## PPC’s Business Targets in Q3 2024

|

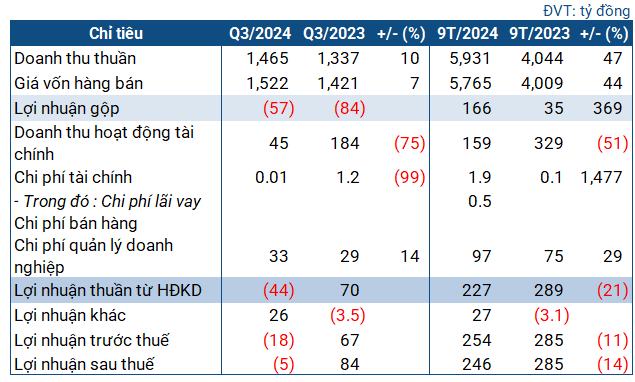

Q3 2024 Business Performance of PPC

Source: VietstockFinance

|

In the third quarter, PPC‘s net revenue increased by 10% to nearly VND 1,470 billion. Cost of goods sold increased by only 7%, but the absolute value exceeded revenue, resulting in a gross loss of VND 57 billion, down from a loss of VND 84 billion in the same period last year.

However, financial revenue for the period dropped sharply by 75% to VND 45 billion. The company explained that this was dividend income received from units in which PPC holds capital. This decline in revenue caused the company to incur a net loss of VND 5 billion (compared to a profit of VND 84 billion in the same period last year), despite additional other income of VND 26 billion (compared to a loss of VND 3.5 billion in the same period last year). This is also the first quarterly loss for PPC since Q3 2021.

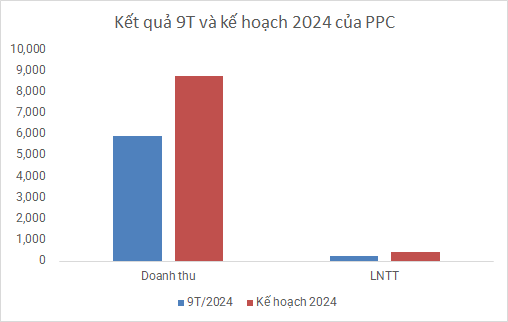

For the first nine months of the year, PPC achieved VND 5,900 billion in revenue, up 47%; net profit decreased by 14% to VND 246 billion compared to the same period last year. Compared to the plan set at the 2024 Annual General Meeting of Shareholders, PPC achieved nearly 68% of the revenue target and over 59% of the annual pre-tax profit plan.

Source: VietstockFinance

|

As of the end of September, the company’s total assets decreased slightly by 6% compared to the beginning of the year, to over VND 5,400 billion. Half of this was in the form of short-term assets, amounting to nearly VND 2,600 billion, a decrease of 13%. Cash holdings stood at just over VND 13 billion, a significant drop from the VND 123 billion held at the beginning of the year. Accounts receivable increased slightly, recording more than VND 1,900 billion. Inventory decreased by 29%, to over VND 500 billion.

On the capital side, all of the company’s payables were short-term, amounting to VND 804 billion, an increase of 5%, with no borrowings. All solvency ratios exceeded 1, indicating stable financial health for PPC.

As of the end of Q3, retained earnings were VND 460 billion, half of what they were at the beginning of the year. Recently, the company announced a dividend payout for the remaining 2023, with a ratio of 6.25% (VND 625/share), equivalent to a payout of over VND 200 billion. The ex-dividend date is November 5, and payment is expected to be made on December 6, 2024.

The Mighty Makeover: “Camau Protein’s Quarterly Profit Plunge: Hoarding a Staggering $9,000 Billion in Cash”

The explanation provided in the consolidated financial statements attributes the almost 63% increase in profit to the reduction in cost of goods sold, which outpaced the decrease in revenue. Additionally, this year’s revenue deductions were significantly lower than those of the previous year, contributing to the substantial growth in profit.

The Money Trend: What to Do When Stocks Have Good Earnings but Prices Don’t Soar?

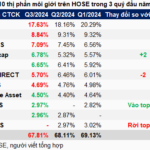

The Q3 2024 earnings season is in full swing, yet market movements have not reflected commensurate reactions. Last week, the VN-Index fell for the first three sessions, recovered on Thursday, but stumbled in the final trading day. The index once again retreated as it approached the 1,300-point mark. The HoSE’s average matching liquidity also showed no significant improvement and even slightly decreased.

The Pennies-on-the-Dollar Stocks

As of the close of the 11th of October 2024 trading session, the VN-Index stood at 1,288 points, marking a notable 14% increase since the beginning of the year, equivalent to a rise of 157 points. However, not all stocks have fared equally well; some have plummeted or stagnated over the past year, lingering at extremely low prices, often referred to as the “tea-and-chat” zone.