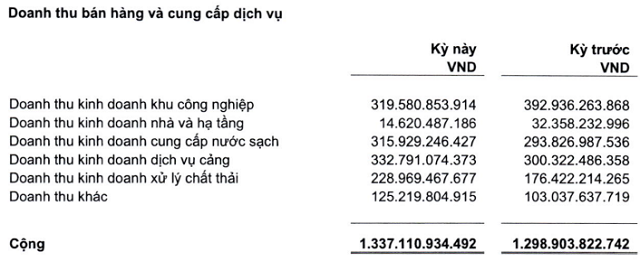

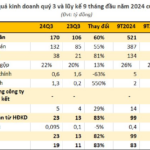

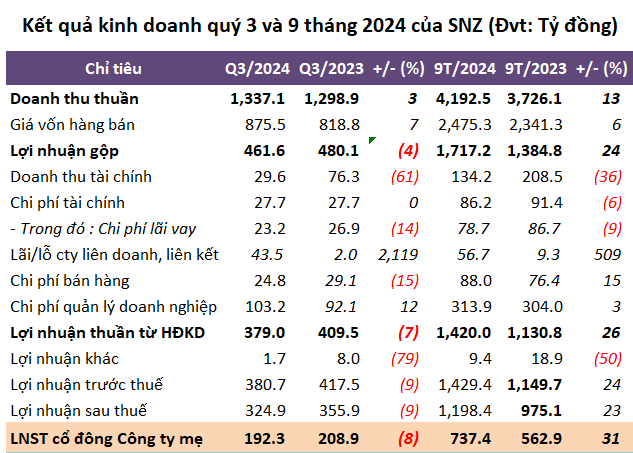

Sonadezi’s third-quarter revenue rose slightly by 3% year-over-year to over VND 1,337 billion. The main revenue streams remained industrial park operations, clean water supply, port services, and waste treatment. Due to higher cost of goods sold, gross profit decreased by 4% to nearly VND 462 billion after deductions.

|

SNZ’s revenue structure in Q3/2024

Source: SNZ

|

On the other hand, financial revenue plunged by 61% to nearly VND 30 billion due to a significant decrease in dividends and profit sharing, which fell from over VND 46 billion in the previous year to just over VND 8 billion. Total expenses increased by 5% to VND 156 billion. As a result, net profit decreased by 8% to over VND 192 billion.

For the first nine months of the year, net revenue was nearly VND 4,193 billion, and net profit was over VND 737 billion, up 13% and 31% year-over-year, respectively. Compared to the full-year plan of over VND 6,366 billion in total revenue and over VND 1,370 billion in after-tax profit for 2024, SNZ has achieved 68% and 87% of these targets, respectively.

Source: VietstockFinance

|

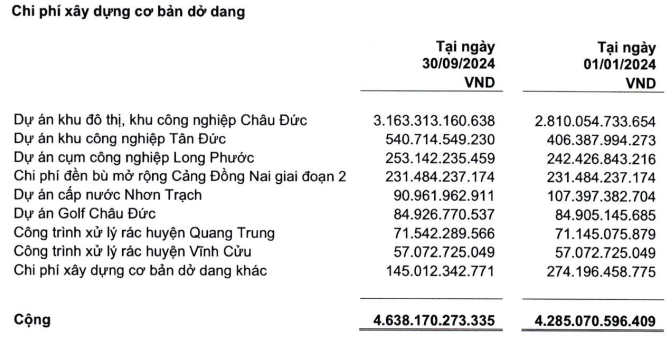

As of the end of the third quarter, SNZ’s total assets stood at nearly VND 21,271 billion, an 8% decrease from the beginning of the year. This included over VND 4,000 billion in bank deposits, a 31% increase, and a significant 52% drop in short-term receivables to over VND 914 billion. Inventories totaled nearly VND 2,233 billion, a 4% increase, with the majority comprising production and business operating expenses for the Chau Duc industrial park – urban area project at over VND 1,500 billion. Unfinished basic construction expenses amounted to over VND 4,638 billion, a rise of 8%.

Source: SNZ

|

Payables stood at over VND 10,674 billion, a 19% decrease from the start of the year. Financial borrowings accounted for VND 4,138 billion, a 14% drop, making up 39% of total debt. Prepaid amounts by customers and unearned revenue, considered “reserved funds,” totaled over VND 3,300 billion, a 36% decline, and constituted 31% of total debt.

Thanh Tú

The Power Players: KIM Vietnam Group and Coteccons’ Chairman Accumulate CTD Shares

The KIM Vietnam Fund Management Company Ltd. has increased its holdings in CTD by purchasing an additional 550,000 shares, bringing their total ownership to 7.18%. In a separate transaction, Mr. Bolat Duisenov, Chairman of the Board, acquired 200,000 CTD shares, taking his personal stake to 1.57%.

The Tasty Tale of a Snack Company’s Success: Tripling Profits, One Delicious Cracker at a Time

After the first nine months, the company achieved 65% of its revenue target and surpassed its profit goal.