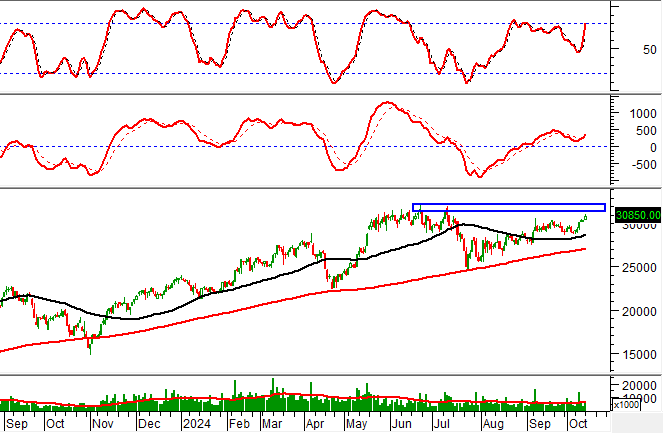

Technical Signals of VN-Index

During the trading session on the morning of October 14, 2024, the VN-Index gained points and a Doji candlestick pattern emerged, while trading volume slightly dipped in the morning session, indicating investors’ hesitation.

Currently, the VN-Index continues to retest the old peak from June 2024 (equivalent to the 1,300-1,310 point region) as the MACD indicator flashes a buy signal again. Should the index successfully surpass this resistance zone, the intermediate-term optimistic outlook would be further reinforced.

Technical Signals of HNX-Index

On October 14, 2024, the HNX-Index witnessed a slight increase in points, and a Doji candlestick pattern emerged, with trading volume rising during the morning session, reflecting investors’ uncertainty.

Additionally, the Stochastic Oscillator indicator continues to trend downward after previously signaling a sell signal. Should this factor improve, a short-term recovery scenario may unfold in the upcoming sessions.

DBC – Vietnam Dabaco Group JSC

On the morning of October 14, 2024, DBC formed a Rising Window candlestick pattern, and liquidity significantly improved during the morning session. It is expected to surpass the 20-day average by the end of the session, indicating active trading among investors.

Moreover, the stock price rebounded and retested the old peak from July 2024 (equivalent to the 31,300-32,300 region) as the MACD indicator maintained its upward trajectory after previously signaling a buy signal. Should the stock price successfully breach this resistance zone, the long-term optimistic outlook would be further bolstered.

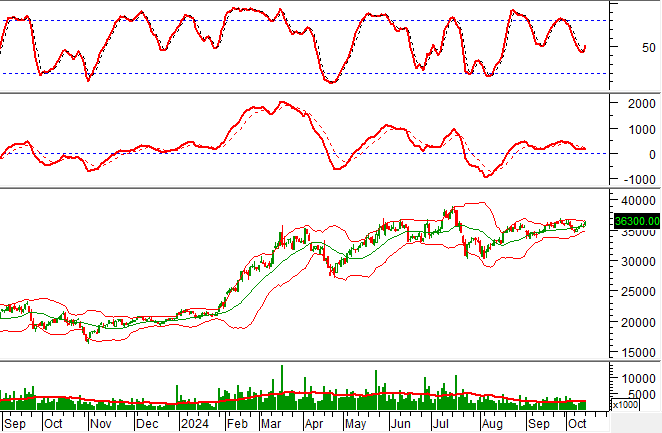

GVR – Vietnam Rubber Group JSC

On October 14, 2024, GVR witnessed a price increase, and trading volume surpassed the 20-session average, reflecting investors’ optimism.

Additionally, the stock price is retesting the Middle line of the Bollinger Bands, and the Stochastic Oscillator indicator flashes a buy signal again. Should this factor be sustained, a short-term recovery scenario may unfold in the upcoming sessions.

Vietstock Consulting’s Technical Analysis Team

The Market Beat: A Tale of Diverging Fortunes, VN-Index Falters at the 1,295 Mark

The market ended the session in negative territory, with the VN-Index down 2.05 points (-0.16%) to close at 1,286.34. The HNX-Index followed suit, falling 0.65 points (-0.28%) to 230.72. It was a sea of red across the broader market, as sellers dominated with 395 declining stocks compared to 294 gainers. The large-cap VN30-Index also painted a similar picture, with 19 stocks in the red, 8 in the green, and 3 unchanged.

Gold is Alluring, but What’s Drawing Investors to Equities?

Gold has been a significant competitor to stocks as an investment avenue in recent times, but the stock market also boasts elements that can boost cash flow in the future.