I. MARKET ANALYSIS FOR OCTOBER 23, 2024

– The main indices recovered during the October 23 trading session. Specifically, VN-Index closed slightly up 0.08%, reaching 1,270.9 points; HNX-Index increased by 0.44% to 226.5 points.

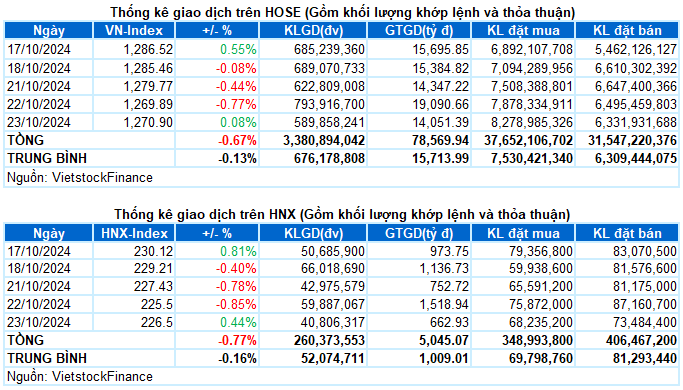

– The matching volume on HOSE reached nearly 536 million units, down 26.4% compared to the previous session. The matching volume on HNX also decreased by 24.1%, reaching more than 40 million units.

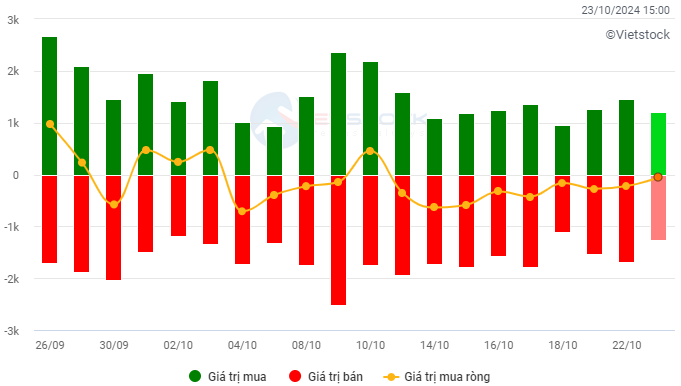

– Foreign investors still net sold slightly on the HOSE with a value of more than VND 4 billion and net sold nearly VND 68 billion on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

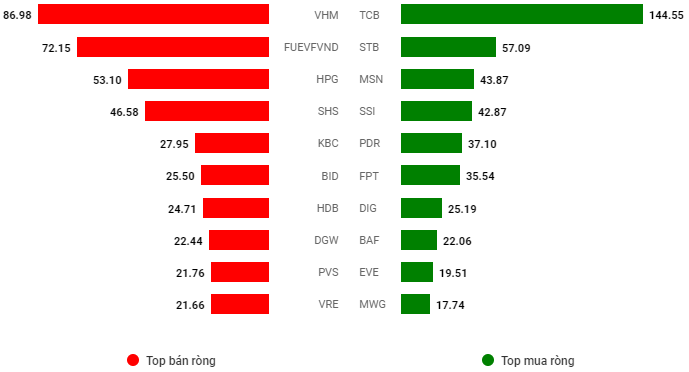

Net trading value by stock code. Unit: VND billion

– The market fluctuated during the October 23 trading session. The continuous adjustment of the index since the end of the previous week and the lack of supportive information made investors cautious. Today’s market liquidity remained low, although buyers made significant efforts to successfully regain green at the end of the day. From the deepest drop of more than 6 points in the morning session, the VN-Index closed slightly up 1.01 points to 1,270.9 points.

– In terms of impact, VIC stock shone in today’s session, increasing positively from the beginning of the day, helping VN-Index gain nearly 1 point. Following were FPT, STB, and TPB, which contributed nearly 1 point to the index increase. In contrast, VHM, after a string of glorious days, adjusted back, putting the most pressure on the market today, taking away nearly 1.3 points. In addition, BID, HPG, and VPB also had a significant impact, causing the VN-Index to fall by more than 1 point.

– VN30-Index closed up slightly by 0.06%, reaching 1,349.72 points. The breadth of the basket was balanced with 14 gainers, 11 losers, and 5 stocks standing at reference prices. Among them, VIC, STB, and TPB stood out with gains of over 2%. On the opposite side, only VHM fell by 2.6%, the most representative, while the rest decreased slightly by less than 1%.

Most industry groups successfully reversed the trend in the afternoon session to close with a positive green. The information technology group led with a 0.76% increase thanks to stocks like FPT (+0.83%), POT (+6.75%), and ITD (+0.37%). Following was the essential consumer group with the main increase from MCH (+1.02%), HAG (+1.9%), VSF (+2.01%), KDC (+1.18%), DBC (+1.58%), and MSN (+0.63%).

The most notable group today must be real estate, although the industry index was not impressive due to the significant influence of the largest capitalization stock in the industry, VHM (-2.59%). Many stocks in this group attracted positive buying power from the beginning of the session, including VIC (+2.37%), KDH (+1.83%), PDR (+3.35%), NLG (+3.01%), DIG (+3.46%), DXG (+2.47%), and SNZ (+6.31%). The financial group performed quite differently, with most stocks rising or falling below 1%, except for the significant volatility of STB (+2.29%), TPB (+2.02%), VDS (+2.56%), PTI (+2.25%),…

Materials and non-essential consumer goods were the only two groups left dominated by red. Sellers still prevailed in many stocks such as HPG (-0.75%), GVR (-0.74%), PLC (-2.18%); MWG (-0.9%), FRT (-1.15%), DGW (-0.91%),…

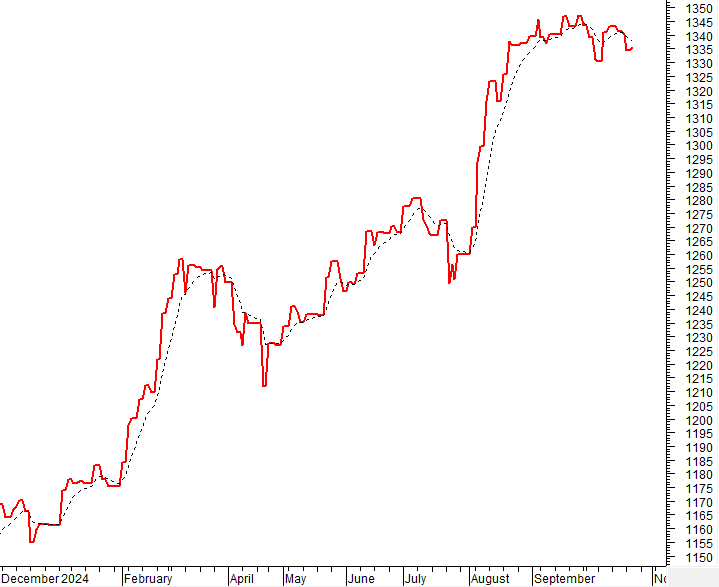

VN-Index closed slightly up while retesting the old bottom of early October 2024 (equivalent to the 1,265-1,270-point range). If, in the coming time, the index holds above this threshold, along with the trading volume exceeding the 20-day average, the short-term outlook will be more positive. In addition, the MACD indicator needs to give a buy signal again to maintain optimism.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Re-testing the old bottom of early October 2024

VN-Index closed slightly up while retesting the old bottom of early October 2024 (equivalent to the 1,265-1,270-point range). If, in the coming time, the index holds above this threshold, along with the trading volume exceeding the 20-day average, the short-term outlook will be more positive.

In addition, the MACD indicator needs to give a buy signal again and not fall below the 0 threshold to maintain optimism.

HNX-Index – Stochastic Oscillator indicator gives a buy signal in the oversold region

HNX-Index increased well and recovered after consecutive declining sessions. However, investors’ cautious sentiment still existed as the trading volume fell below the 20-day average.

Currently, the Stochastic Oscillator indicator has given a buy signal in the oversold region. If, in the next sessions, the indicator continues to rise and leaves this region, the short-term outlook will show positive signs.

Analysis of Capital Flows

Changes in smart money flow: The Negative Volume Index indicator of VN-Index cut down below the EMA 20 line. If this state continues in the next session, the risk of an unexpected drop (thrust down) will increase.

Changes in foreign capital flow: Foreign investors continued to net sell in the October 23, 2024, trading session. If foreign investors maintain this action in the coming sessions, the situation will be less optimistic.

III. MARKET STATISTICS FOR OCTOBER 23, 2024

Economic Analysis & Market Strategy Department, Vietstock Consulting

The Market Beat: A Rapid Decline, A Strong Surge in the Expiry of Derivatives

The VN-Index faced pressure throughout the morning session and the early minutes of the afternoon, dipping below 1,272 points. However, true to the nature of an expiration day for derivatives, the VN-Index staged a strong comeback, closing above 1,286 points. This impressive turnaround was largely driven by the banking, securities, and real estate sectors, which provided the much-needed boost to push the index higher.

Vietstock Weekly 14-18/10/2024: Aiming for July 2024 Highs

The VN-Index rallied and staged a strong recovery last week after retesting the middle line of the Bollinger Bands. However, trading volume fell below the 20-week average, indicating that investors are becoming cautious again. In the coming week, the index has the opportunity to target the old peak of July 2024 (corresponding to the 1,290-1,300 point range). If the index can surpass this crucial threshold, we may see a more positive outlook emerge.

Market Beat: Buyers Return in Afternoon Trade, VN-Index Surges Over 9 Points

The market ended the session on a positive note, with the VN-Index climbing 9.87 points (0.78%) to reach 1,281.85, while the HNX-Index gained 0.25 points (0.11%), closing at 231.77. The market breadth tilted in favor of the bulls, as evident from the advance-decline ratio of 411:256. A similar trend was observed in the VN30 basket, with 22 stocks advancing, 6 declining, and 1 remaining unchanged, resulting in a sea of green on the screen.

The Market Pulse: The Crucial 1,300-Point Threshold

The VN-Index retreated to close a week of volatile trading. Investor caution persisted as trading volume remained below the 20-week average. Additionally, the index continued to struggle as it approached the September 2024 high (1,290-1,300 points range). If the index recovers with improved liquidity in the coming phase, it is highly likely to surpass this range.

The Market Beat: The Tug-of-War Continues

As of the market close, the VN-Index dipped 1.06 points (-0.08%), settling at 1,285.46, while the HNX-Index witnessed a decline of 0.91 points (-0.4%), closing at 229.21. The market breadth tilted towards decliners, with 364 stocks falling against 315 advancing stocks. The VN30-Index basket saw a relatively balanced performance, with 13 stocks in the red, 12 in the green, and 5 unchanged.