This report was presented by Mr. Tran Minh Toan, Chief Financial Officer (CFO) of DSC, at the Investor Conference held on the afternoon of September 27.

Mr. Tran Minh Toan, CFO of DSC, speaking at the Conference on September 27

|

Specifically, in Q3 2024, DSC recorded positive proprietary trading performance with a pre-tax profit of approximately VND 48 billion, accounting for 56% of the profit structure, up 847% over the same period last year. From the beginning of the year until now, proprietary trading has brought in VND 51 billion (exceeding the annual plan by 535%).

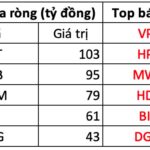

It is known that, as of June 30, 2024, in the FVTPL asset portfolio, DSC held more than VND 299 billion in listed shares, of which the largest investment proportion was ACB with a book value of VND 98.5 billion. Compared to the beginning of the year, DSC has invested VND 70 billion in CTG, VND 62.5 billion in HCM, VND 51 billion in MBB, and an additional VND 15 billion in OCB…

On the contrary, the Company sold all its investments in FPT with a book value of VND 68 billion; SSI for VND 71 billion, and VAB for VND 3 billion.

In Q3, the Company also recorded a pre-tax profit of VND 34 billion from securities brokerage services, bringing the total profit for the first nine months to VND 104 billion (reaching 64% of the annual plan). Regarding capital utilization activities, as of the end of Q3, the total lending value of DSC is estimated at VND 1,720 billion, up 31% over the same period.

CFO Tran Minh Toan stated: “Revenue from lending activities remains stable and ensures the growth of DSC throughout 2024. In addition, with the sharp decline in the market interest rate for margin loans, revenue from DSC’s deposit and some other activities has also been affected to some extent. However, this is a common issue in the securities industry and will be adjusted soon to be more suitable in the next phase.”

In the first nine months of 2024, DSC is estimated to have achieved VND 388 billion in revenue, fulfilling 92% of the annual plan, and a pre-tax profit of about VND 184 billion, achieving 92% of the annual target.

According to Mr. Toan, the strategy of managing and optimizing human resources and capital has directly impacted the business results of the first nine months and Q3 2024, in particular. DSC’s CIR ratio has decreased from 66% in 2023 to 53% in 2024.

Sharing about future plans, DSC‘s leadership stated that besides the goal of completing the management and business plan presented at the 2024 AGM, the Company will focus on upgrading its information technology infrastructure and improving and expanding some new digital services and products based on the needs of customers and investors.

In related news, on September 24, Ho Chi Minh City Stock Exchange (HOSE) approved the listing of more than 204.8 million DSC shares with a par value of VND 10,000/share, corresponding to a total listing value of over VND 2,048 billion.

The plan to switch from UPCoM to HOSE was unanimously approved at the 2024 AGM.

The Young Chairman: Unveiling the Face Behind the Newly-Approved HoSE-Listed Securities Firm

As of now, the young chairman holds 73 million DSC shares (35.6% of the capital), with an estimated value of nearly VND 1,700 billion.