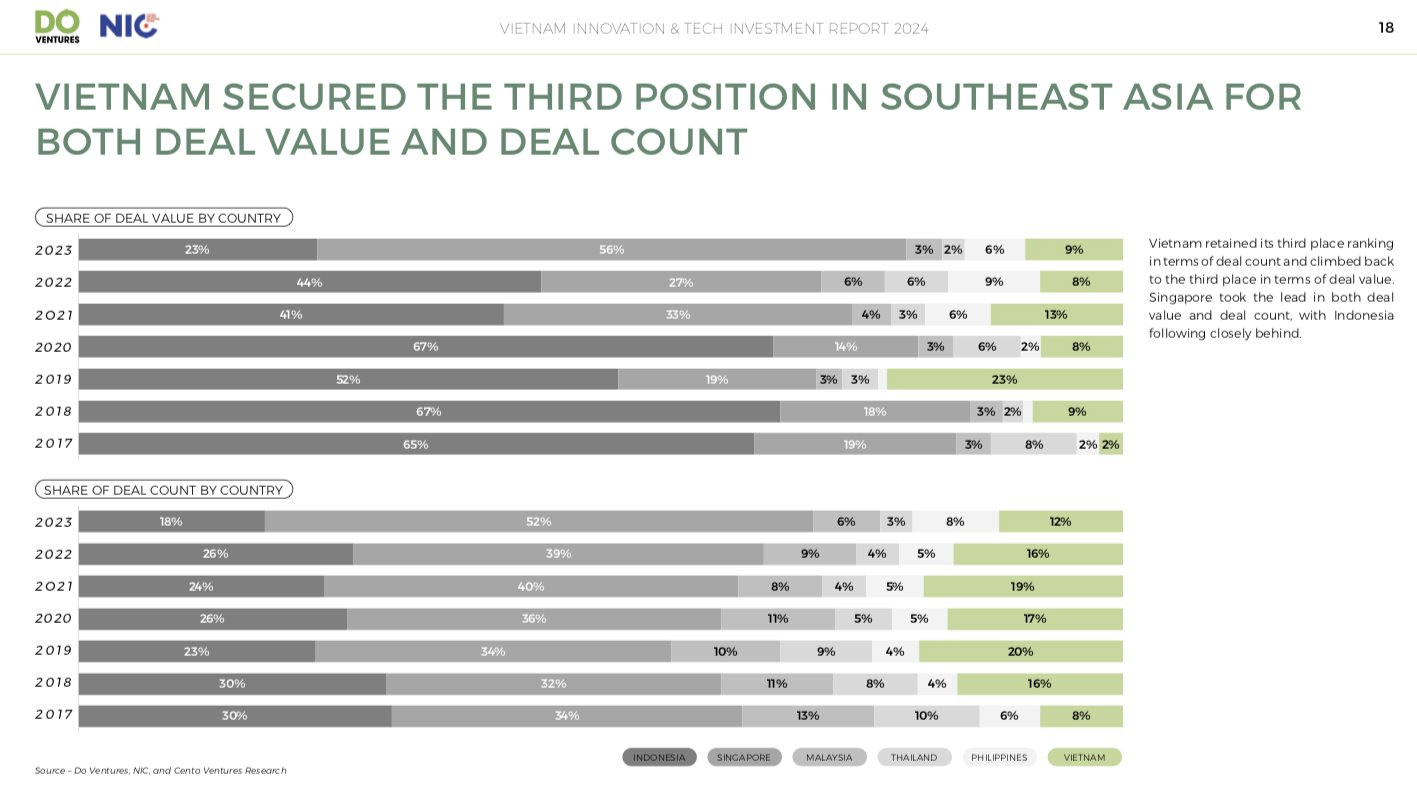

Currently, Vietnam ranks third in attracting startup investment capital in Southeast Asia. However, if we consider the nature of these investments, we still have a long way to go to catch up with the top two positions, especially Singapore.

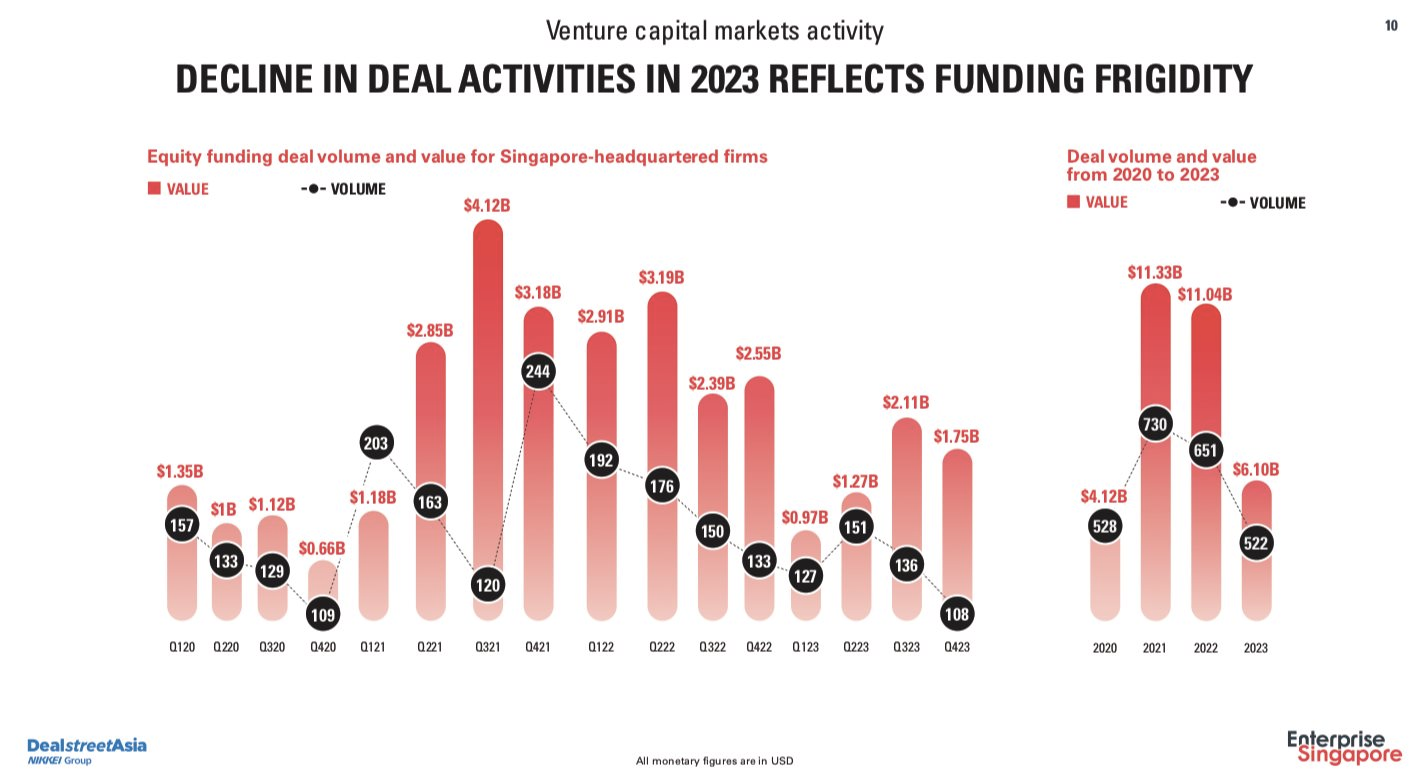

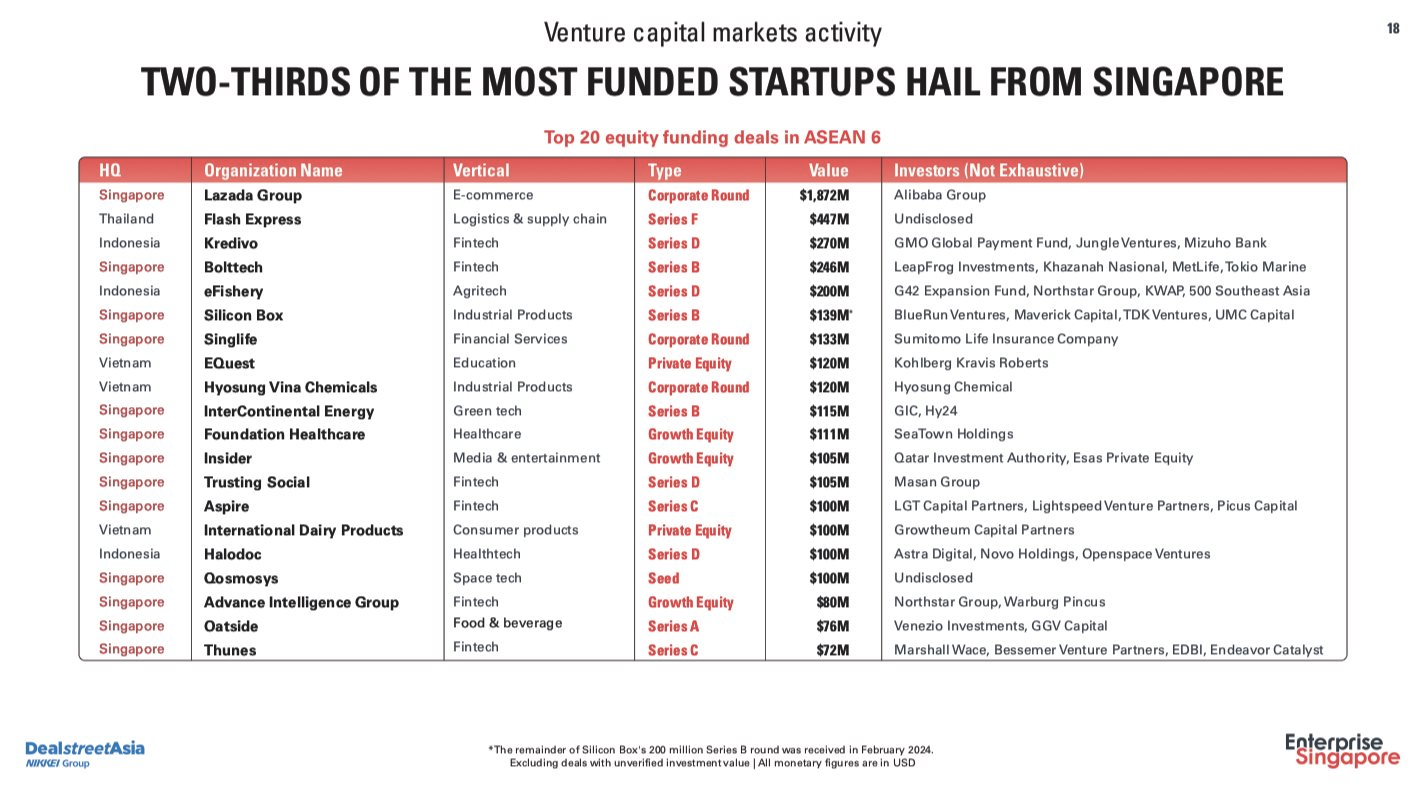

According to a recent report by the Singapore government, conducted by DealstreetAsia, Singaporean startups raised $6.1 billion from investors in 2023. From 2020 to 2023, they attracted a total of $32.59 billion in investment from domestic and foreign funds. Notably, they received over $11 billion in investment for two consecutive years, 2021 and 2022.

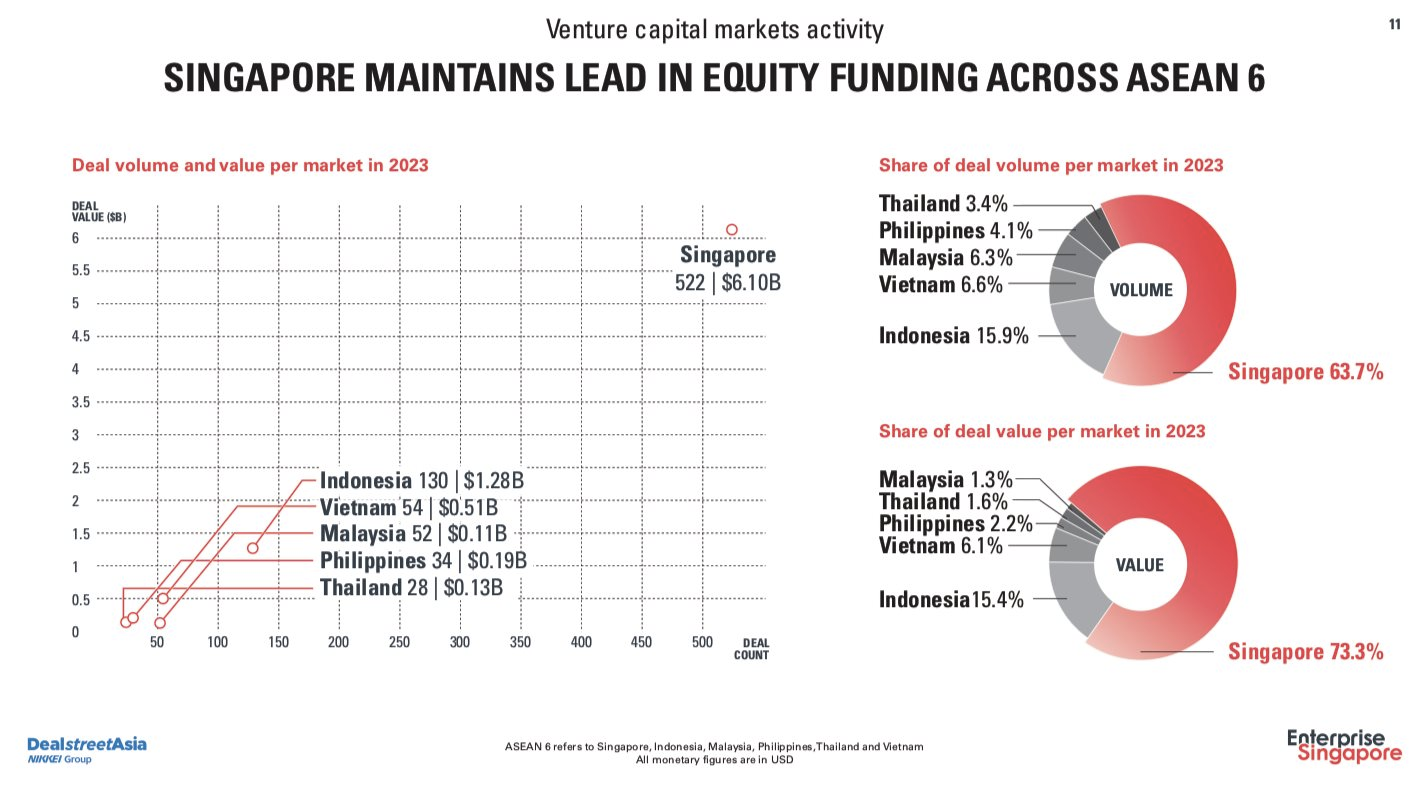

Specifically, in 2023, out of the six countries with the most developed startup ecosystems in ASEAN, Singapore attracted $6.1 billion through 522 deals, Indonesia $1.28 billion/130 deals, Vietnam $0.51 billion/54 deals, and Malaysia $0.11 billion/52 deals. In terms of transaction value, Singapore accounted for 73.3%; the other five countries combined, including Vietnam, Indonesia, Malaysia, the Philippines, and Thailand, accounted for less than half of Singapore’s total.

In 2023, Singaporean startups received 464 early-stage investment deals and 29 late-stage deals, with a balanced value ratio of $3.04 billion to $3.06 billion. Singapore is home to many ‘unicorns’ and near ‘unicorns,’ including well-known names like ShopBack, Thunes, Esco Lifesciences, and Fazz.

Singapore also boasts two-thirds of the companies in the Top 20 equity fundraising deals in the six ASEAN countries, including prominent names such as Lazada Group, Bolttech, Insider, Trusting Social, and Aspire. Vietnam and Indonesia each have three companies on the list.

Why is the Vietnamese market less attractive to VC/PE investors compared to Singapore or Indonesia?

“The Vietnamese market is less attractive to VC and PE investors because we only invest 0.4% of GDP in R&D, while the global average is 2.6%. Vietnam also has only 60 incubators and accelerators for startups, while Singapore has 305,” said Ms. Uyen Vy.

“Regarding VC, we have few domestic VC firms investing in later stages, a low exit rate, and significant legal barriers. As for PE, Vietnam’s PE ecosystem is still very young, with inconsistent deal quality and limited exit options. In terms of the public market, there are few tech companies going public, and there is limited presence from institutional investors,” she added.

In 2023, Vietnam had only three IPO deals, raising $7 million, while Singapore had six deals raising $35 million, Indonesia had 79 deals raising $3.607 billion, Malaysia had 32 deals raising $790 million, and Thailand had 40 deals raising $1.297 billion. From 2019 to 2023, Indonesia consistently had more than 50 successful IPO deals per year, while Malaysia averaged around 30, and Vietnam’s peak was 27 deals in 2019.

While the stock markets of Malaysia, Indonesia, Singapore, and Thailand have provisions and regulations allowing SMEs or tech startups to go public, Vietnam lacks such provisions. The Vietnamese stock market is dominated by domestic individual investors, accounting for a significant 87.0% in 2023. In contrast, foreign institutional and individual investors account for just under 7%.

As mentioned earlier, the two ideal options for VC or PE investors to exit successfully are through trading on the stock exchange or M&A. However, both options are facing significant challenges in Vietnam compared to pre-COVID-19 years and other countries in the region.

What is the basis for the $35 billion target by 2035?

Firstly, according to Do Ventures, strong FDI, supported by favorable trade agreements, will create a more conducive environment for IPO and M&A activities in Vietnam in the future. This will enhance the market’s attractiveness, improve capital access, and promote innovation and strategic partnerships, fostering sustainable growth in both the IPO and M&A sectors.

VPCA Founding Council

Additionally, according to data released by the General Statistics Office, in the first six months of 2024, foreign direct investment (FDI) in Vietnam reached an estimated $10.84 billion, an increase of 8.2% compared to the same period last year. This is the highest FDI figure for the first half of the year in the past five years.

Analyzing the overall economic picture of Vietnam in the first half of the year, Mr. Jack Nguyen, CEO of InCorp Vietnam, stated that FDI mainly focused on manufacturing, real estate, and energy sectors. Singapore, Japan, and Hong Kong remained the largest investors.

“Vietnam is becoming an attractive destination for Chinese companies looking to diversify their supply chains, with new industrial parks being developed. We receive consulting requests from Chinese companies, especially in the northern region,” said Mr. Jack. “Many Chinese manufacturers are moving to Vietnam to establish their supply chains. The trend of building large-scale industrial parks on the outskirts of cities promises to create a new wave of investment.”

Furthermore, he emphasized that compared to other ASEAN countries, Vietnam ranked third in FDI inflows in the first half of 2024, after Indonesia and Singapore, and ahead of Thailand and Malaysia.

Secondly, Vietnam’s stock market is improving, and there are drafts to allow more tech companies like VNG to list on HOSE or HNX.

Vietnam’s stock market is still in the process of convincing FTSE to upgrade its status to an ‘Emerging Market’ in the coming years (expectedly in 2025). The primary stock exchange in Vietnam, HOSE, has an average P/E ratio of 12.4, which is relatively low compared to other stock markets in the region. This indicates that the Vietnamese market still offers reasonable valuations and attracts investors.

Most importantly, Vietnam is considering a pilot project for ‘IPO by introduction’ to facilitate the listing of special economic models, such as tech startups. In early 2023, VNG officially listed on UpCOM, and in the future, Vietnam may have more ‘unicorns’ or near ‘unicorns’ becoming public companies.

Mr. Binh Tran – Vice Chairman of VPCA and Co-Founder of AVV

“Third, VPCA’s initiatives are designed to achieve this goal and will serve four main entities: investors, industry experts, policymakers, and entrepreneurs,” said Mr. Binh Tran. “We will connect investors with opportunities to contribute to and benefit from a dynamic and growing VC/PE ecosystem. We will also support local entrepreneurs in accessing capital, expertise, and networking opportunities, thereby fostering business growth.”

“Additionally, we will collaborate with the government to advocate for policies that improve the investment environment and support economic growth. At the same time, VPCA will work with industry experts to build efficient business and investment infrastructure,” he added.

Finally, considering the $35 billion target for both VC and PE in the next ten years and the success of the Singaporean startup ecosystem in attracting capital over the past four years, the goal set by VPCA and the CEO of Do Ventures for the Vietnamese market in the next decade may not be too far-fetched.

Nevertheless, it is still too early to predict the outcome for the next ten years. To find out how the story unfolds, stay tuned for the “next episode.”

“Vingroup Signs MoU with Warner Music Group and Indochina Productions”

On September 25, 2024, Vingroup (HOSE: VIC) inked a memorandum of understanding with two powerhouses in the global music and film industries, Warner Music Group and Indochina Productions. This collaboration not only brings world-renowned music stars to Vietnam but also serves as a launchpad for the country’s tourism and cultural image to reach a global audience of hundreds of millions.