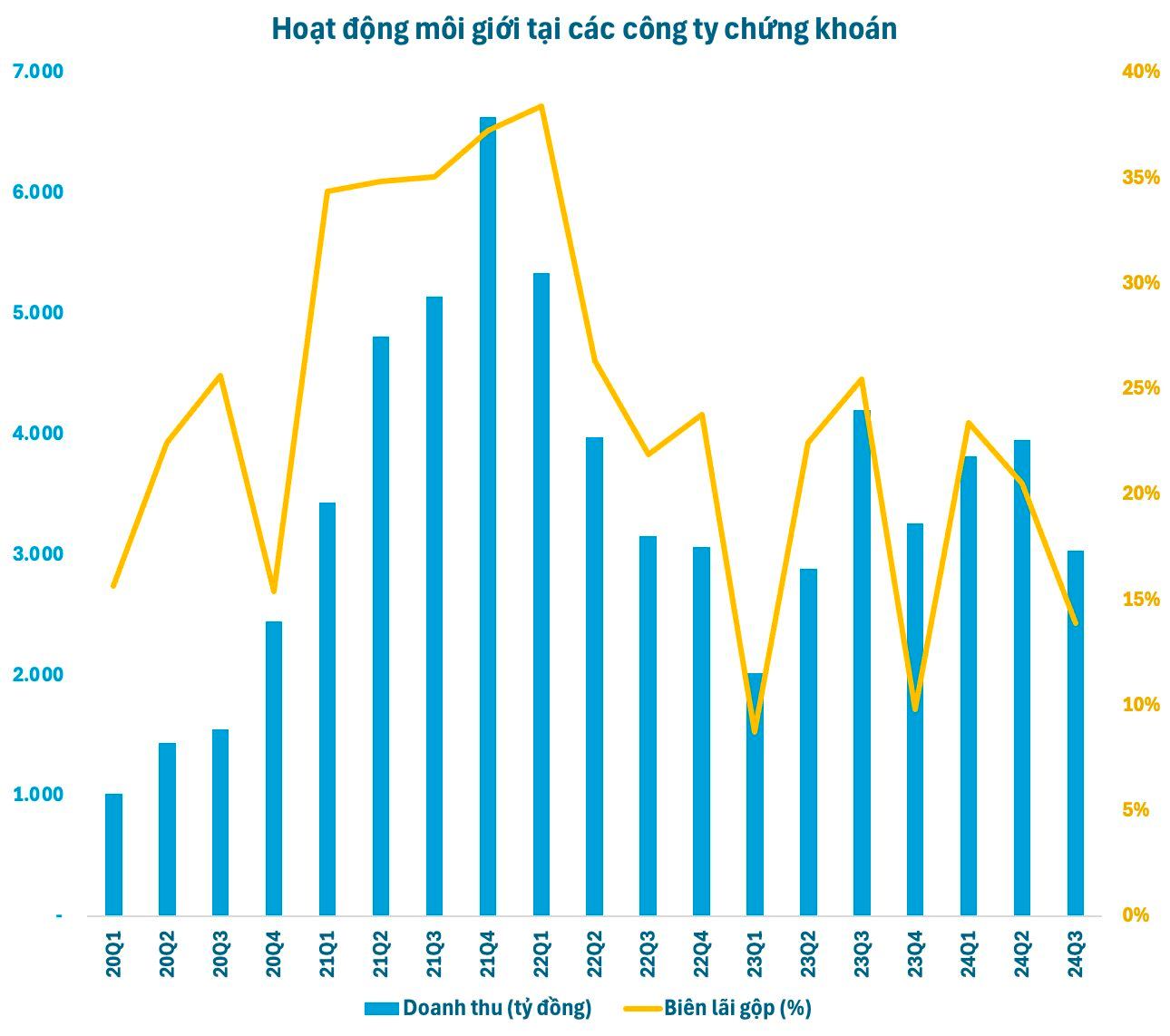

The brokerage activities of securities companies witnessed a significant downturn in the third quarter after two quarters of recovery. Revenue from this business barely reached VND 3,000 billion, a 28% decrease compared to the same period in 2023 and 23% lower than the previous quarter. This is the lowest revenue from brokerage activities that securities companies have experienced in the last five quarters.

This decline can be attributed to the lackluster trading activities in the stock market. In the third quarter, the average trading value on HoSE barely reached VND 15,000 billion per session, approximately 25% lower than the same period in 2023 and the first half of this year. The decrease in liquidity caused a significant shrinkage in the market share of securities companies.

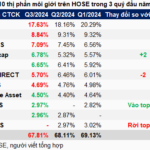

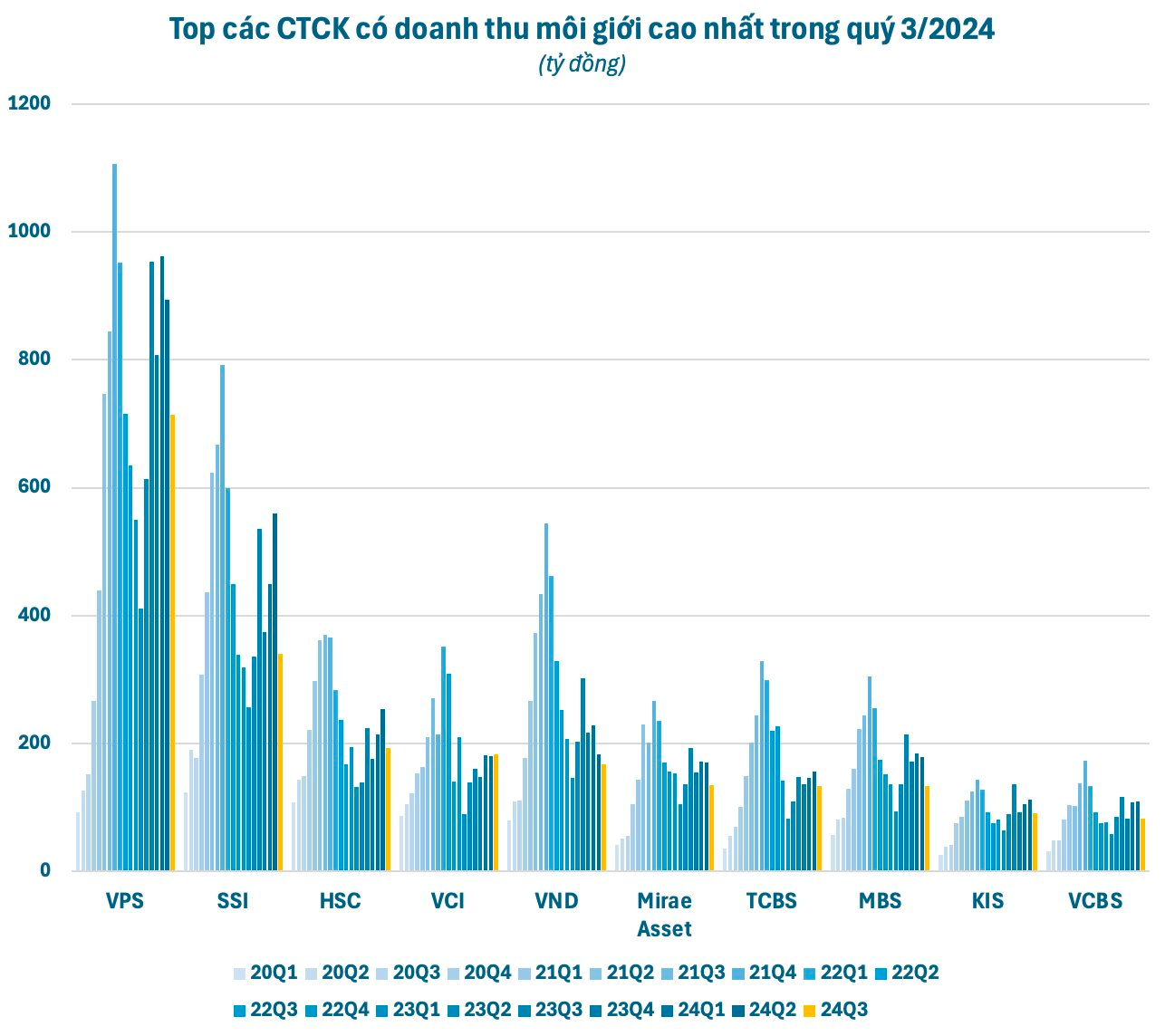

Most of the leading securities companies in terms of market share observed a drop in brokerage revenue compared to the same period in 2023 and the previous quarter. In absolute terms, VPS, SSI, and VNDirect experienced the most significant declines compared to the previous quarter. These companies also lost a considerable market share in the third quarter. Only eight securities companies recorded brokerage revenue of over VND 100 billion, a sharp decline compared to the exceptionally vibrant trading period at the end of 2021 and the beginning of 2022.

The gross profit margin for the brokerage business of securities companies in the third quarter of 2024 also contracted to less than 14%, down from 25.5% in the same period last year and 20.6% in the previous quarter. Gross profit stood at just over VND 400 billion, a 60% decrease compared to the previous year and only half of the figure recorded in the first two quarters of this year.

On a positive note, most of the leading securities companies still managed to generate gross profits from brokerage activities in the third quarter. Out of the eight securities companies with brokerage revenue exceeding VND 100 billion, only Mirae Asset incurred a gross loss. The gross profit margin varied significantly among companies due to different development strategies and commission policies. However, most of the leading securities companies in terms of market share maintained a higher gross profit margin in the brokerage segment than the industry average, particularly HSC (22%), VNDirect (35%), and TCBS (57%).

Intensifying Competition

The shrinking gross profit margin reflects the intensifying competition as securities companies engage in a race to waive or reduce fees to capture market share. To attract investors and retain customers, most securities companies have lowered their transaction fees to some extent. The majority of securities companies now charge a fee of around 0.1-0.15% (including the fee payable to the Stock Exchange). Some have even gone as far as offering a “zero-fee” policy for life, such as TCBS, Pinetree, DNSE, and MBS.

Additionally, securities companies bear numerous expenses related to this business, which erodes their profits. In reality, many securities companies still adhere to the traditional brokerage model, and the commissions paid to their brokers are substantial. Nonetheless, the non-human brokerage model is gaining traction, particularly among newer securities companies.

While strategies differ, it is undeniable that the brokerage business remains crucial to the operations of securities companies. The benefits derived from a quality customer base can far exceed the revenue from standard transaction fees, especially in driving margin lending. Furthermore, a large customer base from brokerage activities facilitates cross-selling of various products and services, such as margin lending, consulting, asset management, bonds, and fund certificates, generating significant profits for securities companies.

With the upcoming effectiveness of Circular No. 68/2024/TT-BTC from November 2, which allows foreign institutional investors to place buy orders for stocks without requiring sufficient funds, the market share pie could expand significantly as foreign transactions become more flexible. In the future, Vietnam’s securities market is expected to attract billions of dollars in foreign capital if it achieves an upgrade. This will present a new target for securities companies in their race for market share.

“A Significant Spike in Margin Lending: DNSE’s Third-Quarter Report Shows a 65% Surge in Margin Debt Since the Start of the Year.”

In Q3 2024, DNSE Securities’ margin lending outstanding balance witnessed a remarkable 65% year-to-date surge, significantly contributing to the firm’s robust financial performance. This quarter, DNSE reported a 12% increase in revenue, totaling VND 193.7 billion, along with a 10% rise in net profit, amounting to VND 44.3 billion, compared to the same period in 2023.