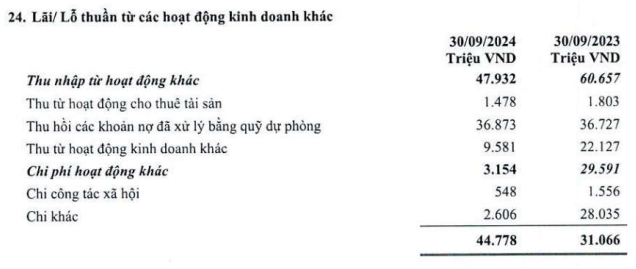

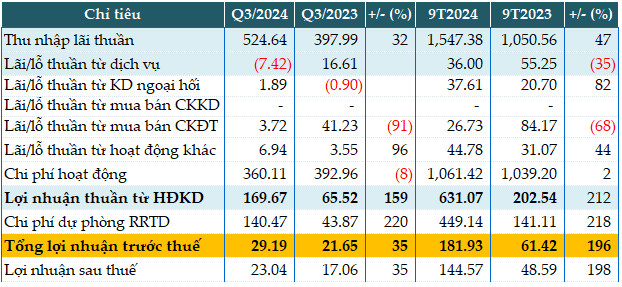

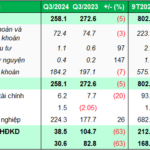

In the first nine months of 2024, BVBank reported a 47% year-on-year growth in net interest income, surpassing VND 1,547 billion.

Profit from foreign exchange trading decreased by 35% to VND 36 billion due to increased payment service charges.

Foreign exchange operations yielded nearly VND 38 billion in profit, attributable to increased earnings from spot foreign exchange transactions (VND 152 billion). The cost-to-income ratio (CIR) improved by 18%.

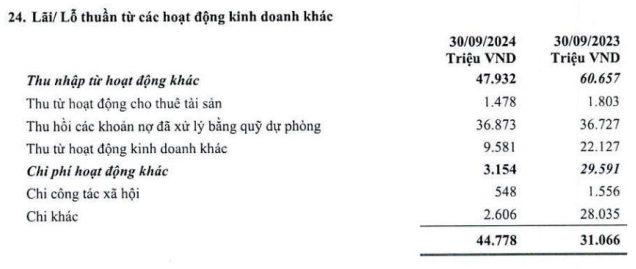

Profit from other activities also increased by 44% to nearly VND 45 billion due to reduced miscellaneous expenses (VND 2.6 billion).

Consequently, the bank’s profit from business operations exceeded VND 631 billion, triple the figure from the previous year. Despite setting aside over VND 449 billion for credit risk provisions (triple the amount from the previous year), BVBank still recorded a pre-tax profit of nearly VND 182 billion, almost triple the previous year’s figure. The bank attributed this achievement to stable credit growth and effective capital restructuring measures.

With a pre-tax profit target of VND 200 billion set for the full year, BVBank has accomplished 91% of its goal in just nine months.

In the third quarter alone, BVBank’s pre-tax profit exceeded VND 29 billion, a 35% increase year-on-year, thanks to effective cost management and sustained credit growth to individual customers.

|

BVBank’s Q3 and 9M 2024 business results. Unit: Billion VND

Source: VietstockFinance

|

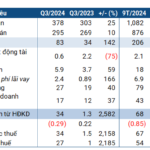

As of the end of the third quarter, the bank’s total assets increased by 13% from the beginning of the year to VND 99,419 billion. Cash balances rose by 35% (VND 675 billion), deposits with other credit institutions increased by 45% (VND 15,150 billion), and loans to customers grew by 11% (VND 64,080 billion).

Customer deposits also increased by 6% from the beginning of the year to VND 60,432 billion. This included VND 67 trillion in funds mobilized from economic organizations and the population.

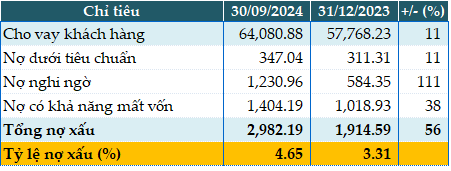

As of September 30, 2024, the bank’s total non-performing loans (NPLs) stood at VND 2,982 billion, a 56% increase from the beginning of the year. The NPL ratio, as a percentage of total loans, increased from 3.31% to 4.65% during this period.

|

BVBank’s loan quality as of September 30, 2024. Unit: Billion VND

Source: VietstockFinance

|

Han Dong

“Declining Core Revenue and Soaring Expenses: Unveiling Dragon Capital’s Manager’s Earnings in Q3”

In Q3 of 2024, the financial results of Dragon Capital Vietnam Asset Management JSC (DCVFM) were significantly impacted by a decline in revenue from its two core business segments: advisory and fund management. While revenue from these key areas decreased, management expenses rose sharply, creating a challenging environment for the company.

“Soaring Provisioning Costs, Yet BVBank’s 9-Month Pretax Profit Triples Year-on-Year”

The consolidated financial statements show that despite increasing provisions for risk, BVBank (BVB on UPCoM) reported a remarkable performance with a near threefold increase in pre-tax profit for the first nine months, totaling VND 182 billion. This impressive growth is a testament to the bank’s core lending business, which has seen a significant boost in revenue.

The Magic Formula to Success: Unveiling the Secrets Behind a Vinachem Enterprise’s Astonishing Profit Surge

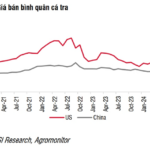

The sharp surge in revenue has led to a booming profit for Viet Tri Chemical JSC (HNX: HVT) in the third quarter, surging by several folds compared to the same period last year. However, this significant increase is partly attributed to the low base effect from the previous year.