VN-Index witnessed two strong rallies during the first halves of the morning and afternoon sessions, propelling the index beyond the 1,290 threshold and even challenging higher resistance levels of 1,295, briefly approaching 1,300. However, the resistance zone proved formidable as immediate corrections followed.

At the close of September 26, the VN-Index gained 4.01 points to reach 1,291.49, successfully holding above the 1,290 level. The HNX-Index also ended in positive territory with a slight increase of 0.08 points to 235.92, while the UPCoM-Index remained unchanged at the reference level of 93.5.

|

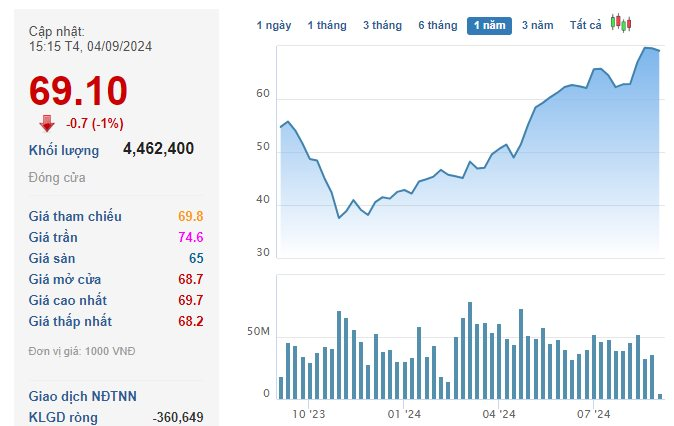

Source: VietstockFinance

|

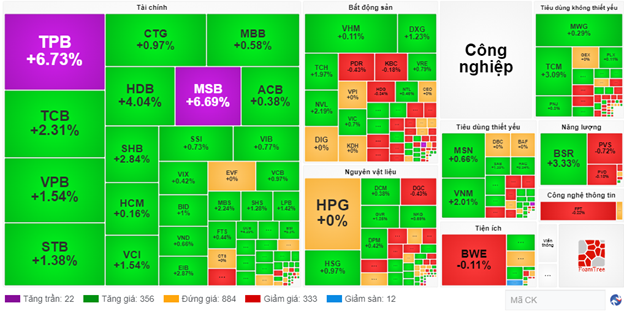

The upward momentum for the index was primarily driven by banking stocks, especially during the afternoon session, with numerous stocks surging or even reaching the maximum daily limit. Despite a notable cooldown in the latter half of the afternoon session, most banking stocks maintained their gains, notably MSB, which rose by 5.44%, HDB by 3.85%, SHB by 1.9%, TCB by 1.26%, CTG by 1.11%, and notably, TPB retaining its purple hue.

In the top 10 stocks positively influencing the VN-Index, the banking group naturally dominated with the most names, including HDB contributing 0.77 points, TPB 0.6 points, CTG 0.53 points, TCB 0.52 points, MSB 0.43 points, VPB 0.29 points, and SSB 0.25 points, collectively accounting for more than half of the total.

The remaining positive contributors in the top 10 were VNM, GVR, and VHM.

Conversely, VCB exerted the most significant negative influence, deducting 0.4 points from the VN-Index, surprising as the stock of this banking giant had been among the top positive contributors earlier in the session, contributing approximately 1 point.

Foreign investors ramped up net buying in today’s session, with a scale of over 900 billion VND, focusing on TPB with nearly 129 billion VND, VNM with nearly 115 billion VND, HDB with nearly 107 billion VND, and others. On the selling side, the scale was not significant, hence not creating any substantial pressure.

Thus, the market recorded the second consecutive net buying session by foreign investors, and this was also the seventh net buying session in the last 10 sessions, a rare occurrence during the recent period.

| Foreign Investors’ Net Buying and Selling Activity |

According to VS-SECTOR data, two sectors recorded distinct increases: food and essentials retail rose by 6.35%, and energy increased by 2%. All other gaining sectors posted increases of less than 1%.

In the declining group, media and entertainment, and semiconductors shared the top spots with decreases of 2.66% and 1.9%, respectively.

14:00: Banking Sector Surges, VN-Index Approaches 1,300 Points

After the lunch break, the market resumed with enthusiasm and consistently posted decisive gains. As of 14:00, the VN-Index climbed over 10 points, inching closer to the 1,300-point mark.

Source: VietstockFinance

|

The main driving force came from the banking sector, with TCB and VCB contributing a combined total of nearly 2 points to the index. Within the banking group, several stocks witnessed robust gains, including TPB and MSB hitting the daily limit, HDB rising by 4.04%, SHB by 2.37%, TCB by 2.31%, and others.

Apart from banking, the green also appeared in the large-cap real estate sector, such as DXG, VHM, NVL, and others.

|

Banking Sector Surges, TPB and MSB Hit Daily Limit

Source: VietstockFinance

|

Foreign investors increased net buying, pushing the net buying value to over 665 billion VND, led by two banking stocks, TPB and HDB, with net purchases of over 116 billion VND each. With these moves, many investors anticipate another net buying session from foreign investors.

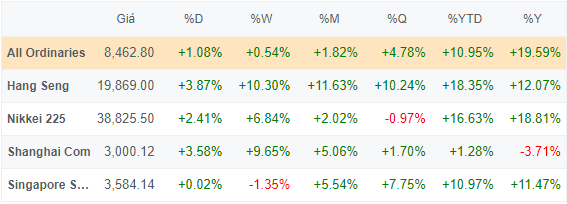

The Vietnamese market’s positive performance echoed the sentiment in other Asian markets, with notable gains in the Hang Seng Index, which rose over 3.8%, the Nikkei 225, which climbed 2.4%, and the Shanghai Composite, which advanced nearly 3.6%.

|

Green Dominates Asian Stock Markets

Source: VietstockFinance

|

Morning Session: VN-Index Encounters Resistance at 1,290 and Faces Immediate Corrections

The market opened the morning session on a buoyant note, briefly surpassing the 1,295-point level, but the resistance zone proved challenging as the index quickly entered a corrective phase. On the positive side, the VN-Index managed to hold above the 1,290 level, gaining over 3.3 points compared to the previous day’s close.

In contrast to the VN-Index, both the HNX and UPCoM indices turned red, with the former declining by 0.3 points to 235.53 and the latter slipping by 0.1 points to 93.41.

At the end of the morning session, 340 stocks advanced, including 17 stocks that hit the daily limit, while 308 stocks declined, of which 11 fell to the floor price. Overall, the disparity between the two sides was not significant, and the market’s gains were primarily driven by the contributions of large-cap stocks.

Specifically, the top 10 stocks positively influencing the VN-Index contributed over 4 points, higher than the index’s gain. Leading the list was VCB, which added nearly 1.1 points, followed by VNM, GVR, HDB, TCB, and others.

The energy group continued to lead the market in terms of gains, rising 2.06% with momentum from BSR, TMB, POS, and others. The second-best performing sector was food and essentials retail, which increased by 1.59%.

Seven sectors posted declines during the morning session, fewer than the number of gaining sectors, but three of these sectors fell by more than 1%, including media and entertainment, which dropped by 1.75%, household goods and personal items, which declined by 1.47%, and semiconductors, which decreased by 1.19%.

As the morning session progressed, foreign investors’ net buying became more evident, with a provisional value of nearly 533 billion VND, almost matching the previous session’s net buying. This buying activity was concentrated in TPB, with net purchases of over 102 billion VND, HDB with over 60 billion VND, VNM with over 51 billion VND, and others.

On the selling side, the most heavily sold instrument was the FUESSVFL fund certificate, but the net selling value was less than 13 billion VND, lower than any stock appearing in the top 10 net buying list.

| Top 10 Stocks with the Highest Net Buying and Selling by Foreign Investors in the Morning Session of September 26, 2024 |

10:45: Cooling Off After a Strong Start

Building on the previous day’s gains, the VN-Index continued its upward trajectory and staged a strong rally, climbing over 5 points within the first 25 minutes of trading to approach the 1,295-point level. However, the index quickly entered a corrective phase, retreating to the 1,292 level, representing a gain of more than 4.7 points compared to the previous day’s close.

VCB remained the standout performer, contributing nearly 1 point to the index, followed by GVR with nearly 0.6 points and VNM with nearly 0.4 points. Conversely, CTG exerted pressure by deducting nearly 0.5 points.

In terms of sector performance, energy stocks stood out, rising 2.18% and leading the market with momentum from BSR, which climbed 3.33%, and PVD, which edged up 0.36%.

Foreign investors temporarily posted net buying of over 300 billion VND, with buying interest spread across various stocks, including VNM with over 36 billion VND, HDB with over 29 billion VND, VCB and STB with over 27 billion VND each, and others.

If this trend persists until the end of the trading day, foreign investors will record their second consecutive net buying session and the seventh net buying session in the last 10 sessions.

Opening: VN-Index Approaches the 1,290-Point Region

Extending the winning streak from previous days, the VN-Index started the session on September 26 with a gain of 2.35 points, approaching the 1,290-point threshold at 9:30 am. The HNX and UPCoM indices also opened in positive territory.

The market recorded 290 advancing stocks, nearly double the number of declining stocks at 159, indicating that the green dominated the initial part of the session. The remaining 1,159 stocks were unchanged.

Trading liquidity was robust, significantly higher than the previous day’s level and close to the 5-day average.

GVR was the top contributor to the index’s gains, adding 0.85 points, followed by VHM with 0.37 points and VNM with 0.2 points. On the flip side, stocks of two banking giants, CTG and MBB, were the biggest detractors, each deducting nearly 0.2 points.

Asian markets also opened on a positive note, with notable gains in the Nikkei 225, which rose nearly 2.4%, and the Hang Seng Index, which advanced over 1.8%. However, on the other side of the globe, the Dow Jones and S&P 500 indices declined on Wednesday (September 25), retreating from their latest record highs.

Foreign Block Surprises With Over 148 Million Shares Sold, Nearly 5% of Capital in a Bank – What’s Going On?

The net selling value of these stocks in the 24/9 session amounted to a staggering 2,700 billion VND.