Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 607 million shares, equivalent to a value of more than 13.9 trillion VND; HNX-Index reached over 34.8 million shares, equivalent to a value of more than 662 billion VND.

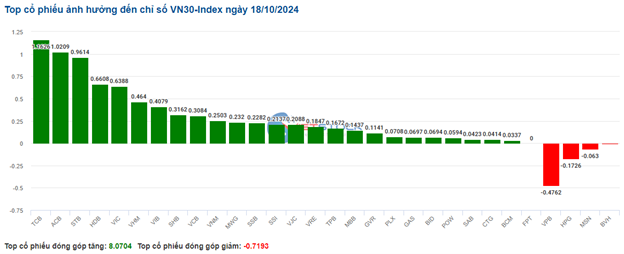

VN-Index opened the afternoon session on a positive note as buyers returned, but unexpected selling pressure emerged, causing the index to reverse and close in the red. In terms of impact, VPB, HPG, CTG, and MSN were the most negative stocks, taking away more than 1.7 points from the index. On the other hand, bank stocks such as STB, EIB, HDB, and VCB were the most positive and contributed 1.3 points to the index.

| Top 10 stocks with the most impact on the VN-Index on October 18, 2024 |

Similarly, the HNX-Index also had a less optimistic performance, with the index negatively impacted by PVS (-1.27%), KSV (-2%), CEO (-1.95%), and NTP (-1.75%)…

|

Source: VietstockFinance

|

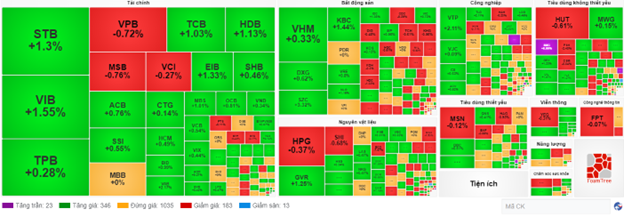

The materials sector had the largest decline in the market at -0.55%, mainly due to HPG (-1.1%), HSG (-0.96%), NKG (-1.42%), and GVR (-0.42%). This was followed by the utilities and consumer staples sectors, which fell by 0.43% and 0.22%, respectively.

On the other hand, the industrial sector had the best recovery in the market, reaching 0.61% with green mainly in the transportation group, including VJC (+1.14%), VTP (+1.29%), ACV (+1.05%), and HVN (+0.49%).

In terms of foreign trading, they continued to net sell over 184 billion VND on the HOSE exchange, focusing on MSB (33.78 billion), VHM (33.07 billion), VCI (24.45 billion), and CTG (22.05 billion). On the HNX exchange, foreigners net sold more than 12 million VND, focusing on IDC (13.02 billion), MBS (7.78 billion), HJS (1.5 billion), and VGS (1.35 billion).

| Foreign trading net buying and selling on October 18, 2024 |

Morning session: Back to the starting line

Buyers gradually lost momentum towards the end of the morning session. From an increase of more than 6 points earlier, the VN-Index reversed to return to the reference level, reaching 1,286.99 points. Meanwhile, the HNX-Index fluctuated within a narrow range, ending the mid-session slightly in the red at 230 points. The number of declining stocks continued to increase, with 266 stocks declining and 291 stocks advancing.

The matching volume of the VN-Index in the morning session reached nearly 298 million units, equivalent to a value of more than 6.7 trillion VND, not a high level but still significantly better than the lackluster performance of the previous session. Liquidity on the HNX exchange recorded a matching volume of over 17 million units, with a value of over 335 billion VND.

VIC, GVR, and GAS are jointly and positively supporting the index, but the impact is less than 1 point. On the other hand, the most negative stock dragging down the index’s upward momentum is VPB, followed by HPG and CTG.

The performance of industry groups is becoming more polarized, with the number of declining groups increasing to half. On the rising side, the positive performance of VGI (+1.8%), VNZ (+1.3%), and FOX (+0.56%) was the main driver for the telecommunications group, which led the market with a gain of nearly 1.5% at the end of the morning session. This was followed by the industrial group, which also attracted strong buying interest, notably in the stocks of ACV (+1.31%), VEF (+2.05%), VTP (+1.4%), MVN (+1.16%), and PHP (+3.45%).

The real estate and financial groups, which led the market’s upward momentum at the beginning of the session, returned to a polarized performance, with most stocks rising or falling slightly around the reference level. Exceptions included some stocks that maintained gains of over 1%, including SZC (+3.45%), DTD (+1.57%), NTC (+1.43%), CRE (+1.31%); SSB (+1.19%), VIB (+1.03%), and EIB (+1.06%). In contrast, selling pressure was significant in DIG (-1.43%), TCH (-1.22%), HDC (-1.33%); VPB (-1.2%), and MSB (-1.14%).

The groups that were dominated by red at the end of the morning session included energy, utilities, materials, consumer staples, and information technology.

10:35 am: Real estate and financial groups jointly pull the VN-Index up

Investor sentiment gradually became more optimistic, with the main indices tilting towards positive territory. Real estate and financial stocks led the market’s upward momentum.

Most of the stocks in the VN30-Index basket were in positive territory. On the rising side, bank stocks such as TCB, ACB, STB, and HDB contributed 1.16 points, 1.02 points, 0.96 points, and 0.66 points to the overall index, respectively. Meanwhile, four stocks, VPB, HPG, MSN, and BVH, continued to face selling pressure but did not decline significantly.

Source: VietstockFinance

|

Leading the current recovery was the real estate sector, which rose by 0.74% with green spreading across most stocks. Specifically, VHM increased by 0.67%, PDR by 0.24%, KBC by 1.44%, VRE by 1.07%…

Regarding SZC, this stock stood out as buying interest emerged early at the market opening. From a technical perspective, the stock’s price in the October 18, 2024, session surged strongly and formed a candle pattern similar to a White Marubozu, accompanied by rising volume that exceeded the 20-session average, indicating increased trading activity. Moreover, the price of SZC remained above the Middle Bollinger Band, while the MACD continued to trend upward after giving a buy signal, further reinforcing the potential recovery scenario in the future.

Source: https://stockchart.vietstock.vn/

|

Following closely was the financial sector, which also exhibited a positive performance. This included bank stocks such as STB, VIB, TCB, and HDB, which all gained over 1%. Additionally, securities stocks such as SSI, MBS, FTS, and VIX also recorded decent gains ranging from 0.23% to 1.35%.

The market breadth inclined towards the buying side, with over 346 advancing stocks outnumbering approximately 183 declining stocks. The VN-Index rose over 5 points to 1,291 points, while the HNX-Index gained 0.14% to hover around 230 points. The UPCoM-Index increased by 0.16%.

Source: VietstockFinance

|

The total trading volume on the three exchanges exceeded 251 million units, corresponding to a value of over 5.2 trillion VND. On the downside, foreign investors resumed net selling, offloading over 102 billion VND, across several stocks such as FPT, HDB, OCB, and DBC…

Source: VietstockFinance

|

Opening: Up from the start

At the beginning of the October 18 session, as of 9:30 am, the VN-Index started in positive territory, reaching 1,290.36 points. Meanwhile, the HNX-Index also edged slightly higher, maintaining the 230.56-point level.

Green temporarily prevailed in the VN30 basket, with 5 declining stocks, 23 advancing stocks, and 2 stocks remaining unchanged. Among them, BVH, GVR, and VPB were the top losers. Conversely, PLX, VIC, and VRE were the top gainers.

The telecommunications services group was one of the most prominent sectors in the early morning session. Stocks that traded positively from the start included VGI, which rose by 1.01%, CTR by 0.23%, VNZ by 0.56%, ELC by 0.81%, and YEG by 0.1%…

Along with this, the energy sector also contributed positively to the market’s performance. Specifically, stocks such as BSR increased by 0.45%, PVD by 0.19%, PVB by 0.69%, and AAH by 2.86%, while the remaining stocks in the sector remained unchanged.

The Market Beat 24/10: Another Day, Another Dive

The market on October 24th delivered a somber day for investors as it witnessed a continuous decline, especially during the afternoon session, ending with a deep slump. A sea of red engulfed the market, with the spotlight on the banking and real estate sectors, dragging down the overall sentiment.

The Rising Pessimism

The VN-Index witnessed a significant decline, forming a bearish Black Marubozu candlestick pattern and breaching the middle line of the Bollinger Bands. The MACD and Stochastic Oscillator indicators continue on a downward trajectory, reinforcing the sell signal. Moreover, persistent foreign net selling sends a cautious message to investors about the market’s outlook in the near term.

The Ultimate Headline:

“Warning Signs: Are Negative Signals Brewing?”

The VN-Index witnessed a significant decline, forming a Black Marubozu candlestick pattern and breaking below the previous low from early October 2024 (around the 1,265-1,270 point level). This strong bearish move reflects the prevailing pessimistic sentiment among investors. Moreover, the trading volume remains below the 20-day average, indicating that buying interest is still limited. The MACD indicator continues to flash a sell signal and has dropped below zero, suggesting that the downward trend is likely to persist in the near term.

The Market Beat: Buyers Strike Back, VN-Index Holds its Ground

The market ended the session on a positive note, with the VN-Index climbing 2.03 points (0.16%) to reach 1,288.39; the HNX-Index also rose, gaining 0.08 points (0.03%) to close at 231.37. The market breadth tilted in favor of gainers, with 372 advancing stocks against 317 declining ones. The large-cap VN30 basket painted a similar picture, as 15 constituents added value, 12 lost ground, and 3 remained unchanged, ending the day in the green.

The Big Shake-Up: Small-Cap Stocks’ Surprising Resilience

The “blue morning, red afternoon” trend persisted today, but losses were less severe. The market experienced a sharp decline towards the end of the afternoon session, with the VN-Index plunging as much as 3.7 points before recovering to close just 1.6 points (-0.12%) lower. The VNSmallcap was the sole index in positive territory and the only group to maintain liquidity compared to yesterday’s session.