In a surprising turn of events, VNECO 9’s stock (VE9) skyrocketed with six consecutive sessions of reaching the ceiling price from September 18 to 25, while the overall market was also on the rise.

The market price doubled to 3,700 VND per share in just over a week, marking the highest price for VE9 in over two years. Trading volume for this stock also surged, with hundreds of thousands of matched orders per session, far surpassing the previous period.

In a statement explaining the stock price movement, the company attributed the phenomenon to factors beyond its control, stating that the stock price is influenced by market supply and demand. The company assured that its operations remain normal and there are no significant developments to report.

VNECO 9, formerly known as Construction and Installation Joint Stock Company 3.9, was established through the equitization of a state-owned enterprise. In 2006, the company was renamed VE9 with an initial charter capital of 4.1 billion VND, which has since increased to over 125 billion VND.

Its main business activities include construction of power grid systems and substations up to 500KV, power plants, industrial, civil, and irrigation works, as well as trading of construction materials and interior decoration items.

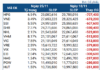

In stark contrast to the stock’s impressive performance, VNECO 9’s financial results paint a bleak picture. The company has consistently incurred losses over the last five years, with a meager revenue of 2.3 billion VND and a negative profit after tax of 12 billion VND in 2023.

For the second quarter of 2024, VNECO 9 reported zero revenue, marking the fourth consecutive quarter without any revenue. However, a net profit from business activities of 90.6 million VND helped the company achieve a profit after tax of 90.6 million VND for the quarter, a significant improvement compared to the same period last year. In the first six months of 2024, the company narrowed its losses to 46 million VND, showing a notable improvement from the 889 million VND loss in the same period last year.

As of June 30, 2024, the company’s total assets stood at 18.6 billion VND, unchanged from the beginning of the year. Cash and cash equivalents were recorded at a mere 169 million VND. Payable debts also showed a slight decrease, amounting to 9.3 billion VND. Profit after tax not distributed by the end of June was negative, amounting to 120 billion VND.

The Quiet Achiever: Obscure Real Estate Developer with Prime Ba Son Location (Ho Chi Minh City) Reports Half-Yearly Losses in 2024, with Debt Surpassing VND 12,000 Billion in Bonds.

The esteemed enterprise, owners of the prestigious Ba Son project in Ho Chi Minh City, boasts an impressive estimated total asset value of nearly VND 17,000 billion.

“Eurowindow Holdings Reports Six-Month Profit Quadruples, Liabilities Exceed Equity”

Eurowindow Holding, a member of the prestigious Eurowindow Group, has announced impressive financial results for the first half of 2024. The company reported a remarkable after-tax profit of 96.6 billion VND, more than quadrupling its earnings from the same period last year. This achievement is even more impressive considering Eurowindow Holding’s payable debt, which has increased to over 8.8 trillion VND, surpassing its owner’s equity by 1.1 times.