Closing Session on October 17, VN-Index rose 7.04 points to 1,286.52, HNX-Index gained 1.86 points to 230.12, while UPCoM climbed 0.38 points to 92.7. The expiration session also concluded with the one-month VN30 futures contract (VN30F1M) closing at 1,358.3 points, 4.59 points lower than the VN30’s level of 1,362.89.

|

Source: VietstockFinance

|

Overall, the market was dominated by green, with 424 gainers (including 21 stocks hitting the ceiling price) while only 265 losers (including 7 stocks hitting the floor price) were seen. Banking, securities, and real estate stocks were the main driving force behind the strong rally in the afternoon session.

Banking stocks continued to exert a strong influence, with many stocks posting gains, such as STB (+2.98%), MSB (+3.94%), TPB (+2.29%), ACB (+1.55%), VCB (+0.77%), BID (+0.9%), MBB (+1.57%), and CTG (+0.69%).

The securities sector also witnessed numerous stocks surging, including SSI (+1.29%), VIX (+1.33%), and SHS (+1.32%).

Additionally, the real estate industry stirred up a frenzy in the afternoon session, with several stocks even hitting the ceiling price, such as DXG, PDR, and NHA.

In contrast to the morning session, where 21 out of 24 sectors declined, 19 out of 24 sectors ended in positive territory by the close, with financial services being the only sector climbing over 1% thanks to the momentum from securities stocks.

Liquidity surged towards the end of the session, surpassing 18.6 trillion VND on all three exchanges, higher than the previous session but slightly lower than the 5-session average.

Following the market’s liquidity, foreign investors accelerated their trading in the afternoon session, resulting in net selling for the fifth consecutive session, with a value of more than 426 billion VND.

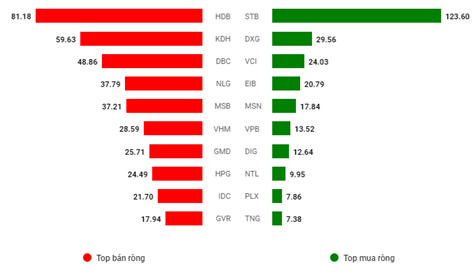

In terms of net buying, foreign investors focused on STB, with a net purchase value of nearly 177 billion VND, followed by NTL with over 84 billion VND, far surpassing other stocks. On the net selling side, the selling pressure was concentrated on FUESSVFL fund certificates, with nearly 24 billion VND, HDB with nearly 113 billion VND, and KDH with over 75 billion VND. Overall, the selling force was distributed across a wider range of stocks.

| Top 10 stocks with the strongest foreign net buying and net selling on October 17, 2024 |

2:00 PM: Money flow accelerated, and the index recovered to the reference level

*After the lunch break, the market resumed with a rapid recovery accompanied by improved liquidity, and there was even a moment when the index turned green.*

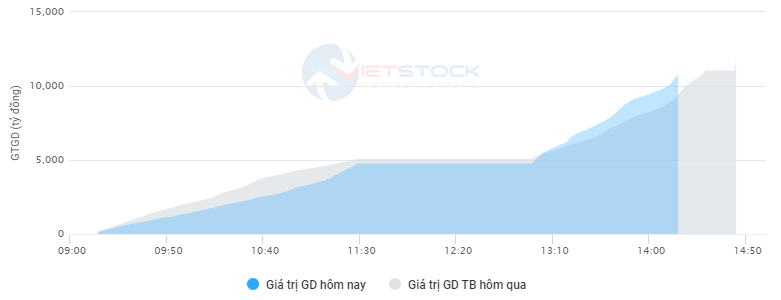

Liquidity increased rapidly in the afternoon session, reaching over 11.6 trillion VND at 2:00 PM, while it was only 6.1 trillion VND in the morning session. The surge in liquidity partly supported the market’s recovery.

|

VN-Index’s liquidity increased after the lunch break

Source: VietstockFinance

|

However, the pressure remained significant as most stocks on the market were still in the red. At 2:00 PM, the VN-Index fell by only 1.79 points, standing at 1,277.69; the HNX-Index dropped by 0.06 points to 228.2, and the UPCoM-Index decreased by 0.05 points to 92.28. Overall, there was a recovery after the first half of the afternoon session.

The trading value of foreign investors also increased, with net buying of nearly 877 billion VND and net selling of over 1,269 billion VND, resulting in a net sell-off of nearly 393 billion VND.

The scale of foreign investors’ transactions was significantly higher than in the morning session. Their main strategy was to increase net buying in STB while net selling in a series of stocks such as HDB, KDH, DBC, etc.

|

Net trading value by stock on October 17, 2024

Unit: Billion VND

Source: VietstockFinance

|

Morning Session: A Green Opening, But A Steep Slide

*Despite starting in the green and even surging over 3.8 points to surpass the 1,283 level, the VN-Index later plunged into a decline and showed no signs of stopping. The morning session ended with the index falling 5.61 points to 1,273.87.*

From being dominated by green at the beginning of the day, the market suddenly fell into a downward spiral and showed no signs of recovery, closing the morning session with red across all three exchanges. Specifically, the VN-Index dropped 5.61 points to 1,273.87, the HNX-Index slid 0.76 points to 227.5, and the UPCoM-Index lost 0.32 points to 92.

Source: VietstockFinance

|

According to VS-SECTOR, 21 out of 24 sectors declined, led by telecommunications with a 1.26% drop due to the pressure on VGI (-1.49%) and CTR (-1.05%). This was followed by specialized services and commerce, which fell by 1.16%, and energy, which decreased by 1.08%.

The market declined, but liquidity was almost non-existent, with the total trading value of the market barely exceeding 6.1 trillion VND. It is evident that during the derivatives expiration session, which is often associated with significant fluctuations, investors are exercising caution.

Foreign investors also haven’t fully engaged in the morning session, with transaction volume lower than in previous sessions. They net bought over 450 billion VND, focusing on STB with more than 72 billion VND, while net selling nearly 722 billion VND, mainly offloading HDB (nearly 48 billion VND), VHM, and HPG (around 25 billion VND each). As a result, they temporarily net sold nearly 272 billion VND.

If this scenario persists, foreign investors will record their fifth consecutive net selling session in the Vietnamese stock market.

10:40 AM: Balance Restored, Liquidity Dried Up During Derivatives Expiration

*The market quickly narrowed its gains after the number of declining stocks increased and balanced out the number of advancing stocks. During the derivatives expiration session, market liquidity was significantly lower than in previous sessions.*

The number of advancing and declining stocks was relatively balanced, with 254 gainers, including 12 stocks hitting the ceiling price, while there were 259 losers, including 6 stocks hitting the floor price, and the remaining 1,095 stocks were unchanged.

On the market map in terms of trading value, green and red were interspersed. Some notable green areas included MWG (+0.15%), FPT (+0.07%), EIB (+1.08%), and DXG (+0.66%). In addition, TNG stood out with a 3.73% increase. The company had just released its Q3/2024 financial statements, reporting a net profit of over 111 billion VND in Q3, a remarkable 63% increase compared to the same period last year.

With these developments, the VN-Index’s gain narrowed to just 0.06 points, reaching 1,279.54. Similar fluctuations occurred in the HNX and UPCoM.

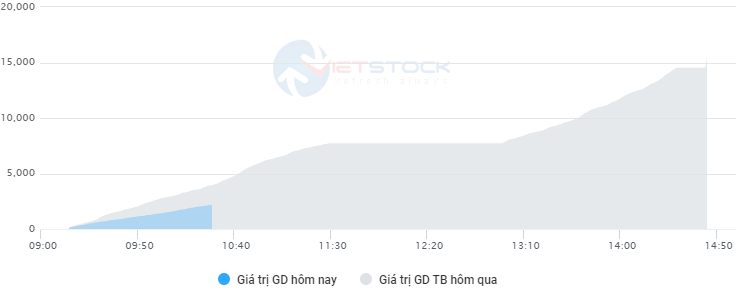

The trading value of the entire market as of 10:30 AM was slightly above 2.9 trillion VND, which was quite low compared to recent averages, especially on the VN-Index. The drop in liquidity is understandable given that expiration sessions of derivatives often entail unpredictable risks.

|

VN-Index’s liquidity dropped during the derivatives expiration session

Unit: Billion VND

Source: VietstockFinance

|

Opening: A Mild Increase at the Start

*At the beginning of the October 17 session, the market edged higher, supported by numerous large-cap stocks, a recurring theme in recent times.*

As of 9:25 AM, green prevailed across all three exchanges, with the VN-Index climbing 2.99 points to 1,282.47, the HNX-Index rising 0.46 points to 228.73, and the UPCoM advancing 0.19 points to 92.51.

In the market, a host of financial stocks witnessed mild gains, notably EIB, MBB, LPB, CTG, MSB, HCM, VCI, and VND, along with real estate stocks like VHM, QCG, KDH, DXG, PDR, and CEO, as well as non-essential consumer stocks such as TNG, MWG, and PET.

The green spread was broad, but the contribution of large-cap stocks was significant, as their substantial market capitalization translated into a certain number of points for the VN-Index. Specifically, VCB contributed 0.4 points, BID 0.35 points, VHM 0.32 points, and FPT 0.25 points.

Vietnamese stocks edged higher, partly reflecting the positive sentiment in global markets.

Asian markets opened on a cheerful note, with benchmarks like the Hang Seng, Shanghai Composite, and Singapore Straits Times in the green. Overnight, the Dow Jones index in the US market climbed 337.28 points to 43,077.7, hitting a new peak, while the S&P 500 rose to 5,842.47, and the Nasdaq Composite advanced to 18,367.08.

[Huy Khai]

Market Beat: Buyers Return in Afternoon Trade, VN-Index Surges Over 9 Points

The market ended the session on a positive note, with the VN-Index climbing 9.87 points (0.78%) to reach 1,281.85, while the HNX-Index gained 0.25 points (0.11%), closing at 231.77. The market breadth tilted in favor of the bulls, as evident from the advance-decline ratio of 411:256. A similar trend was observed in the VN30 basket, with 22 stocks advancing, 6 declining, and 1 remaining unchanged, resulting in a sea of green on the screen.

The Market Pulse: The Crucial 1,300-Point Threshold

The VN-Index retreated to close a week of volatile trading. Investor caution persisted as trading volume remained below the 20-week average. Additionally, the index continued to struggle as it approached the September 2024 high (1,290-1,300 points range). If the index recovers with improved liquidity in the coming phase, it is highly likely to surpass this range.

The Market Beat: The Tug-of-War Continues

As of the market close, the VN-Index dipped 1.06 points (-0.08%), settling at 1,285.46, while the HNX-Index witnessed a decline of 0.91 points (-0.4%), closing at 229.21. The market breadth tilted towards decliners, with 364 stocks falling against 315 advancing stocks. The VN30-Index basket saw a relatively balanced performance, with 13 stocks in the red, 12 in the green, and 5 unchanged.

The Market Beat: Selling Pressure Mounts, VN-Index Dips into the Red

The market closed with the VN-Index down 5.69 points (-0.44%) to 1,279.77 and the HNX-Index down 1.78 points (-0.78%) to 227.43. The market breadth tilted towards decliners with 473 losers and 228 gainers. The large-cap stocks in the VN30-Index basket painted a similar picture, with 23 stocks declining, 5 advancing, and 2 unchanged.

The Market Beat 24/10: Another Day, Another Dive

The market on October 24th delivered a somber day for investors as it witnessed a continuous decline, especially during the afternoon session, ending with a deep slump. A sea of red engulfed the market, with the spotlight on the banking and real estate sectors, dragging down the overall sentiment.