Silver prices have surged to their highest level in over a decade, influenced by strong gold prices and China’s economic stimulus measures, although some analysts predict that silver’s rally will slow as industrial demand remains the main driver.

On Thursday (26/9), silver prices reached $32.71 per ounce, the highest since December 2012.

Silver prices hit a 12-year high.

Silver is both a safe-haven investment (closely linked to gold) and an essential material in industrial applications (considered an industrial metal). Beyond investment demand, the majority of silver’s demand comes from the industrial sector, with the use of this metal in photovoltaic products such as solar panels nearly doubling compared to a year ago.

Silver prices have increased by more than 35% since the beginning of 2024, the strongest gain among precious metals. Gold prices have risen over 29% year-to-date after repeatedly breaking records, driven by expectations of US interest rate cuts, safe-haven demand, and strong buying from central banks.

Silver has seen the strongest gains among precious metals this year.

The People’s Bank of China recently announced the largest economic stimulus package since the COVID-19 pandemic and is expected to cut the 7-day reverse repo rate. Last week, the US Federal Reserve cut interest rates by half a percentage point.

“China’s stimulus measures are boosting industrial metal prices, which silver traders have been eagerly awaiting,” said Ole Hansen, head of commodity strategy at Saxo Bank.

“Silver will continue to rise in the coming quarters due to consecutive rate cuts and also because China’s stimulus may last a little longer,” said Amelia Xiao Fu, head of commodity markets strategy at BOCI. She expects silver prices to climb to $37 an ounce.

One of the main drivers of the silver price rally is its strong correlation with gold, according to Aneeka Gupta, director of macroeconomic research at WisdomTree.

“The long-term strength of gold, combined with steady to rising industrial metal prices, will cause silver to continue to outperform gold, with the gold-silver ratio falling back to around 82 as silver prices rise, potentially boosting silver’s performance to over 10% versus gold,” said Saxo’s Ole Hansen.

The gold-silver ratio, which indicates how many ounces of silver it takes to buy an ounce of gold, is used by the market to gauge future trends as it shows silver’s current performance relative to its historical correlation with gold.

The gold-silver ratio is currently at its lowest since July 2024.

“Central bank rate cuts will provide impetus for global activities and support higher silver consumption,” said Citi analyst Max Layton, who forecasts silver prices to rise to $35 per ounce in the next three months and $38 per ounce in 6-12 months.”

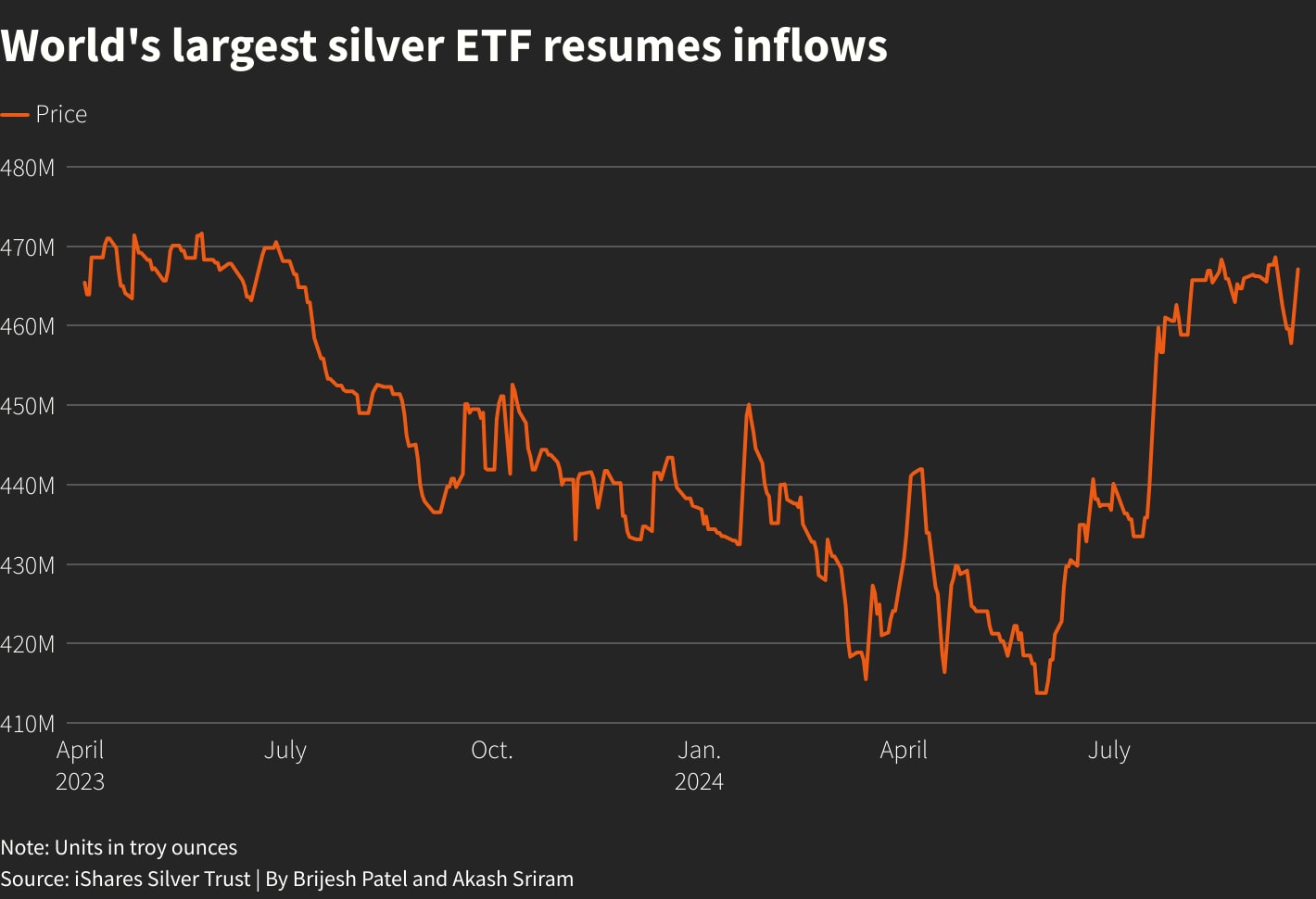

Macquarie Bank noted that investment flows are likely to remain a key factor in silver price movements in the short term, with holdings in silver ETFs expected to provide the most support. Macquarie anticipates a silver market deficit to persist for the next five years.

Investment flows into silver ETFs are on the rise again.

However, a slowdown in China’s solar energy sector and the country’s overall economic growth could pose challenges for silver prices in the near term.

“China’s latest support measures may not be enough to boost growth by themselves, and traders appear to be overestimating the likelihood of the Fed cutting rates by another 50 basis points in November,” said Hamad Hussain, climate and commodity economics associate at Capital Economics. According to Hussain, the current silver price rally is unlikely to sustain over the next few months as some of the drivers of silver demand are weakening.

In China, the world’s top consumer, industrial output growth slowed to a five-month low in August, indicating weakening domestic demand.

“We believe silver is primarily dependent on gold for its mid to long-term performance rather than any specific silver market parameters,” said Carsten Menke, an analyst at Julius Baer.

While investors are currently keen on gold and silver as a means of protecting their wealth amid global uncertainty and inflation, the question of whether now is the right time to invest in these precious metals remains unanswered.

Philip Newman, managing director of Metal Focus, highlighted the risks after gold reached a new all-time high. He cautioned that in a rapidly changing market, the momentum for gold and silver price increases could wane.

Reference: Reuters

The Transport Ministry Proposes Alterations to the Implementation Plan for the Construction of Ho Chi Minh City’s Ring Road 4

The Ministry of Transport has proposed a plan to the Ministry of Planning and Investment and the People’s Committee of Ho Chi Minh City to develop the city’s Ring Road 4. This proposal highlights the ministry’s proactive approach in addressing the city’s infrastructure needs and enhancing its transportation network.

Unlocking Opportunities: The Path to Success in the EU Market

The upcoming visit from Slovenia’s transport and logistics experts offers a strategic opportunity for Vietnamese businesses to strengthen their presence in Southern and Central Europe. This delegation visit opens doors for local enterprises to explore new avenues of collaboration, particularly in terms of accessing fresh routes for the efficient transportation of goods into the heart of the EU market.

![[On Seat 47] ‘EC40 Wants to Win, Volvo Vietnam Needs to Educate Customers: Using Electric Cars Without Public Charging Stations is Normal’](https://xe.today/wp-content/uploads/2024/12/v-quote-te-100x70.jpg)