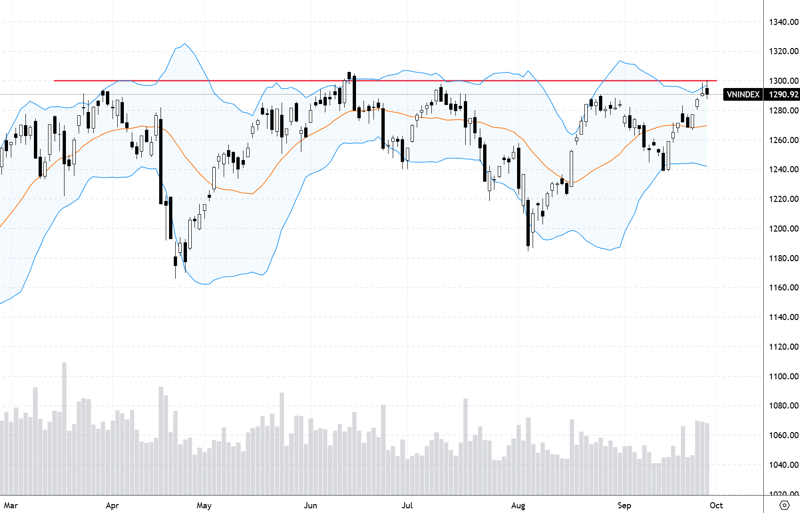

The VN-Index has made two attempts to break through the 1300-point mark in the past five sessions, but both were unsuccessful. The strong liquidity in these failed attempts has left a more distinct impression of distribution activities…

Experts continue to have opposing views on the short-term market outlook. The negative outlook from last week proved correct as the VN-Index experienced two fairly strong corrective sessions at the end of the week. This perspective continues to be concerned about the market being distributed and awaits the bottom of this corrective phase at a relatively deep level. In contrast, more positive opinions still hold that although last week’s high liquidity and clear downward pressure, the selling signal was exhausted by the end of the week. The expected adjustment threshold is mainly around the 1250-1260 point level.

Despite differing short-term perspectives, experts generally remain positive about the market’s future trend. The current adjustment does not affect the existing upward trend, and the opportunity to surpass the 1300-point mark remains.

Nguyen Hoang – VnEconomy

The market had a rather disappointing trading week, with three unsuccessful attempts to surpass the 1300-point peak. Each time it reached this threshold, selling pressure pushed it down, and it fell sharply in the last two sessions. Last week’s average liquidity also increased significantly, with high liquidity in the declining sessions. This week’s performance was quite different from the previous week. Does this indicate large-scale distribution in the market?

As the leading banking group still maintains a positive signal, without significant selling pressure, I am more inclined to believe that the market is only experiencing a short-term shakeout at the 1300-point level before attempting to conquer it again.

Nguyen Thi My Lien

Nguyen Viet Quang – Director of Business Center 3, Yuanta Hanoi

Looking at the weekly VN-Index candle, it has formed a reversing candle cluster with high liquidity compared to the previous period; the daily candle has had an SFP session on Thursday, breaking the accumulation base of the previous five sessions with large liquidity. Additionally, since September 29, the index has not had any attractive candles; the green sessions with high liquidity also have long wicks, and the red sessions’ liquidity has mostly been above the 20-session average volume. From this, I assess that the market is likely undergoing large-scale distribution.

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

The market’s sentiment has turned more negative after the continuous upward momentum was halted around the 1300-point mark. Such a development is understandable as investors had high expectations, especially with the banking group taking the lead. The supply-demand correlation became apparent in the final trading session, with liquidity plummeting and the index closing at the session’s lowest point, signaling a contraction from the buying side.

However, I believe these signals indicate profit-taking rather than redistribution around the peak. Liquidity above the 20,000 billion threshold is positive at this point, but it is not significant enough to confirm a distribution session. The market will likely continue to fluctuate to shake off short-term trading positions and return to a balanced zone to attract proactive demand.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

Last week, the market once again failed to conquer the psychological threshold of 1300 points and experienced stronger selling pressure. However, with only one session of intense selling, I don’t think there are enough signals to conclude that the market is being distributed. On the contrary, as the leading banking group still maintains a positive signal without significant selling pressure, I lean more toward the possibility that the market is only undergoing a short shakeout at the 1300-point level before attempting to conquer it again.

Money Flow Trend: A Retreat to Gain Momentum for Breakthrough?

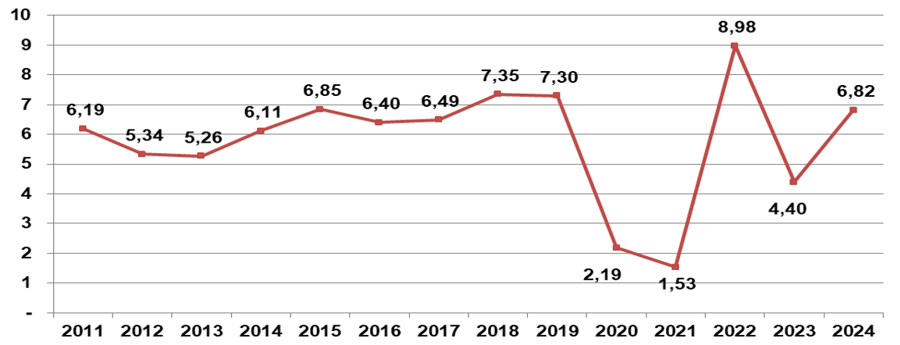

Despite Super Typhoon Yagi, Q3/2024 GDP Still Rose 7.4%

Nguyen The Hoai – Director of Dong Nai Branch, Rong Viet Securities

The short-term trend is being challenged as the banking group is experiencing profit-taking. This group has a large market capitalization and high liquidity, which causes the overall market liquidity to increase. But to say that the market is undergoing large-scale distribution, I think it’s not time yet.

Le Duc Khanh – Director of Analysis, VPS Securities

The strong resistance level of 1300 points remains a challenging milestone for the market. It is common for the index to adjust and accumulate or turn downward to the support zone below. In my opinion, the VN-Index needs more time to return to the peak, and there is an opportunity for the market to recover next week.

Nguyen Hoang – VnEconomy

Last week, you assessed that the market was moving sideways and had not surpassed the 1300-point threshold, only a normal accumulation retreat. With more negative changes this week, will the market enter a real corrective phase? How deep can the adjustment threshold be?

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

As mentioned earlier, I don’t think the current signals are overly negative. The market has only experienced one intense selling session, and there was no continuous selling pressure in the final session, evident in the low-volume decline. Simultaneously, the leading banking group still maintains a positive trend. Therefore, I expect this to be just a short correction, and the market may recover next week. Support is in the 1266-1283 or 1250-1260-point region.

Nguyen The Hoai – Director of Dong Nai Branch, Rong Viet Securities

I assess that the market’s overall trend remains positive in the medium term. Last week, tense geopolitical news hindered the conquest of the 1300-point threshold, forcing a retreat. But with the domestic and foreign macroeconomic situation remaining stable, I think the index’s adjustment level could be 1250 +/- 10 points.

Many bank stocks have returned to their all-time highs or reached strong resistance zones. I assess that this group will not maintain its role in leading and supporting the market as it did in the previous phase and may even create additional downward pressure.

Nguyen Viet Quang

Nguyen Viet Quang – Director of Business Center 3, Yuanta Hanoi

Last week, I assessed that the VN-Index had reached the end of Wave 5 and would enter a corrective phase, and the market was undergoing distribution. This played out, and the index has had strong corrective sessions, breaking the previously built base. Currently, I am paying attention to several support zones: around 1240 points; around 1200 points. However, these support zones do not guarantee a rebound, and we need to consider the price action at these levels.

Le Duc Khanh – Director of Analysis, VPS Securities

In my opinion, the market will adjust but remain within the 1265-1275-point range. Two support and resistance zones to note reflect the market’s movement above the 1260-1265 +/- point threshold (the lowest level early next week), after which it will recover to the 1270-1275-point zone. If the VN-Index surpasses 1275, there is a high chance it will return to the old peak of 1300 points and break through in the subsequent upward wave.

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

The less favorable developments this week have not changed my personal perspective. The overall market sentiment has turned negative as the VN-Index’s attempt to conquer the 1300-point mark failed, leading to increased profit-taking and reduced positions to safer levels. However, I believe that the previous upward momentum was mainly driven by cash inflows from investors, and leverage was not significant. Therefore, the market is unlikely to experience a series of sharp declines. The potential support zone where the index may show a recovery reaction is around the 1255 (+-10) point level.

Nguyen Hoang – VnEconomy

One reason the VN-Index failed to break through the 1300-point mark last week was the weakening of large-cap stocks, including the leading banking group. Stocks like VHM, VIC, GAS, and FPT lacked strength, while bank stocks experienced clear profit-taking after an impressive previous gain. In our previous discussion, you highly valued the strength of the banking group and its role in pushing the VN-Index to new highs. Can this group maintain its role while facing profit-taking and turning downward?

Nguyen The Hoai – Director of Dong Nai Branch, Rong Viet Securities

After a considerable increase, it is reasonable for the banking group to undergo a correction. In terms of valuation, this group remains attractive, so I think it will continue to be the market’s main driver in the coming period. Additionally, foreign investors have consistently net bought in the recent period, supporting the market. When large-cap stocks achieve consensus, the market will overcome this challenge.

I assess that the market’s overall trend remains positive in the medium term.

Nguyen The Hoai

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

Some bank stocks have gone through a steep upward phase, so profit-taking is a normal development as investors want to secure profits. This is not necessarily a negative signal, and what’s important is the supply-demand correlation for that stock. When there is sufficient inflow into the stock, with large volumes maintained over multiple sessions, the stock’s upward momentum will improve, and demand will rejoin the corrected stock. Additionally, large-cap stock waves typically last a long time rather than just a few sessions. Therefore, I expect the banking group to maintain its leading role for the index.

Nguyen Viet Quang – Director of Business Center 3, Yuanta Hanoi

In our previous discussion, I did not highly value the strength of the banking group because the robust and profitable stocks were mostly small and medium-sized ones. Many bank stocks have returned to their all-time highs or reached strong resistance zones. I assess that this group will not maintain its role in leading and supporting the market as it did in the previous phase and may even create additional downward pressure.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

After the corrective signals last week, I still expect the banking group to maintain its crucial role in driving the VN-Index’s upward trend. Although the entire market experienced intense selling last week, the banking group showed resilience, not facing significant selling pressure and maintaining its positive trend. Moreover, money flowed into small and medium-sized bank stocks. These signals suggest that it was small and medium-sized investors taking profits after a good gain rather than large-scale investors exiting their positions. Therefore, I expect this group to avoid a trend reversal and continue its role in leading the index’s recovery.

In my opinion, the VN-Index needs more time to return to the peak, and there is an opportunity for the market to recover next week.

Le Duc Khanh

Le Duc Khanh – Director of Analysis, VPS Securities

In my opinion, the banking group can still recover after a few corrective sessions, but then it will diverge, with some stocks continuing to rise while others accumulate and correct without further increases. Other groups, such as securities, steel, and oil and gas, may replace the banking group in supporting the market.

Nguyen Hoang – VnEconomy

Amid the poor performance of the underlying market, the VN30 index futures maintained a wide positive basis. Is this an absurdity or a positive signal about market expectations? If you were to participate in derivatives, would you bet on Long or Short at this point?

Nguyen Viet Quang – Director of Business Center 3, Yuanta Hanoi

Vietnam’s derivatives market is currently quite small, so various factors can influence it. I won’t try to explain the absurdity of the VN30 futures’ nearly seven-point positive basis. Technically, VN30F1M has completed Wave 5 and is in a corrective “a” wave, so I would bet on Short, but I’ll wait for the second bounce to get a reasonable entry point.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

Currently, the indices are undergoing corrections, but the overall upward trend remains intact. In an upward trend, the futures index having a higher score than the underlying index indicates a positive basis, reflecting the market’s expectation that the index may continue to rise in the future. Therefore, the positive basis suggests the market expects the upward trend to persist. If I were to participate in derivatives, I would prioritize Short intraday positions due to the short-term correction, while Long positions would be preferred when the market approaches the support level.

I believe that the previous upward momentum was mainly driven by cash inflows from investors, and leverage was not significant, so the market is unlikely to experience a series of sharp declines. The potential support zone where the index may show a recovery reaction is around the 1255 (+-1