In tandem with the price hike, APP’s liquidity also improved, with an average trading volume of over 53,000 shares per session, more than double the annual average.

Source: VietstockFinance

|

APP has just sent a written explanation to the State Securities Commission of Vietnam and the Hanoi Stock Exchange regarding the stock’s five consecutive ceiling-priced sessions, with the content of the explanation following a typical “template”.

The company affirmed that its production and business activities are proceeding normally and that there are no particular fluctuations.

“The ceiling-priced increase in APP shares is due to the supply and demand of the stock market, and the decision to buy or sell shares is made by investors and is beyond the company’s control. There is no influence on the share price in the stock market”, quoted from APP‘s explanation.

APP’s streak of ceiling-priced increases ended when the code fell by 5.88% to 8,000 VND/share (closing on October 14th). However, liquidity increased sharply compared to many previous sessions, reaching nearly 107,000 shares.

Looking at a broader perspective since the beginning of 2024, after a long period of fluctuating around 4,000-5,000 VND/share, APP shares experienced a sharp increase from mid-April, pushing the market price to a historical peak of 17,300 VND/share on June 12th, more than 3.2 times higher just two months later. From that point on, APP’s market price has adjusted and is currently trading in the region of 8,000 VND/share, still more than double the beginning of the year.

| Price Movement of APP Shares Since the Beginning of 2024 |

A brief introduction to APP: This enterprise specializes in the production of lubricating oils and special fluids, established in 1996, with a current charter capital of over 47 billion VND.

In terms of business performance, during the period of 2018-2023, APP consistently recorded annual revenue of over 200 billion VND, except for 2019 when revenue reached only 190 billion VND due to the impact of COVID-19. However, net profit was modest, ranging from a few hundred million to a few billion VND, and in 2023, the company incurred a significant loss of nearly 5 billion VND, mainly due to a loss of market share and a decrease in sales volume…

For the year 2024, the company set a record revenue target of 364 billion VND, an increase of 81% compared to 2023, and expected a pre-tax profit of 765 million VND.

| APP’s Pre-tax Profit and Net Profit Since the Release of Information |

Regarding dividend payment history, APP shareholders have not received any dividends for a long time since 2019. Prior to that, the company maintained a dividend payment habit from 2010 to 2018, for nine consecutive years.

The Stock Market Surge: A Surprising Rise with Liquidity Still Lacking

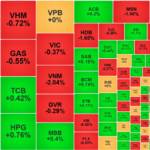

The VN-Index witnessed a significant decline during the afternoon session, plunging below the reference level due to substantial pressure from the blue-chip group. While bottom-fishing funds became more active at lower price levels, facilitating the recovery of many stocks, the buying momentum failed to adequately spread across the market, resulting in today’s overall liquidity dipping to a 14-session low.

The Flow of Funds: Consecutive Failures at the 1300-Point Peak – Is There Still a Chance for a Breakthrough?

Over the past five trading sessions, the VN-Index has witnessed two attempts to breach the 1300-point mark, yet it fell short of success. The notable surge in trading volume during these failed attempts leaves a profound impression of distribution activities.

The Capital Flows In: MSN and FPT Witness Billion-Dollar Liquidity

A surge in trading this morning pushed the liquidity of the two exchanges up 34% compared to yesterday’s morning session, with the breadth of the market showing a widespread upward trend. However, the money flow was not well dispersed, focusing on a group of strong stocks. FPT and MSN received enormous buying power from both domestic and foreign investors, accounting for 23.2% of the total matched value on the HoSE exchange and nearly 37% of the VN30 basket.

The Ever-Rising Bridge of Prices: Green Electric Board

Although the VN-Index only slightly increased by 3.24 points (+0.25%) during the morning session, the index remained above the reference level for the entire period. This can be attributed to a strong buying force, with investors willing to accept higher prices. Blue-chip stocks are leading the way in terms of both index points and liquidity, accounting for over half of the market.