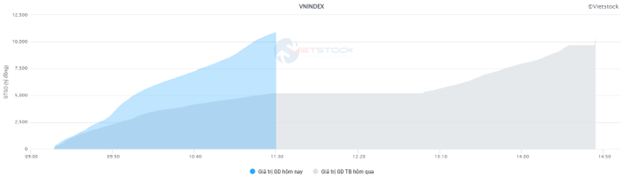

Market liquidity increased compared to the previous trading session, with the VN-Index matching volume reaching over 904 million shares, equivalent to a value of more than 20.5 trillion VND; HNX-Index reached over 71.7 million shares, equivalent to a value of more than 1,385 billion VND.

VN-Index opened the afternoon session with a tug-of-war state despite the presence of short-term profit-taking selling, but the buying side still dominated, helping the index close in positive territory. In terms of impact, VCB, BID, MBB, and HPG were the most positive influences on the VN-Index, with an increase of over 4.3 points. On the contrary, VNM, GVR, NAB, and VHM were the most negative influences, but not significantly so.

| Top 10 stocks impacting the VN-Index on September 25, 2024 |

Similarly, the HNX-Index also had a fairly positive performance, with the index positively impacted by the codes MBS (+5.76%), KSV (+2.78%), CEO (+3.21%), SHS (+1.96%)…

|

Source: VietstockFinance

|

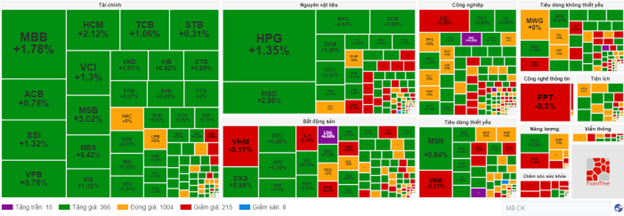

The financial sector was the group with the strongest gain, up 1.39%, mainly driven by STB (+2.67%), VPB (+1.3%), MBB (+1.98%), SSI (+3.2%)… Following were the energy and materials sectors, with increases of 0.55% and 0.53%, respectively.

On the other hand, the healthcare sector continued to fall into negative territory, recording the largest loss in the market with a decrease of -0.6%, mainly due to the performance of DCL (-0.55%), IMP (-2.9%), DVN (-2.81%), and DHG (-0.19%).

In terms of foreign trading, they continued to net buy over 398 billion VND on the HOSE exchange, focusing on VCI (89.68 billion), TCB (75.36 billion), SSI (64.03 billion), and MWG (54.85 billion). On the HNX exchange, foreigners net bought over 2 billion VND, focusing on SHS (26.21 billion), CEO (9.21 billion), MBS (8.95 billion), and VGS (4.56 billion).

| Foreign Trading Buy – Sell Net |

Morning Session: The market was vibrant with the return of the “Bank – Securities – Steel” trio

The green color spread widely, and the market traded actively in the morning session with the brilliant comeback of the “bank – securities – steel” trio. At the midday break, the VN-Index rose 10.36 points, or 0.81%, to 1,285.88 points; HNX-Index increased by 0.58% to 235.67 points. The advantage leaned towards the buying side with 413 gainers and 233 losers.

Positive momentum was concentrated in the large-cap stock group, helping to improve liquidity. The matching volume of the VN-Index this morning reached over 483 million units, equivalent to a value of nearly 11 trillion VND, doubling that of the previous morning. The HNX-Index recorded a matching volume of over 40 million units, with a value that tripled to nearly 808 billion VND.

Source: VietstockFinance

|

VCB was the driving force, helping the VN-Index gain more than 2 points, followed by BID, HPG, and TCB, which also contributed positively with more than 2.5 points. On the opposite side, VNM, FPT, and VJC were slightly lower, negatively impacting the index, but not significantly.

Most industry groups were covered in green, with the most notable being the “bank – securities – steel” trio. The securities group led the market with a gain of 2.67%. Almost all stocks broke through strongly above 2%, notably MBS (+6.44%), HCM (+3.26%), BVS (+3.26%), SSI (+3.01%), VIX (+3.07%), VCI (+2.61%), FTS (+2.44%),…

Following was the steel group, with a gain of nearly 2%, with buying momentum concentrated in the leading stocks of the industry, such as HPG (+1.74%), HSG (+2.98%), NKG (+2.84%), TVN (+3.45%), VGS (+4.66%), and TIS (+7.46%). Although the “king” group had a more modest increase than the two groups mentioned above, with a market capitalization of more than 30%, it was the group that contributed the most to the market’s explosion this morning. The leading stocks in the industry, including VCB, BID, CTG, TCB, VPB, MBB, and ACB, all rose by more than 1%.

In contrast, telecommunications and information technology were at the bottom of the table, with decreases of 0.66% and 0.28%, respectively. This was mainly due to the red color of VGI (-0.89%), CTR (-0.15%), VNZ (-0.43%), SGT (-1.73%), and FPT (-0.3%)

Foreigners net bought slightly more than 49 billion VND on the HOSE exchange this morning, with SSI being the stock with the highest net buying by foreigners. On the HNX exchange, foreigners net bought more than 13.5 billion VND, focusing on buying SHS the most.

10:30 am: Financial and Materials sectors lead the VN-Index

The main indices, which initially surged positively, turned to tug-of-war around the reference level, indicating investors’ hesitation. As of 10:30 am, the VN-Index rose 5.2 points, trading around 1,282 points. The HNX-Index increased by 0.84 points, trading around 235 points.

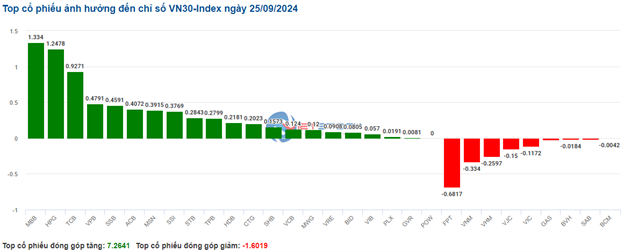

Stocks in the VN30 basket mostly rose and were more dominant. Specifically, MBB, HPG, TCB, and VPB contributed 1.33 points, 1.25 points, 0.93 points, and 0.48 points to the overall index, respectively. Conversely, FPT, VNM, VHM, and VJC faced selling pressure, taking away more than 1 point from the VN30-Index.

Source: VietstockFinance

|

Leading the current recovery were financial stocks, with green dominating most codes. Notably, securities stocks surged from the beginning of the ATO session, with SSI up 1.13%, HCM up 2.12%, VCI up 1.3%, and MBS up 4.75%… This optimistic sentiment could be attributed to the fact that on September 18, the Ministry of Finance issued Circular 68/2024/TT-BTC, amending and supplementing a number of articles of the Circulars guiding securities trading on the securities trading system, clearing, and settlement of securities transactions, which helped remove a major obstacle regarding the issue of allowing foreign institutional investors to trade stocks without requiring sufficient funds (Non Pre-funding). This is expected to enhance the competitiveness of Vietnam’s stock market in the coming time and create more development opportunities for companies providing services in this field.

In addition, banking stocks also witnessed optimistic movements, with green appearing in most codes, such as MBB up 1.58%, VPB up 0.52%, STB up 0.32%, and ACB up 0.58%…

Following was the materials sector, which also attracted money flow. Notably, the three giants in the steel industry, HPG up 1.35%, HSG up 2.98%, and NKG up 2.61%, along with some chemical stocks like DCM up 1.83%, DPM up 1.54%, and DGC up 0.61%…

Compared to the beginning of the session, the buying side still dominated. There were 366 gainers and 215 losers.

Source: VietstockFinance

|

Opening: Maintaining a slight gain

At the start of the September 25 session, as of 9:30 am, the VN-Index rose more than 3 points to 1,280.69 points. Meanwhile, the HNX-Index also edged higher, reaching 235.1 points.

Gold prices rose more than 1% and hit a new record on Tuesday (September 24) as tensions in the Middle East fueled safe-haven demand, while investors anticipated further interest rate cuts in the US.

At the close of the trading session on September 24, spot gold contracts rose 1.1% to $2,656.38 an ounce after hitting a previous high of $2,654.96. Gold futures contracts increased by 1% to $2,680.00 an ounce.

As of 9:30 am, large-cap stocks such as VCB, HPG, and CTG were leading the market, with a total increase of more than 1 point. On the contrary, VHM, KDC, and NAB were at the top of the list of negative impacts on the market, but the decrease was less than 0.5 points.

The energy sector maintained stable growth from the beginning of the session, with stocks such as BSR up 1.26%, PVS up 0.72%, PVD up 0.54%, PVC up 0.76%, PVB up 1%, and the remaining stocks standing still or slightly lower.