Source: VietstockFinance

|

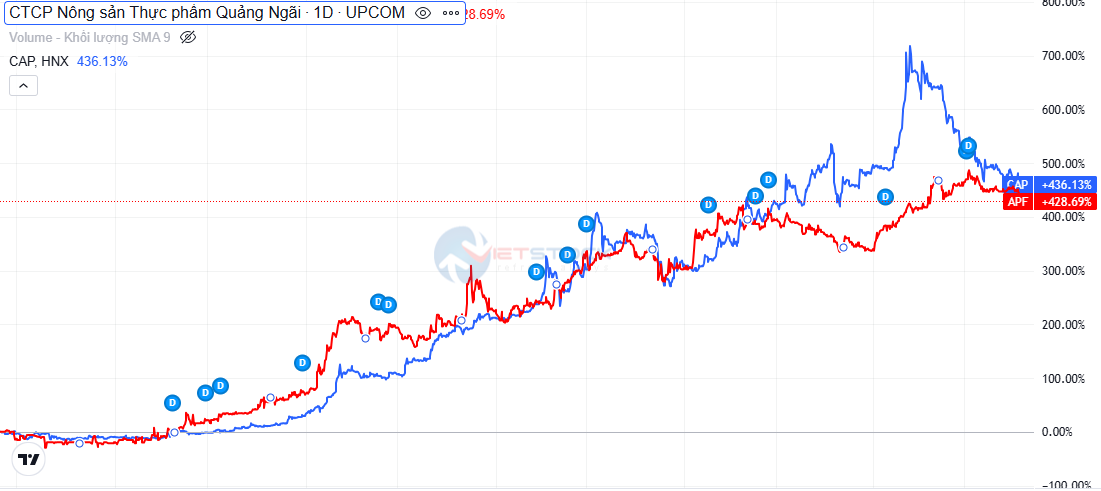

CAP’s share price has been on a steady upward trajectory for the past four years, reaching a record high of 106,900 VND per share in mid-March 2024, marking a more than fourteen-fold increase since 2020. However, CAP’s market price quickly dropped by more than half from its peak, closing at 45,100 VND per share on October 25th.

Similarly, APF’s share price also experienced a prolonged accumulation period since 2020, pushing the market price up from the 9,000 VND per share region to a historical peak of 62,700 VND per share in early July 2024, a more than seven-fold increase over four years. At the close of trading on October 25th, APF’s share price stood at 56,500 VND per share, a 10% decrease from the aforementioned peak.

The downturn in share prices comes as both cassava starch businesses underwent a particularly bleak period in their operations. APFCO follows a fiscal year from January 1st to December 31st, while CAP’s fiscal year starts on October 1st and ends on the following September 30th.

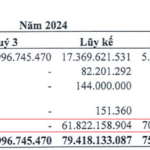

CAP’s financial statements for the fourth quarter of the 2024 fiscal year (equivalent to the third actual quarter) revealed a net profit of just 5.8 billion VND, a 42% plunge compared to the same period in the previous fiscal year. Despite a more than three-and-a-half-fold increase in revenue to 235 billion VND, primarily driven by a surge in gross profit and soaring selling expenses, this decline is attributed to a decrease in gross profit.

For the entire 2024 fiscal year, CAP’s net profit evaporated by 73% compared to the previous year, settling at 31 billion VND, the lowest in four years and still 56% short of the minimum annual profit plan.

Delving into the company’s primary business segments, the “backbone” of starch accounted for a slight 1% uptick in revenue in the 2024 fiscal year, reaching 302 billion VND. Conversely, the two paper products, paper base, and gold-joss paper, witnessed significant downturns, attaining mere 43 billion VND (a 31% drop) and 30 billion VND (a 10% decline), respectively.

Profit weakness puts an end to the 800% surge of the share price of the gold joss paper company

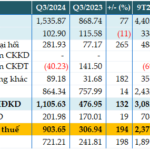

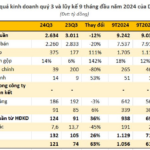

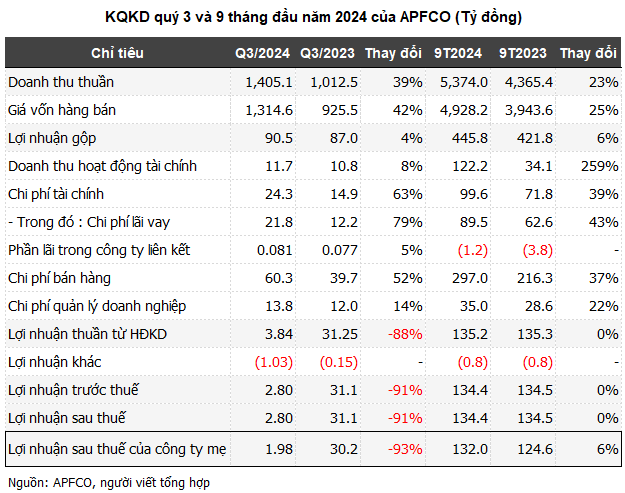

During the third quarter of 2024, APFCO garnered 1,405 billion VND in revenue, marking a robust 39% year-on-year increase. Nonetheless, the cost of goods sold escalated even more sharply by 42%, accounting for nearly 94% of revenue, resulting in a slender gross profit of 90.5 billion VND and a shrinking gross profit margin of 6.4% (compared to 8.6% in the previous year). The company attributed this contraction to fierce competition in raw material procurement, which drove up the price of input materials, coupled with continuously declining selling prices.

Moreover, expenses soared across the board, with financial costs surging the most dramatically to 63%, totaling 24 billion VND. Selling expenses also more than doubled from the previous year, constituting the most substantial expense at 60 billion VND.

Consequently, APFCO’s net profit for the third quarter plummeted by 93%, dipping below 2 billion VND—the lowest quarterly profit for the enterprise in the last five years. Nevertheless, for the first nine months, net profit remained 6% higher year-on-year at 132 billion VND, bolstered by gains from foreign exchange rate differences between the USD and the Kip during the initial quarters.

In relation to the target of 150 billion VND in post-tax profit for 2024, the company accomplished 88% of the plan after three quarters.

The Mighty Makeover: “Camau Protein’s Quarterly Profit Plunge: Hoarding a Staggering $9,000 Billion in Cash”

The explanation provided in the consolidated financial statements attributes the almost 63% increase in profit to the reduction in cost of goods sold, which outpaced the decrease in revenue. Additionally, this year’s revenue deductions were significantly lower than those of the previous year, contributing to the substantial growth in profit.

A Scandal Unveiled: Foreign Investors Exit Loc Troi Amid Corporate Governance Woes

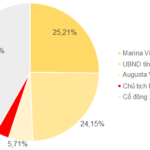

Over the past five months, foreign shareholders have been consistently selling their stakes in Loc Troi Group Joint Stock Company (UPCoM: LTG). During this period, the company’s board of directors also removed Mr. Nguyen Duy Thuan from his position as General Director and subsequently issued a statement accusing him of deceitful behavior.