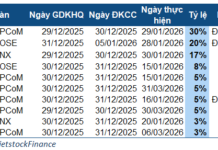

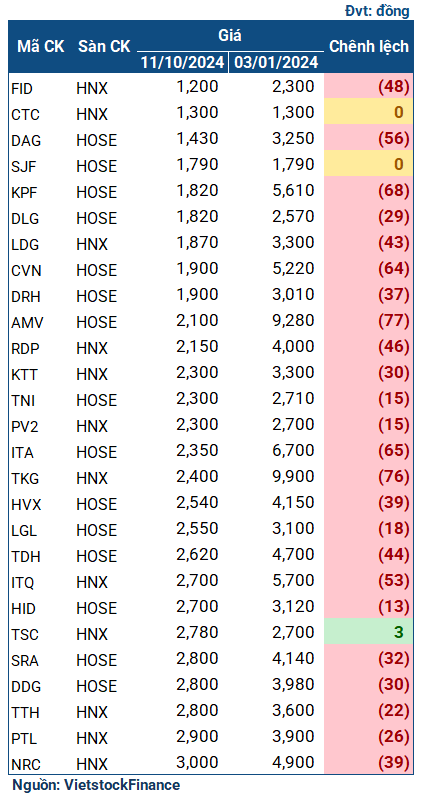

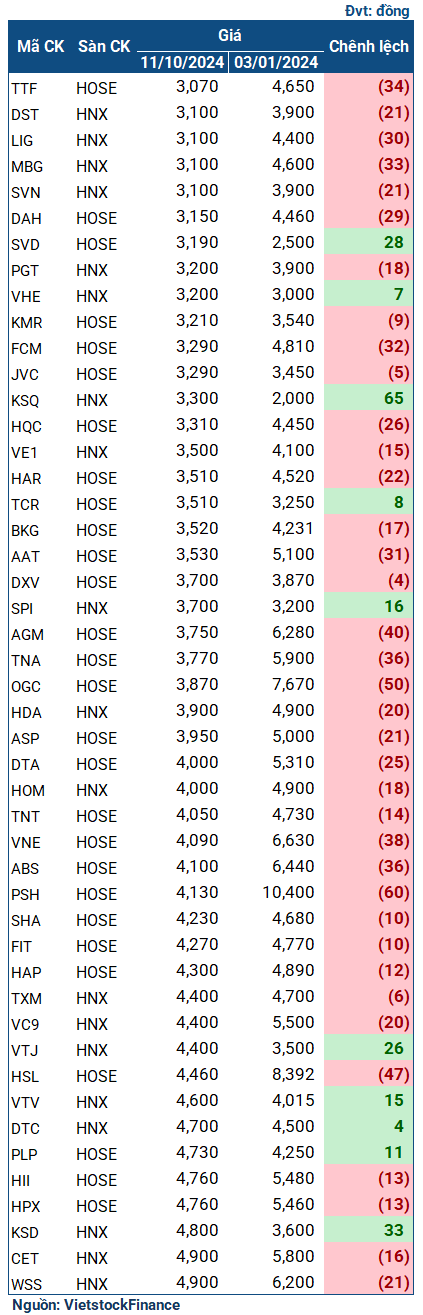

Ice tea is a humble drink, often associated with affordability in Vietnam. To be fair, let’s assume the price of a cup of ice tea, however temporary, is the lowest in the market at 3,000 VND. At this price, there are 27 tickers on the HOSE and HNX exchanges with market prices equal to or lower than this amount. Among these, the cheapest stock is priced at 1,200 VND, while the highest is only 3,000 VND per share.

|

List of stocks cheaper than a cup of ice tea in the current market

|

Topping this unfortunate list is FID (Vietnam Enterprise Investment and Development JSC). As of October 11, FID’s market price stood at only 1,200 VND per share, a 48% decrease compared to the beginning of the year. In second place is CTC (Tay Nguyen Hoang Kim Group), which has maintained a market price of 1,300 VND per share since the start of the year. The last on the list, indicating the highest price, is NRC of Danh Khoi Group, priced at 3,000 VND per share.

In terms of percentage decrease, the top two losers are AMV (Vietnam-America Pharmaceutical and Medical Equipment Production and Trading) and TKG (Tung Khanh Production and Trading), with a drop of 77% and 76% in value since the beginning of the year, respectively. Their current market prices are 2,100 VND and 2,400 VND per share, respectively. Other notable mentions include KPF (Koji Asset Investment) at 1,820 VND per share, down 68%; ITA (Tan Tao Investment and Industry) at 2,350 VND per share, a decrease of 65%; and DAG (Dong A Plastic Joint Stock Company) at 1,430 VND, down 56%.

|

Stocks with a price below 5,000 VND per share that are currently listed on the stock exchanges

|

What led to this situation?

Stock prices are influenced by numerous factors, including a company’s fundamentals, business potential, industry outlook, and market supply and demand. However, in most cases, extremely low-priced stocks are often accompanied by deeper stories or, simply put, internal issues.

For FID, the stock is currently facing a “combo” of warnings, surveillance, and trading restrictions. The company’s internals are not positive, with continuous losses, the heaviest being a loss of 4 billion VND in 2020. In 2023, despite a 2.2-fold increase in revenue compared to the previous year, reaching over 84 billion VND, FID still incurred a net loss of nearly 3 billion VND (a profit of nearly 64 million VND in 2022).

| FID is experiencing a prolonged streak of losses |

In the first half of 2024, FID continued to incur a net loss of 2.5 billion VND, with a cumulative loss of over 23 billion VND as of the end of June. The reviewed semi-annual financial statements for 2024 also received a series of qualified audit opinions, mainly related to provisions for personal advances – explained by FID as “advances for handling company affairs” – and loan contracts with a number of joint-stock commercial banks.

DAG, on the other hand, is currently in the process of suspended trading. Similar to FID, DAG is mired in a mess and is going through its most challenging phase in two decades. According to the audited financial statements for 2023 (released in July 2024), DAG incurred a net loss of up to 600 billion VND, mainly due to a provision for inventory devaluation of up to 404 billion VND, which caused a significant increase in cost of goods sold. This massive loss wiped out the company’s consistent profitability over the previous 16 years, resulting in a negative retained earnings figure of 588 billion VND at the end of 2023 (compared to a positive 19 billion VND at the beginning of the year). The report received three pages of comments from the auditor, highlighting bad debts – including loan and tax debts – and expressing doubts about the company’s ability to continue as a going concern.

In the first half of 2024, DAG‘s situation did not improve, with a loss of 67 billion VND and equity of just over 27 billion VND. The company generated only 55 billion VND in revenue, equivalent to 6% of the same period last year. The suspension of trading can even be considered fortunate for DAG, preventing the stock price from falling further.

| The huge loss in 2023 pushed DAG into its most challenging phase in two decades |

ITA is another company that has been making headlines. The company, led by Dang Thi Hoang Yen (or Maya Dangelas), was recently placed under suspended trading at the end of September 2024 due to continued violations of information disclosure regulations.

In reality, ITA‘s financial performance in the recent period has not been disappointing. After a record loss of 260 billion VND in 2022, ITA bounced back with a net profit of over 202 billion VND in 2023. In the first half of 2024, ITA continued to be profitable, with a net income of nearly 64 billion VND, a 66% increase compared to the same period, mainly due to the reversal of provisions for doubtful debts and reduced bank interest expenses, along with cost-saving measures in the second quarter.

Nevertheless, ITA‘s stock price has continued to plummet due to various controversies surrounding the company. In 2022, the company was ordered by the Ho Chi Minh City People’s Court to initiate bankruptcy proceedings, relating to a debt of approximately 21 billion VND to Cong Ty TNHH Thuong Mai Dich Vu Xay Dung Quoc Linh – a claim that Ms. Yen has consistently denied. This ruling also triggered a series of other lawsuits, which continue to impact the company’s operations, as explained in ITA‘s quarterly financial statements for Q2/2024.

| ITA‘s stock price has been on a downward spiral since the beginning of the year |

Additionally, ITA has often made shocking statements. Regarding the delay in publishing the audited financial statements for 2023 and the reviewed semi-annual financial statements for 2024, Nguyen Thanh Phong – CEO of ITA – claimed that HOSE and the State Securities Commission of Vietnam (SSC) had acted unusually, creating difficulties for auditing firms and suspending the practice of auditors performing audits for ITA, leading to the departure of these firms. Ms. Yen asserted that ITA was being sabotaged by malicious forces aiming to acquire the company. In the face of potential delisting, ITA issued a statement implying that the SSC and HOSE would be held responsible.

Another notable mention is DDG (Indochina Import Export Industrial Investment Joint Stock Company). On the market, DDG‘s stock is currently under warning and has recently been placed under surveillance due to violations of information disclosure regulations regarding the reviewed semi-annual financial statements for 2024. The market price as of October 11 was only 2,800 VND per share, a 30% decrease compared to the beginning of the year. However, compared to its peak in 2023 – before the consecutive “floor price” sessions – the drop is as high as 93%.

| DDG experienced a series of “floor price” sessions in 2023, leading to its current position in the “ice tea” price range |

The main reason for DDG‘s predicament is the challenges it faces in its business operations. In 2023, the company incurred a record loss of nearly 206 billion VND (compared to a profit of 44 billion VND in the previous year). In the first half of 2024, the company’s revenue reached over 120 billion VND, only one-third of the same period last year. While it made a net profit of approximately 6.6 billion VND (compared to a loss of nearly 194 billion VND in the same period last year), this profit was mainly due to the disposal of fixed assets of the parent company.

| Business operation difficulties are the main reason for the decline in DDG‘s stock price |

Optimistic investors often say that every rain will eventually stop, and that a stock that falls will eventually rise. However, the rain that shareholders of the aforementioned companies are facing may still have a long way to go.