Services

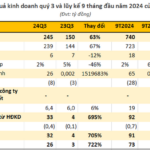

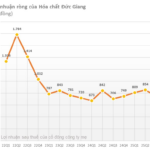

An Gia Investment and Real Estate Development Joint Stock Company (HOSE: AGG) has just announced its consolidated financial statements for the nine-month period ended September 30. For the first nine months, An Gia recorded revenue of over VND 1,750 billion and after-tax profit to parent company shareholders of VND 250 billion.

This year, An Gia set a target of VND 250 billion for after-tax profit to parent company shareholders, a 43% increase compared to the previous year. Despite this ambitious goal, the company has already achieved a 10% increase in revenue and met its profit target after just nine months.

An Gia is also one of the few listed companies in the stock market at this time that has completed its annual plan, a remarkable achievement for the company’s leadership and employees in realizing their business targets.

The company has also fulfilled its plan to pay a 25% dividend to existing shareholders, completing an increase in its charter capital to nearly VND 1,564 billion. The after-tax profit not distributed by the end of the period amounted to VND 1,305 billion.

Westgate Complex in the Administrative Center of Binh Chanh District

|

Abundant capital resources have helped the company enhance its competitiveness and strengthen its financial resources, expand the scale of investment activities, and develop its potential in the context of the real estate market’s recovery; while also actively preparing resources to invest in many new projects.

A bright spot in An Gia’s 2024 financial picture is the significant reduction in debt. As of September 30, debt levels have decreased by 29% compared to the beginning of the year, standing at VND 1,036 billion. The debt-to-equity ratio is at a low and safe level.

In the past nine months, An Gia has completely settled its bond debt, repaying nearly VND 315 billion, becoming one of the first real estate enterprises on the stock exchange to be “debt-free” at this point.

As of September 30, An Gia’s total assets amounted to over VND 7,204 billion. Inventory value was nearly VND 900 billion, a decrease of 55% from the beginning of the year, due to the delivery of products at many projects during the period, including the Westgate Complex (Ho Chi Minh City) and The Standard independent residential area (Binh Duong).

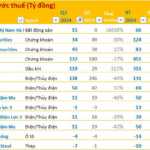

As planned at the beginning of the year, An Gia is preparing resources to invest in and develop The Gio Riverside project (Binh Duong) with approximately 3,000 products. When this project is put into business, the revenue generated, estimated at VND 7,000 billion, will be the main contributor to An Gia’s business results in the 2025-2027 period.

The Gio Riverside Project in Binh Duong

|

The Gio Riverside project is expected to be launched as the real estate market is recovering and entering a new growth cycle. In line with this growth momentum, An Gia is also assessing new opportunities to accelerate the implementation and sales of many other projects.

In the next 2-3 years, the company will develop three large key projects, including The Gio Riverside, The La Village (Ho Chi Minh City), and Westgate 2 (Ho Chi Minh City), totaling nearly 10,000 products. The successful implementation of large-scale urban area projects with complete infrastructure and utilities will elevate An Gia’s status as a major real estate developer in the region.

An Gia’s land fund development strategy relies on the process of mergers and acquisitions (M&A) of projects that have basically completed legal procedures and are ready for deployment, resulting in a relatively short investment cycle. This enables the company to be flexible in recovering cash flow and preserving business resources.

The company’s management expects that in the coming time, as the market recovers, An Gia’s implementation and sales activities will become more vibrant, and the legal advancement of projects will be faster, supporting business operations.

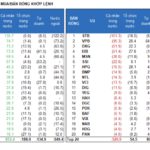

The Astonishing Number of Vinhomes Shares Bought on the First Day of the Biggest Deal in Vietnam’s Stock Market History

Vinhomes is committed to purchasing a minimum of 11.1 million shares daily and will acquire up to 37 million shares during the trading period, as per the regulations.

The Lion City’s Sticker Shock: How Ho Chi Minh City’s Property Prices Surpassed Singapore’s, Ranking Among the Priciest in ASEAN

The real estate market in Ho Chi Minh City is experiencing a boom, with property prices soaring above those of its Southeast Asian counterparts. This vibrant city now boasts higher prices than the likes of Bangkok, Jakarta, and even Singapore.