Restructuring Plan for EVN until the end of 2025

|

Aiming for a 7-10% average growth rate in EVN’s total revenue by the end of 2025

The objective of this plan is to develop the Vietnam Electricity Group (EVN) into a strong economic group, with sustainable, efficient, and profitable business operations. It aims to preserve and grow the state-owned capital invested in EVN, as well as the capital invested by EVN in other businesses. EVN takes primary responsibility for ensuring electricity supply for the economy and people’s lives, ensuring national energy security, and providing public utility products and services in the field of electricity supply according to regulations. EVN aims to become the center for the development of the Vietnam National Electricity Group, with modern technology, management, and high specialization. Its main business activities include electricity production, trading, and consulting, with a strong link between production and business operations, science and technology, research and development, and training. The goal is to maximize the efficiency of the Vietnam National Electricity Group.

EVN aims to be the driving force for the rapid and sustainable development of Vietnam’s electricity industry, effectively competing and integrating into the international economy. It will continue to participate in the completion and development of the electricity market according to the roadmap defined by the Government.

The plan sets a target of a 7-10% average growth rate in the Group’s total revenue by the end of 2025, with a contribution of over VND 23,000 billion to the state budget annually. It also aims to fulfill the indicators according to the Production, Business, and Investment Development Plan for the 2021-2025 period, as approved by the Prime Minister in Decision No. 345/QD-TTg dated April 26, 2024.

EVN aims to successfully build its image as a responsible enterprise, serving the community and society, and providing customers with improved service quality.

Accelerating the restructuring of corporate governance

The plan clearly defines the orientation and solutions for restructuring the enterprise until the end of 2025.

Accordingly, the business sectors will be implemented following the Government’s Decree No. 26/2018/ND-CP dated February 28, 2018, on the Charter of Organization and Operation of EVN, Decree No. 105/2024/ND-CP dated August 1, 2024, amending and supplementing several articles of Decree No. 96/2022/ND-CP and Decree No. 26/2018/ND-CP, and other relevant documents issued by authorized agencies according to legal regulations.

EVN will focus on restructuring corporate governance, especially in areas such as improving the management framework, strengthening project management to ensure progress and investment efficiency, enhancing forecasting and risk governance, improving the capacity for auditing, supervision, and inspection, intensifying anti-corruption and anti-wastefulness efforts, and reviewing and implementing plans to handle weak and loss-making projects and enterprises under EVN according to regulations.

EVN will continue to coordinate with ministries and sectors to improve the management framework, mechanisms, and policies to increase EVN’s initiative in production and business activities, in line with market mechanisms and international practices. It will also apply international standards of corporate governance in EVN and its member units.

Regarding the restructuring plan for the management organization, EVN will streamline its management and operation apparatus, innovate its organizational model to reduce indirect management labor at intermediate management levels and subordinate units to ensure a streamlined and efficient structure, and prevent function overlaps at the Parent Company. EVN will also study the organization of a central control room (OCC) to centrally control hydropower plants and renewable energy sources.

Restructuring finances and strengthening financial governance

According to the plan, EVN will develop production, business, and investment plans, as well as financial plans, to optimize, efficiently, and flexibly utilize mobilized capital. The goal is to preserve and develop capital, ensure financial safety indicators, and meet the requirements of domestic and foreign lending credit institutions.

EVN will also develop financial plans, capital balance plans, and cash flow plans to analyze and evaluate the impact of solutions on its financial situation and its ability to balance capital sources for important power projects until the end of 2025.

It will study EVN’s financial mechanism in the competitive retail electricity market. A roadmap for separating the organization and accounting of costs for the distribution and retail electricity sector of the Power Corporations will be developed according to the competitive retail electricity market roadmap. A pricing mechanism for wholesale electricity sales between the Parent Company – EVN and the electricity distribution business units will be established, in line with the mechanism for adjusting retail electricity prices according to market principles…

Plan for rearranging and restructuring the Parent Company and its member units

According to the plan, the Parent Company – EVN will remain a single-member limited liability company, with the State holding 100% of the charter capital, in accordance with Decision No. 1479/QD-TTg dated November 29, 2022, of the Prime Minister. It will maintain its direct subsidiaries (except for Thai Binh Thermal Power Company and Vinh Tan 4 Thermal Power Plant).

The Thai Binh Thermal Power Company will be merged according to a separate plan for the establishment of a single-member limited liability company, pending approval by authorized agencies.

The Vinh Tan 4 Thermal Power Plant will be rearranged according to a separate plan for the establishment of a single-member limited liability company, pending approval by authorized agencies.

Enterprises in which EVN continues to hold 100% of the charter capital include the National Power Transmission Corporation, Northern Power Corporation, Central Power Corporation, Southern Power Corporation, Hanoi Power Corporation, Ho Chi Minh City Power Corporation, Power Generation Corporation 1, and Thu Duc Thermal Power Joint Stock Company.

Enterprises in which EVN maintains a holding ratio of over 50% of the charter capital include Power Construction Consulting Joint Stock Company 1, Power Construction Consulting Joint Stock Company 2, Power Construction Consulting Joint Stock Company 4, Power Generation Corporation 2 – Joint Stock Company, and Power Generation Corporation 3 – Joint Stock Company.

Enterprises in which EVN maintains a holding ratio of less than 50% of the charter capital include Power Construction Consulting Joint Stock Company 3, Dong Anh Electrical Equipment Joint Stock Company, and Vinh Tan 3 Energy Joint Stock Company.

Roadmap to complete the rearrangement and restructuring of EVN by the end of 2025

In terms of the implementation roadmap, EVN will focus on restructuring its organization and ownership, striving to complete the rearrangement and restructuring of EVN and its member units by the end of 2025, in accordance with the approved plan.

EVN will continue to hold 100% of the capital or controlling shares in its subsidiaries in the main business sectors of EVN (power generation, power transmission, power distribution and trading, and power construction consulting) until 2025, in line with the criteria for classifying state-owned enterprises.

By the end of 2025, EVN aims to have a streamlined organization, efficient operations, financial balance, an average annual labor productivity increase of over 8%, corporate governance in line with international standards, modern technology, and a transition to a digital enterprise model. It will also complete the research and implementation of energy transition, sustainable development, and competitiveness in the region and internationally.

“Steady Credit Growth, VPBank’s 9-Month Profit Surges 67% Year-on-Year”

As of the third quarter of 2024, VPBank has recorded a remarkable performance with a consolidated pre-tax profit increase of over 67% year-on-year, thanks to the contributions of its comprehensive ecosystem. The bank has maintained stable credit growth, enhanced debt recovery activities, and continued to tightly control asset quality.

The Miracle of Aloe Vera: Unlocking Record-Breaking Profits and Soaring Stock Prices.

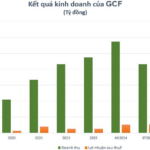

For the first nine months of the cumulative year, the company reported a profit after tax of nearly VND 55 billion, up 138% over the same period and exceeding the yearly plan.

The Chairman of TTC AgriS: Working in the Interests of 91% of Shareholders and Investors

Amidst the growing interest from international investors and prominent financial institutions in Thành Thành Công – Biên Hòa Joint Stock Company (TTC AgriS) (HOSE: SBT), Ms. Đặng Huỳnh Ức My, Chairperson of the company’s Board of Directors, has assured that fairness and transparency will be upheld for shareholders, investors, and all stakeholders.