Gold prices dipped slightly during Monday’s trading session, only to edge slightly higher this Tuesday morning (Oct 29), as US Treasury yields and the dollar continued their upward trajectory, putting downward pressure on the precious metal. This week, gold prices could fluctuate as a raft of fresh US economic data is likely to shape the Federal Reserve’s interest rate trajectory.

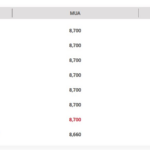

At the close of the first trading day of the week in New York, spot gold fell by $6.9/oz compared to the previous session’s close, equivalent to a 0.25% drop, to $2,741.8/oz, according to data from the Kitco exchange.

As of 8 a.m. Vietnam time, spot gold prices in the Asian market rose by $4.1/oz compared to the close of the US session, equivalent to a 0.15% gain, trading at $2,746.9/oz. Converted at Vietcombank’s selling exchange rate, this price is equivalent to nearly VND 84.3 million/troy ounce.

Earlier this morning, Vietcombank quoted the dollar at VND 25,164 (buying) and VND 25,464 (selling), down VND 3 at both ends compared to yesterday morning.

US Treasury yields reached a three-month high during Monday’s session. The yield on the 10-year note rose 4 basis points to 4.274%, the highest since July. The yield on the 2-year note rose 3 basis points to 4.131%.

The Dollar Index, which measures the greenback’s strength against a basket of six major currencies, ended the session at 104.32 points, slightly higher than last week’s close. During the session, the index touched 104.55 points, its highest level since late July.

Analysts suggest that this week could bring about significant fluctuations in global financial markets, including the gold market, partly because it is the last week before the US presidential election on November 5 and the Fed’s interest rate decision on November 7.

This week also sees the release of important US economic data, including the advance report on third-quarter gross domestic product (GDP) growth, scheduled for release on Wednesday; the Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred inflation measure, on Thursday; and the non-farm payrolls report on Friday.

All of these data points could significantly influence the Fed’s interest rate path in the coming months, subsequently impacting gold prices.

Demand for gold as a hedge against geopolitical risks in the Middle East eased on Monday as tensions showed signs of abating. In the recent Iranian air strikes, Israel refrained from targeting the country’s oil facilities, contrary to previous fears.

However, some analysts suggest that gold prices could surge this week.

“I think the $2,800/oz target for gold prices is achievable this week. Our expectation is that the US presidential election will curb gold selling. So, any catalyst for gold buying will have a more pronounced effect,” said Daniel Ghali, a commodity strategist at TD Securities.

“Investors are taking advantage of every dip in gold prices to buy. Some want to see a drop of more than $200/oz before buying, but that’s a difficult level to achieve as every slight dip is met with strong buying interest,” said Rhona O’Connell, an analyst at StoneX.

Mr. Ole Hansen, Director of Commodity Strategy at Saxo Bank, suggested that regardless of the outcome of the US election, US public debt will continue to rise, and gold will remain a hedge against this debt risk.

The strategist also emphasized that gold price corrections since the beginning of the year have generally been shallow. “Corrections in gold prices since June have averaged $95/oz, with the most recent one in October showing a mere $80/oz decline. I will be watching two critical support levels at $2,685/oz and $2,666/oz,” he noted.

The Golden Opportunity: Unveiling the Latest SJC Gold Prices and Beyond

On the morning of October 22, domestic gold prices continued to surge, shining brighter than ever before.

Is It Worth Investing In Gold Rings At Their All-Time High Price?

The domestic gold ring price has been on a record-breaking streak over the past week, with gold ring prices matching those of gold bars for the first time ever at the 89 million VND per tael mark.