Fast Loans, Flexible Disbursement

This is the time when businesses producing and trading goods to serve the needs of Christmas, welcoming the New Year 2025 and the Lunar New Year of the Snake have very high capital demands, so banks also design many credit products suitable for each customer group.

For example, MB is offering a credit package for individuals, small traders, and business households to borrow at an interest rate of 6.5%/year, with a loan limit of up to 90% of the secured assets. BVBank offers supplementary working capital loans with a loan limit of up to 80% of the value of secured assets, and borrowers can choose to pay in installments with interest payable monthly or every six months depending on the business’s cash flow. BacA Bank is applying a supplementary business loan program for units developing agricultural products with a loan limit of up to VND 10 billion/unit. The time to maintain the credit limit and principal grace period is a maximum of 36 months and 12 months, respectively, with a simple process for handling documents and flexible principal and interest repayment methods suitable for the cash flow and payment capacity of customers… Sacombank has a short-term credit package with a scale of VND 15,000 billion for individual and business customers to stimulate the economy in the last quarter of 2024. With preferential interest rates of only 4.5% and 5.5% for individual customers when borrowing for production and trading, applied for a maximum term of 3 months.

Most of the loan packages and credit programs serving the year-end business season are designed similarly. Generally, short-term interest rates range from 4.5-6.5%/year for short-term loans, and medium to long-term interest rates are below 9%/year; the loan limit is based on the value of secured assets or the level of bank control over cash flow. The difference that creates the competitiveness of each bank lies in the service provision, customer care, and asset security with standard regulations.

The end of the year is a seasonal business time, so the capital demand is mainly working capital to pay for raw materials, import goods for distribution and retail. Grasping the need for short-term capital, banks are now applying digitization to approve loans. For example, for individual business households, MB provides and installs a cash collection machine for retail units, thereby monitoring monthly cash flow to provide credit based on the revenue of the cash flow. Similarly, Standard Chartered Bank bases its lending decisions on the monthly revenue of individual businesses; VPBank monitors the orders of online business owners to provide credit based on sales revenue. HDBank said that with just one import order from a retail chain, the bank immediately provides credit to a unit producing goods such as agricultural and aquatic products. Some banks also manage cash flow through digital banking applications and use it as a basis for providing credit.

Stable Interest Rates

Mr. Nguyen Duc Lenh, Deputy Director of the SBV’s Ho Chi Minh City Branch, said that the economic indicators in the first nine months of 2024 show that the business environment is recovering positively, which is favorable for absorbing credit capital. The SBV’s Ho Chi Minh City Branch has been organizing consecutive conferences to connect banks and enterprises according to three topics, including connecting with small and medium-sized enterprises; connecting with businesses, business households, and cooperatives in agricultural production, and connecting with exporting enterprises.

According to statistics, the Bank-Enterprise Connection Program in Ho Chi Minh City at the beginning of this year had 17 credit institutions registering a credit package worth VND 509,864 billion. By the end of September 2024, it had disbursed VND 490,138 billion to 153,151 customers, reaching 96.13% of the total credit package registered by credit institutions from the beginning of the year and 77% of the total disbursed in 2023.

Mr. Nguyen Duc Lenh also informed that the total capital mobilization of credit institutions in the area by the end of September 2024 increased by 7.76% compared to the end of 2023 and increased by 13.2% over the same period.

The positive growth in capital mobilization not only creates favorable conditions for credit institutions in the area to meet the year-end capital needs of businesses, business households, and cooperatives in the area but also helps credit institutions keep interest rates stable at low levels to support people and businesses, thereby promoting economic growth.

Mr. Heng Koon How, Head of Market Strategy, Group Research and Global Economics, also informed that UOB Bank assesses that the State Bank of Vietnam will keep the operating interest rates unchanged, with the refinancing rate at the current level of 4.5%/year until the end of the year to create conditions for the market to grow lending.

Sharing this view, in a recent report, HSBC Bank said that the State Bank would keep the operating interest rate at 4.5%/year to support economic growth.

“Undervalued Banking Stocks: Unlocking the Potential of High-Growth Financial Powerhouses”

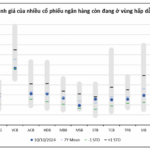

We recommend investing in bank stocks for a medium to long-term vision, even if short-term profit growth prospects don’t present many surprises. Banks possess robust and sustainable growth drivers and are currently undervalued in the market; these include major players such as ACB, CTG, MBB, TCB, and VPB.

The Capital’s Super Transport Projects: Unraveling the Delayed Disbursement and Budget Constraints

With a substantial budget of thousands of billions of dong allocated for construction, the priority is to expedite completion to alleviate traffic congestion. However, the disbursement for the expansion projects of National Highway 6, the extended Thang Long Boulevard expressway, and the Hoang Cau – Voi Phuc segment of Ring Road 1 is progressing slowly, resulting in delayed utilization of the allocated budget.

Gold is Alluring, but What’s Drawing Investors to Equities?

Gold has been a significant competitor to stocks as an investment avenue in recent times, but the stock market also boasts elements that can boost cash flow in the future.