Announcing the List of Shareholders with Ownership of Over 1% of Charter Capital

Several banks have disclosed their shareholder lists, including SHB Bank, which revealed its institutional shareholders: T&T Group Joint Stock Company with a 7.85% stake, Hanoi-Sai Gon Securities Joint Stock Company (SHS) with 1.46%, and Handicraft Import-Export Joint Stock Company and related entities with a combined ownership of 2.44%.

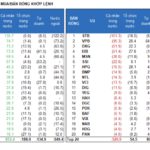

SHB Bank’s recently published shareholder list.

SHB’s individual shareholders with over 1% ownership include Mr. Do Quang Hien, Chairman of SHB’s Board of Directors (2.72%), Ms. Do Thi Thu Ha (2.03%), Mr. Do Quang Vinh (2.77%), and Mr. Do Vinh Quang (2.93%).

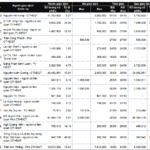

Previously, TPBank also disclosed its shareholder list as of August 30, identifying 22 shareholders with ownership of at least 1% of the bank’s charter capital, totaling nearly 1.56 billion shares, equivalent to 70.74% of the bank’s charter capital.

Notably, Mr. Do Minh Phu, Chairman of TPBank’s Board of Directors, is not among the shareholders with over 1% ownership in the bank. However, his two children, Mr. Do Minh Duc and Ms. Do Vu Phuong Anh, each hold 1.11% of the bank’s shares. They currently serve as Vice Chairman and General Director of DOJI Group, respectively, which is an institutional shareholder with a 5.93% stake in TPBank.

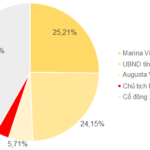

Techcombank has also published a list of 13 shareholders, consisting of six individuals and seven organizations, holding a combined 1.84 billion shares, representing 52.265% ownership of the bank.

According to Techcombank’s disclosure, four foreign funds are among the shareholders: the Government of Singapore Investment Fund with over 1% ownership, Morgan Stanley & Co. International Plc with 1.45%, COG Investment I B.V. and related entities with 7.9%, and Vesta VN Investments B.V. and related parties with 7.9%.

Masan Group Joint Stock Company and related entities hold a 15.2% stake in the bank. Additionally, a consulting firm specializing in residency advice, Mapleleaf Limited Liability Company, owns 4.96% of Techcombank’s shares.

Several individuals with over 1% ownership are related to Mr. Ho Hung Anh, Chairman of Techcombank, and his family. Specifically, the Chairman’s wife holds nearly 5%, while individuals and organizations related to her own more than 980 million shares, equivalent to a 27.8% stake in the bank. Mr. Ho Hung Anh himself holds over 1.1% of the bank’s charter capital, and his three children collectively hold almost 12% of the shares.

At Eximbank, Gelex Group Joint Stock Company is currently the largest shareholder, with over 85.5 million shares, representing a 4.9% stake. Following them are Securities Joint Stock Company VIX with 3.58% and Thang Phuong Joint Stock Company with 3.07%. Additionally, two individual investors, Ms. Le Thi Mai Loan and Ms. Luong Thi Cam Tu, hold 1.03% and 1.12% of Eximbank’s shares, respectively.

Loopholes in the Law Can Be Exploited to Influence Banking Operations

In a recent report to the National Assembly, the State Bank of Vietnam acknowledged the existence of potential risks and legal loopholes that shareholders could exploit to circumvent regulations and exert influence over the operations of credit institutions.

Firstly, identifying interconnectedness between businesses is challenging due to limited information available to determine ownership relationships, especially for non-public companies.

Cross-ownership involves entities under the management of various ministries and sectors, making it difficult for the State Bank of Vietnam to access information and control ownership between companies outside the banking sector.

“Controlling cross-ownership between non-banking companies and banks is exceedingly difficult when major shareholders and their associates deliberately conceal their ownership by having other individuals or organizations hold shares on their behalf to circumvent legal provisions. This lack of transparency and potential for hidden ownership poses risks to the operations of credit institutions,” the State Bank of Vietnam’s report stated.

The State Bank of Vietnam also noted that while some credit institutions have a high concentration of share ownership among a few shareholders and their associates, which does not violate legal regulations, it warrants attention to prevent potential risks.

Moving forward, the State Bank of Vietnam will continue to monitor the safe operations of credit institutions and, through inspections, focus on capital, share ownership, lending, investment, and capital contribution. Additionally, the State Bank of Vietnam will include inspections of share transfers and ownership that could lead to the takeover or influence of credit institutions and work on completing the legal framework to implement the Law on Credit Institutions this year.

Capital Injection for Year-End Business Boost

The banking sector is gearing up for the festive season with a plethora of loan offerings tailored for businesses and merchants. As the year draws to a close, financial institutions are rolling out attractive loan packages with a variety of incentives to support enterprises in their endeavor to meet the surging demand during this peak season.

A Scandal Unveiled: Foreign Investors Exit Loc Troi Amid Corporate Governance Woes

Over the past five months, foreign shareholders have been consistently selling their stakes in Loc Troi Group Joint Stock Company (UPCoM: LTG). During this period, the company’s board of directors also removed Mr. Nguyen Duy Thuan from his position as General Director and subsequently issued a statement accusing him of deceitful behavior.

“Huge Cash Injection by Banks: Over $8.6 Billion Pumped into the Economy in Mid-September, Says Governor; A 15% Credit Growth Target is Well Within Reach.”

As of the end of Q3, the banking sector has extended an additional VND 1.2 quadrillion in loans, achieving approximately 60% of its targeted credit growth. This leaves a remaining loanable fund of around VND 800 trillion for the final quarter.