The State Securities Commission’s (SSC) Inspection Agency has recently issued Decision No. 388/QD-XPHC, imposing an administrative penalty on Tri Viet Securities Joint Stock Company (TVB).

Specifically, Tri Viet Securities was fined VND 65 million for late disclosure of semi-annual audited reports on the use of proceeds from bond issuance for 2023, audited financial statements for 2023, and audited financial safety ratio report for 2023.

The SSC applied an aggravating circumstance due to the company’s multiple prior administrative violations.

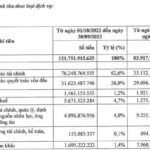

In terms of business performance, according to the reviewed semi-annual financial statements for 2024, TVB’s revenue for the first half of the year stood at VND 134 billion, up 249% year-on-year.

The company attributed the increase in revenue mainly to proprietary trading activities, partly driven by positive developments in the stock market. Additionally, the company’s sound business strategies and effective cost control measures further optimized its business performance.

Total expenses on the reviewed mid-year financial statements for 2024 amounted to VND 46.7 billion, representing an increase of VND 18.1 billion or 64% compared to the same period last year. This included a decrease of VND 2.3 billion in interest expenses to zero, a reduction of VND 6.2 billion in management expenses, and an increase of VND 12.1 billion in operating expenses year-on-year.

Moreover, during the first half of 2024, the company also recorded an increase of VND 13.7 billion in losses from financial assets measured at fair value through profit or loss (FVTPL).

After accounting for taxes and fees, Tri Viet Securities reported a net profit of nearly VND 73.8 billion for the first half of 2024, marking an impressive 872% year-on-year growth.

In a separate development, in August 2024, the Hanoi People’s Court handed down a verdict to Mr. Pham Thanh Tung, former Chairman of Tri Viet Securities, and two of his subordinates on charges of “Manipulating the Securities Market.”

According to the prosecution, from January 2, 2020, to October 19, 2020, the defendant Pham Thanh Tung directed Thìn and Hạnh to manipulate the securities market by using 109 internal group accounts of 58 account holders to cross-trade with each other for TVB and TVC stock codes, among others.

The defendant’s actions resulted in losses for 31 investors, totaling over VND 3.3 billion.

After considering all the circumstances of the case, the Court decided not to impose a prison sentence on the defendants and opted for a monetary penalty instead. Accordingly, Pham Thanh Tung was fined VND 2 billion, while his two subordinates, Do Thi Hong Hanh and Nguyen Manh Thìn, were each fined VND 500 million.

This is the second case in which Pham Thanh Tung has been tried on the same charge.

Previously, in 2023, Pham Thanh Tung was sentenced to three years in prison, suspended, by the Hanoi People’s Court in a case involving Do Thanh Nhan, former Chairman of Louis Holdings.