Gold prices fell for the sixth consecutive session on Wednesday (Oct 9) as the US dollar and Treasury bond yields continued to strengthen, with markets no longer betting on a significant rate cut in the November meeting of the Federal Reserve. A forecast suggested that gold prices could dip to the $2,500/oz range in the coming months but are expected to remain elevated through 2025.

At the close of trading in New York, spot gold fell by $13.5/oz compared to the previous session’s close, equivalent to a drop of over 0.5%, to $2,608.7/oz, according to data from Kitco Exchange.

As of 8 a.m. Vietnam time on Thursday (Oct 10), spot gold in the Asian market was up by $1.4/oz compared to the US close, equivalent to a 0.05% increase, trading at $2,610.1/oz. Converted at Vietcombank’s selling exchange rate, this is equivalent to about VND 78.7 million/troy ounce, down VND 400,000/troy ounce from yesterday morning.

Earlier this morning, Vietcombank quoted the dollar at VND 24,630 (buying) and VND 25,020 (selling), down VND 5 at both ends compared to yesterday morning.

Gold, an asset priced in US dollars and bearing no interest, fell under pressure from the strengthening greenback and rising US Treasury bond yields.

The Dollar Index, measuring the greenback’s strength against a basket of six major currencies, closed at 102.93, the highest in nearly two months. Over the past five sessions, the index has climbed by 0.84%, according to data from MarketWatch.

Yields on 10-year Treasury bonds continued to climb after surpassing the 4% mark for the first time in two months earlier this week. At the close, the yield on the 10-year note rose by 3.8 basis points to 4.073%. The yield on the two-year note increased by 4.3 basis points to 4.022%.

These moves came as the market this week stopped betting on a 50-basis point rate cut by the Fed in its November meeting.

Minutes from the Fed’s Sept. 18 meeting, released on Oct. 9, showed that “a substantial majority of participants” supported a 0.5 percentage point rate cut at that meeting. However, the minutes also indicated that the Fed did not have a pre-set plan for future rate cuts.

In the futures market, speculators are now betting on an over 80% chance of a Fed rate cut in the November meeting, with a 0.25 percentage point reduction. The possibility of the Fed keeping rates unchanged at this meeting is nearly 20%, up from 12.5% the previous day, according to data from the FedWatch Tool of the CME Exchange.

“The US dollar continued to strengthen, and economic data supported a 0.25 percentage point rate cut more,” said Phillip Streible, chief strategist at Blue Line Futures, in a Reuters interview.

However, according to Carlo Alberto De Casa of Kinesis Money, the downward trend in interest rates and ongoing geopolitical tensions mean that gold prices will remain supported in the long term.

In a report, Oxford Economics researcher Diego Cacciapuoti shared a similar view. He argued that the upward momentum in gold prices is weakening, but strong fundamentals will keep prices elevated through 2025 and beyond.

The report predicts that gold prices could be at risk of a short-term correction “because the recent rally has been largely supported by falling real yields… Since April – after real yields peaked – falling real yields have supported gold prices.” Recently, as real yields have started to climb again, coupled with central banks net buying less gold than before, gold has come under pressure.

Mr. Cacciapuoti forecast that in this context, many investors may sell gold to take profits. “Speculative positions in gold are at their highest since the Covid-19 pandemic and have been rising very slowly recently. This suggests that speculators may be finding gold less attractive,” he wrote, suggesting that between now and January 2025, gold prices could fall and consolidate around $2,500/oz.

However, the expert also believes that gold prices will rebound and remain elevated in 2025 as the fundamental factors remain largely favorable for gold.

Gold Prices Plunge as Fed Rate Cut Hopes Fade

Investors are cautiously awaiting the Fed’s release of the minutes from its September meeting, along with the latest inflation data from the U.S. Labor Department.

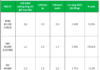

The Evolution of Vietnam’s Banking Sector: Unlocking the Secrets Behind its Success

The State Bank of Vietnam has just released figures pertaining to the latest customer deposit trends.