Minh Phu Seafood Corporation (MPC on UPCoM) has released its Q3 2024 financial statements, reporting impressive growth. With a 35% year-on-year surge, the company’s revenue reached VND 2,700 billion. Gross profit also increased by nearly 9%, totaling VND 202 billion.

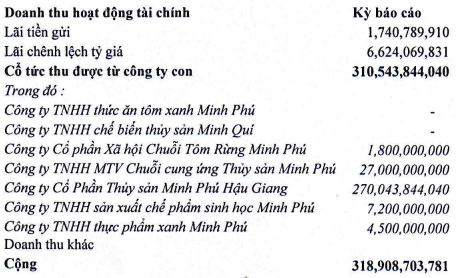

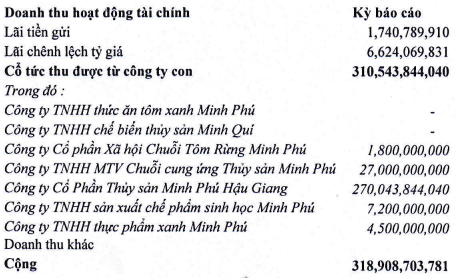

The standout performer was financial revenue, skyrocketing to VND 319 billion—a staggering 32-fold increase year-on-year. This windfall primarily resulted from dividends received from subsidiary companies. Minh Phu Ha Giang Seafood JSC contributed the lion’s share of VND 270 billion, followed by Minh Phu Seafood Supply Chain LLC at VND 27 billion.

Source: MPC

However, financial expenses also rose by 48%, totaling VND 147 billion. This increase was mainly due to provisions for investment losses in subsidiary companies, including VND 63 billion at Minh Phu Kien Giang Seafood LLC and VND 46.5 billion at Minh Phu – Loc An Aquaculture JSC. Selling and management expenses also increased compared to the previous year.

Selling expenses witnessed a significant jump of over 74%, climbing to VND 151 billion, mainly driven by a surge in external service costs. After accounting for taxes and other expenses, Minh Phu posted an after-tax profit of over VND 198 billion, a remarkable turnaround from the VND 13.3 billion loss in the same period last year. This quarter’s performance marks the highest profit for Minh Phu in the last seven quarters.

For the first nine months of 2024, Minh Phu’s cumulative revenue reached VND 6,207 billion, a 33.5% increase year-on-year. The company’s after-tax profit stood at VND 135 billion, almost 17 times higher than the corresponding period in 2023.

As of September 2024, Minh Phu’s total assets amounted to VND 8,159 billion, an 8% increase from the beginning of the year. Investments in subsidiary companies accounted for 68% of Minh Phu’s assets, totaling VND 5,584 billion, with provisions of VND 1,488 billion. The largest provision was made for Minh Phu – Loc An Aquaculture JSC, with a book value of VND 1,020 billion and a provision of VND 720 billion.

Minh Phu Kien Giang Seafood LLC, with an initial investment value of VND 1,215 billion, had a provision of VND 619 billion. Minh Phu Aquaculture JSC, with an investment of VND 257 billion, saw a provision of VND 142 billion.

Inventories decreased by 6.4% from the beginning of the year to VND 1,789 billion. Meanwhile, short-term receivables witnessed a substantial increase of 88%, totaling VND 1,767 billion.

On the liabilities side, Minh Phu’s total liabilities as of September 2024 increased by 22.2% from the beginning of the year to VND 2,638 billion. The company’s financial debt stood at VND 2,041 billion, comprising solely short-term bank loans.

The Chairman of TTC AgriS: Working in the Interests of 91% of Shareholders and Investors

Amidst the growing interest from international investors and prominent financial institutions in TTC Agri-Industries Joint Stock Company (TTC AgriS) (HOSE: SBT), Ms. Dang Huynh Uc My, Chairman of the Board of Directors, assures fair and transparent treatment for shareholders, investors, and all stakeholders.

The Sun Plastic’s Q3 2024 Profit Soars 39% Near Peak: Unveiling the Mystery.

The third-quarter revenue growth this year, compared to the lower-than-average performance last year, can be attributed to Nhựa Bình Minh’s successful implementation of an extensive promotional program.

Unlocking Profits: Bidiphar Unveils 5% Growth in Q3, Aiming for Sky-High Revenue of 4000 Billion by 2030

At the investor conference held on the morning of September 26, Joint Stock Company for Pharmaceutical and Medical Equipment in Binh Dinh (Bidiphar, HOSE: DBD) announced its estimated financial results for the third quarter and the first nine months of 2024. The third quarter saw a 5% increase in pre-tax profit, while the cumulative results showed a slight decrease from the previous high.

Viettel Construction: Leading Listed Company in IR Excellence 2024

Viettel Construction’s unwavering commitment to transparency and openness in its corporate governance has been a pivotal factor in winning over investors, both domestic and international. The company is proud to have been bestowed with the prestigious “Mid Cap with the Most Favorite IR Activities by Investors in 2024” and “Mid Cap with the Most Appreciated IR Activities by Financial Institutions in 2024” awards at the IR Awards 2024 ceremony.