Gold prices rose on Friday, with spot gold trading at $2,747 per ounce, up $7.48 from yesterday’s open. The December 2024 gold futures contract is currently trading at $2,754 per ounce.

Analysts attribute the rise in gold prices to escalating tensions between Israel and Iran, which have driven investors to seek safe-haven assets. Nitesh Shah, a commodities strategist at WisdomTree, believes that geopolitical tensions in the Middle East, coupled with concerns about the US economy, have fueled demand for safe-haven assets, pushing gold prices higher.

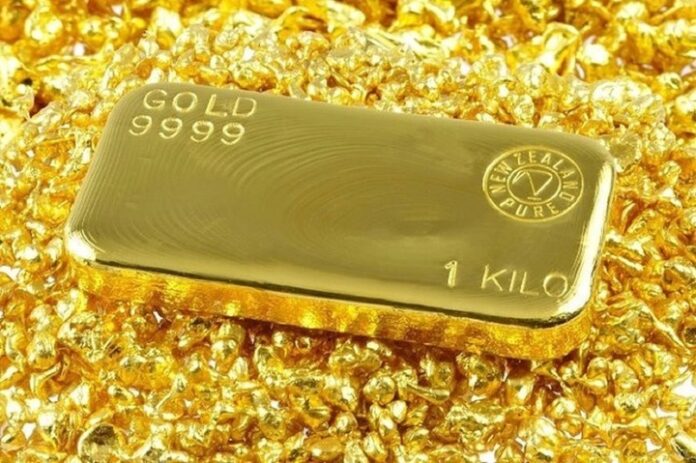

Gold prices continue to rise. (Illustrative image)

However, the strength of the US dollar has somewhat curbed gold’s upward momentum. Adrian Day, a market expert, suggests that while a gold price correction may occur, it is unlikely to be prolonged due to supportive factors such as a weak economy and low-interest rates.

David Meger, director of metal trading at High Ridge Futures, agrees that gold will continue to benefit from safe-haven demand amid the uncertainty leading up to the US election.

Gold Price Movements:

+ Domestic Gold Prices:

As of 6 am on October 27th, SJC gold bars were priced at VND 87 million per tael for buyers and VND 89 million per tael for sellers. Doji gold bars were listed at VND 87 million per tael for buyers and VND 89 million per tael for sellers.

SJC gold rings (1-5 taels) were priced at VND 87-88.5 million per tael, while Doji gold rings (1-5 taels) were quoted at VND 87.9-88.9 million per tael.

+ International Gold Prices:

Spot gold prices on Kitco were trading at $2,747 per ounce on Friday, up $7.48 from the previous day’s open. The December 2024 gold futures contract is currently trading at $2,754 per ounce.

Gold Price Forecast:

Analysts suggest that gold prices may face some profit-taking pressure in the short term following the recent rally. Marc Chandler, CEO of Bannockburn Global Forex, predicts that a breach of the $2,700 per ounce level could pressure long-term investors. He expects gold prices to trade within a range of $2,600 to $2,800 per ounce.

Meanwhile, Mind Money predicts that the upcoming US presidential election results will be difficult to predict. They anticipate that gold prices could continue to rise over the next three months, reaching $2,800 per ounce and possibly surpassing the psychological threshold of $3,000 per ounce.

The Golden Challenge: Navigating the Complex World of Buying and Selling Gold

The SJC gold bar and gold ring prices have reached new heights, yet very few jewelry stores are willing to buy.

An Unstoppable Rally: Gold Price Surges Past $2,700/oz for the First Time

This week, the international gold price surged, resulting in a significant increase of 3.2 million VND per tael in converted value. This substantial rise can be attributed to two primary factors: a robust escalation in global gold prices and a considerable strengthening of the USD/VND exchange rate.

Gold Prices Surge Despite the US Dollar Peaking at a 10-Week High

The greenback hit a 10-week high as expectations for a substantial Federal Reserve rate cut at its November meeting faded, while the European Central Bank is expected to deliver a rate cut on Thursday.