Recently, there has been a notable shift in insider ownership and foreign fund groups at CTCP Construction Coteccons (coded CTD on HoSE). On October 22nd, a group of funds related to KIM Vietnam Investment Management Joint Stock Company collectively purchased an additional 550,000 CTD shares, increasing their ownership from 6.63% to 7.18% of the charter capital.

Specifically, KITMC Worldwide Vietnam RSP Balanced Fund acquired 200,000 shares, TMAM Vietnam Equity Mother Fund purchased 150,000 shares, KIM PMAA Vietnam Securities Investment Trust 1 (Equity) bought 100,000 shares, and KIM Investment Funds – KIM Vietnam Growth Fund secured 100,000 shares.

CTD’s Annual General Meeting for the 2024 Financial Year was held on October 19th

Prior to this, from September 24th to October 23rd, Mr. Bolat Duisenov, Chairman of the Board of Directors, purchased 200,000 CTD shares, increasing his holdings from 1,428,933 shares (1.38% of charter capital) to 1,628,933 shares (1.57%).

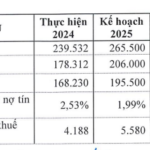

Coteccons recently held its Annual General Meeting for the 2024 Financial Year on October 19th. At the meeting, Mr. Tran Ngoc Hai, Deputy General Director of Coteccons, shared the company’s business results for the first quarter of the 2024-2025 financial year (from July 1, 2024, to September 30, 2024) with a revenue of approximately VND 4,708 billion, a 15% increase compared to the same period last year. New business signings reached VND 8,559 billion (68.7% of total new business signings came from repeat sales with existing customers); and the value of projects that Coteccons is participating in bidding is VND 16,865 billion.

For the business plan for the 2024-2025 financial year (from July 1, 2024, to June 30, 2025), Coteccons set a target revenue of VND 25,000 billion, an 18.8% increase compared to the previous year, and expected after-tax profit of VND 430 billion, a 38.7% rise compared to the previous year.

The General Meeting also approved a 10% cash dividend payout to shareholders. Previously, in a proposal at the end of September, Coteccons had planned not to allocate funds for the year 2025 and not to pay dividends, citing the challenges and difficulties faced by the construction industry. The last time CTD paid dividends was in 2020, with a rate of 10% in cash.

In addition, CTD shareholders also approved the issuance of nearly 5 million bonus shares to increase capital from the owner’s equity source, at a ratio of 20:1 (for every 20 shares held, shareholders will receive 1 new share). The issuance will be funded from the development investment fund based on the audited separate financial statements for 2024. If successful, the charter capital will increase from VND 1,036 billion to over VND 1,086 billion. The issuance is expected to take place within the 2025 financial year.

Moreover, the General Meeting also approved the sale of 1.5 million treasury shares (accounting for 1.43% of the total circulating shares) to employees under the ESOP program at a price of VND 10,000 per share. Currently, Coteccons holds over 3.7 million treasury shares worth more than VND 445 billion (according to the audited financial statements for 2024), equivalent to approximately VND 120,000 per share. The total proceeds from this sale, amounting to VND 15 billion, will be used to increase working capital. These shares will be restricted from transfer for one year.