Yellow phosphorus is a critical commodity for global industries, serving as an essential raw material in the production of electronic circuits and semiconductors. Currently, about 20% of the demand for phosphorus is driven by the semiconductor industry.

In Vietnam, Hoa Chat Duc Giang (code: DGC) is considered the “kingpin” in the production of this vital material for the development of AI and semiconductors. Following the acquisition of Phốt Pho 6 Joint Stock Company, DGC has become the largest exporter of yellow phosphorus in Asia. It is estimated that this enterprise currently accounts for nearly a third of the global exports of this crucial raw material for various industrial manufacturing processes, including semiconductors and electric vehicle batteries.

DGC is also the only company in the world capable of producing yellow phosphorus from apatite ore in both powder and lump forms.

Yellow Phosphorus Prices Rise Amid Recovering Demand, DGC Expected to Benefit in the Second Half of 2024

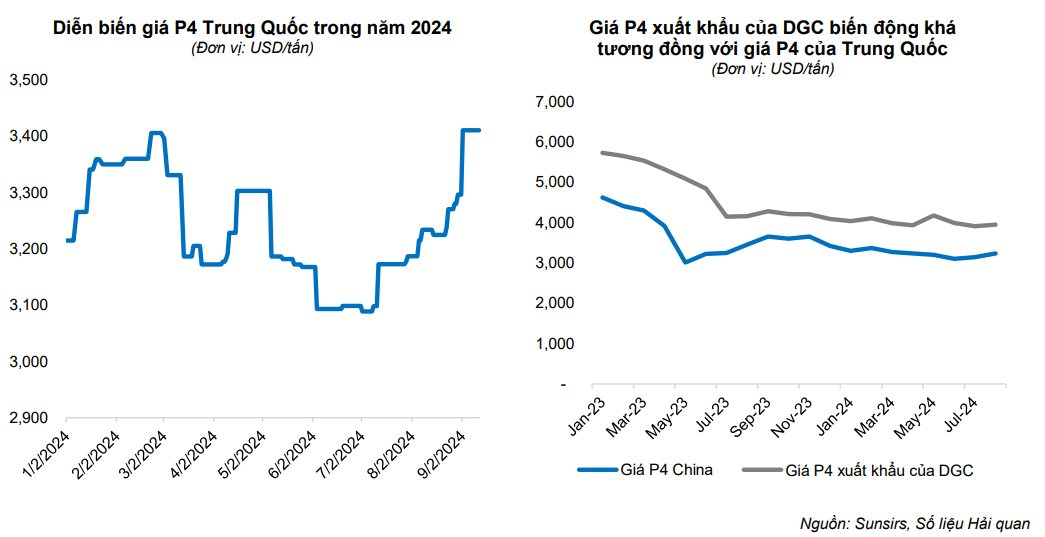

Positive news is flowing in for DGC as yellow phosphorus prices are showing strong signs of recovery. In a recent report, Bao Viet Securities (BVSC) stated that the domestic price of yellow phosphorus in China reached approximately $3,400/ton, marking a more than 10% increase from its low in July 2024.

BVSC predicts that yellow phosphorus prices will continue to climb as China grapples with an intense heatwave. Local governments in China have imposed electricity supply restrictions on businesses, causing some factories to temporarily halt production.

With supply constraints and expected rebounding demand, DGC’s leadership shared that their customers’ inventories have been gradually depleting, particularly in Japan, South Korea, and India. In the first half of 2024, yellow phosphorus sales volume remained stable, ranging from 3,000 to 4,000 tons per month. Notably, DGC’s export volume in July surpassed this range, reaching over 4,700 tons, doubling the previous month and the same period last year.

BVSC anticipates that DGC’s export volume of yellow phosphorus in the second half of 2024 will improve as customers start restocking, and the proportion of sales of high-purity yellow phosphorus for semiconductors is expected to increase.

In the medium to long term, DGC aims to capitalize on the double-digit growth in the semiconductor market by increasing the revenue contribution of yellow phosphorus used in chip manufacturing from 30% to 70%. Simultaneously, the company exports yellow phosphorus to Japan, South Korea, and Taiwan at prices ranging from $4,000 to $4,500 per ton, which is 10-15% higher than the price for Indian customers.

Improved Profitability by Capitalizing on the Recovering Semiconductor Cycle

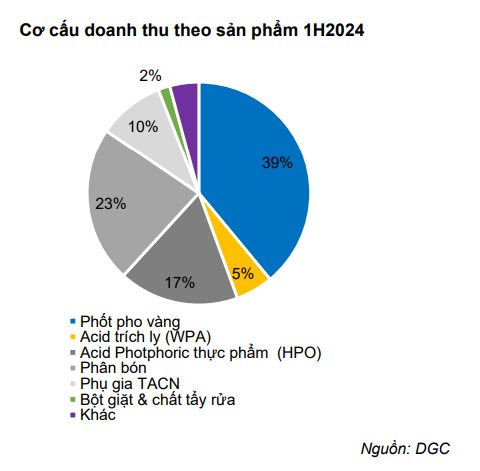

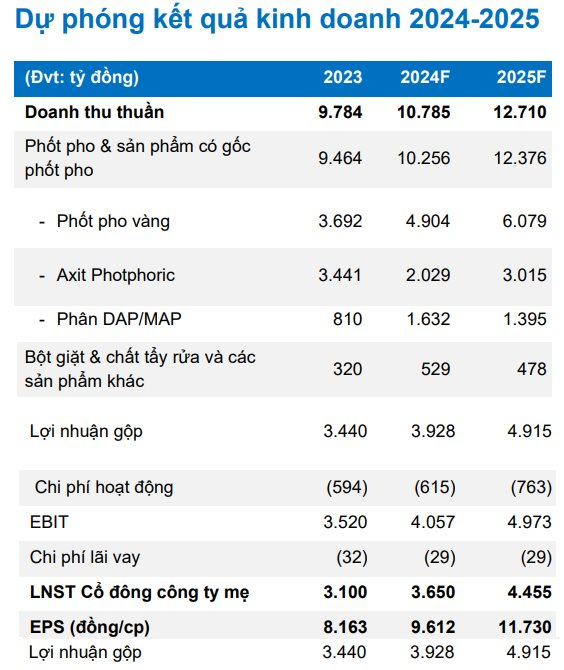

BVSC attributes the primary growth driver for revenue in 2024 and 2025 to yellow phosphorus sales. They expect DGC’s revenue to grow by 20-35% during this period due to recovering consumption. BVSC estimates that DGC’s yellow phosphorus exports will increase by 25% in 2024 and a further 30% in 2025.

Regarding other business segments, BVSC points out that there is a global shortage of MAP/DAP fertilizer supply due to China’s continued export restrictions, while demand is surging in Southeast Asia. DGC can seize this opportunity to boost the production of phosphate fertilizer as an alternative to WAP, given the higher profit margins in this segment.

Gross profit for 2024 is projected to increase by 14% year-over-year, driven by the expected higher revenue contribution from yellow phosphorus in the second half and lower costs for raw materials such as coke and apatite ore. BVSC forecasts DGC’s net profit to reach VND 3,650 billion in 2024.

For 2025, projected revenue is estimated at VND 12,710 billion, with a net profit of nearly VND 4,500 billion. Gross profit is expected to increase by 33% in 2025 as the company focuses on exporting higher-purity yellow phosphorus products. Additionally, DGC is expected to obtain a license to double its ore mining capacity at site 25 by the end of 2024, achieving 100% self-sufficiency in raw material supply.

Regarding the acquisition of the Dai Viet Distillery, DGC is in the process of repairing and upgrading the production line, with commercial operations expected to commence in early October. BVSC projects an annual revenue of approximately VND 1,000 billion and a net profit of VND 200-300 billion from this venture.