The announcement by the Corporation for the Development of Green Land (HOSE: DXG) that it is canceling all previously signed purchase agreements has brought renewed attention to the DXH Riverside project (formerly known as Gem Riverside).

According to a report by BIDV Securities Corporation (BSC) on September 12, 2024, the Ho Chi Minh City Construction Department officially approved the construction permit for the DXH Riverside project based on the new 1/500 planning indices, including 12 blocks, and 3,175 apartments. BSC noted that the project was initially launched in 2018 with the original planning of 8 towers and 2,100 apartments, offering approximately 1,000 products at an average selling price of VND 37-40 million per square meter. However, after several years, DXG proceeded to cancel the purchase agreements with customers as the project was adjusted in the direction of increasing the population and construction density indices to 12 towers and 3,175 apartments.

During DXG’s meeting on October 22, the company’s leaders confirmed the goal of canceling all previously signed purchase agreements and restarting the Gem Riverside project with new prices. It is expected that the remaining 300 purchase agreements will be canceled before the project is restarted in Q1/2025.

DXG’s management stated that this was an undesirable situation due to the prolongation of administrative procedures. The Board of Directors made the above decision after carefully considering the balance of interests between the Company and homebuyers. Affected buyers have two options: (1) receive a refund of the deposit (approximately VND 250 million) with compensation interest of 10-15%/year, or (2) buy an apartment at a new price but will be offered a discount (the discount rate is not disclosed).

According to Yuanta Vietnam, DXG shared that the two new projects located near Gem Riverside currently have prices of over VND 100 million per square meter. Construction has been restarted, with the groundbreaking ceremony taking place in October. DXG aims to complete the foundation and obtain a sales license before the official launch, with the expectation that market conditions in Q1/2025 will be more favorable.

At the present time, the project is dormant, with an unpaved road leading to it and overgrown vegetation inside, showing no signs of construction.

In its reports, DXG introduced DXH Riverside (the new name for Gem Riverside) as having an area of 6.7 hectares, located in An Phu Ward, Thu Duc City. The company acquired the project through M&A in 2016. The announced investment capital for the project in 2016 was VND 5,240 billion, which was later adjusted to VND 5,980 billion in 2019.

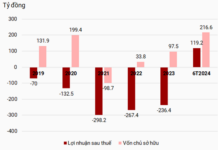

As of December 31, 2017, DXG recorded the value of real estate under construction for DXH Riverside at nearly VND 1,099 billion. The last time the company announced the value of the unfinished project was in mid-2021, which was nearly VND 1,560 billion.

|

Information about Gem Riverside introduced by DXG in 2016.

|

|

The DXH Riverside project (marked in yellow) is located in Rach Chiec residential area, close to highways such as Long Thanh – Dau Giay, Mai Chi Tho avenue, and Song Hanh street, and adjacent to Giong Ong To river. Nearby are projects such as Palm City, Lakeview City, The Global City, and the National Sports Complex in Rach Chiec. |

|

|

Overview of the DXH Riverside project’s frontage. Photo: Thuong Ngoc |

|

|

DXG is introduced as the project’s developer and distributor. Photo: Thuong Ngoc |

|

|

Vietnam International Commercial Joint Stock Bank (HOSE: VIB) is introduced as the project’s financing credit institution. Photo: Thuong Ngoc |

|

|

Inside the DXH Riverside project, vegetation is overgrown. In the distance is the Palm Heights project by Keppel Land. Photo: Thuong Ngoc |

Ha Le

“Caution Advised: VIB Chairman Đặng Khắc Vỹ Cautions Against Loosening Credit Conditions for Short-Term Growth”

“VIB’s Board Chairman, Dang Khac Vy, cautioned against pursuing credit growth at all costs by relaxing lending conditions. He emphasized the potential adverse consequences on the safety and stability of the banking sector, citing increased non-performing loans and diminished profits as key concerns.”