In its latest report, DSC Securities expects a more pronounced recovery in the second half of the year for Petroleum General Services Joint Stock Company (Petrosetco – stock code: PET) ‘s business results.

According to DSC, the core business of distributing ICT products will witness a stronger rebound, benefiting from the wave of electronics upgrades and the 2G network shutdown. DSC projects PET’s net revenue and post-tax profit for 2024 to reach VND 18,900 billion (+10% YoY) and VND 219 billion (+58% YoY), respectively.

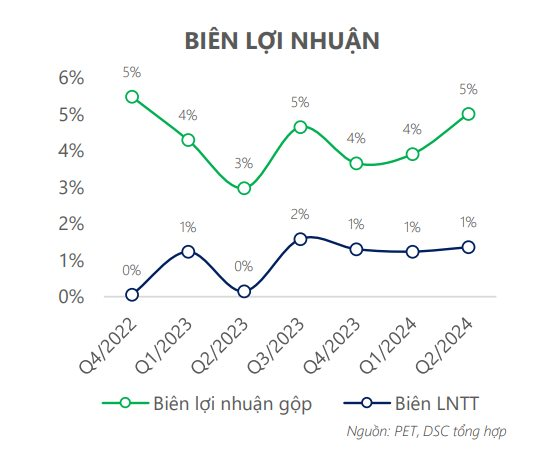

Moreover, with the second half being the launch period for new electronic devices , coupled with PET’s product range expansion into high-margin items such as home appliances, DSC foresees a continued improvement in PET’s gross profit margin. They estimate it to recover to 5-6% in 2024, matching the 2019-2022 levels.

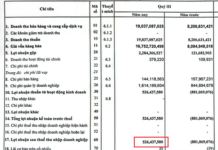

The second-quarter financial results showed positive figures. Specifically, PET’s net revenue reached VND 4,522 billion, unchanged from the previous year. Meanwhile, the company’s post-tax profit surged to VND 45 billion, a tenfold increase compared to Q2/2023. This significant growth was attributed to (1) low base effects, (2) declining input prices, and (3) reduced borrowing costs.

Simultaneously, PET’s gross profit margin in Q2/2024 improved to 5.43%, rising by over 200 basis points from the same period in 2023. Notably, this was the second consecutive quarter of gross margin recovery for PET. Slower growth in cost of goods sold compared to revenue growth was the primary driver of the company’s performance during this period.

Apple’s Online Store Launch in Vietnam Has Minimal Impact on PET

Petrosetco is a leading company under the Vietnam National Oil and Gas Group, specializing in providing multi-sector services in the oil and gas industry and related fields. The company has also expanded into other areas, including commercial trading, ICT equipment distribution, real estate services, and catering services.

It is known that Petrosetco is an authorized distributor of all Apple’s official product lines in Vietnam. Apple products were once a primary growth driver for PET through past distribution contracts.

Now, Apple has started direct product distribution in Vietnam. However, according to PET, Apple’s launch of its online store in Vietnam has had minimal impact on their business . This is because Apple’s prices are slightly higher than those of domestic distributors, and Apple does not interfere with pricing in the Vietnamese market.

Additionally, local distributors often offer promotions and complimentary accessories, making them more attractive to consumers.

In the first half of 2024, PET signed cooperation agreements with several prominent brands:

(1) Providing comprehensive solutions for small and medium-sized resorts and hotels with Samsung Vietnam; (2) Distributing computer and storage equipment from Lenovo and Dell to small and medium-sized enterprises (SMEs);

(3) Initiating a partnership with Aqua for the distribution of water heaters and televisions; (4) Distributing air conditioners under the Daikin brand; (5) Signing with new smartphone brands such as Realme, Nokia, and Inoi; (6) Distributing Tiandy-branded cameras.

DSC believes that these partnerships will help PET diversify its output in the medium to long term, as the ICT equipment distribution market is gradually becoming saturated.

Annual Shareholders’ Meeting 2024 of PET Failed Due to Lack of Quorum

PetroVietnam Technical Services Corporation (HOSE: PET) is unable to organize its annual General Meeting of Shareholders 2024 as planned on 26/04, due to only 36.3% of eligible shareholders in attendance.